This article is a website version of our weekly FREE Best Ideas Newsletter sent on 25.04.2023. Sign up here to get it in your inbox every Tuesday.

I'm sure you also read a few articles saying that the UK market is very undervalued.

Apart from tobacco companies (two of which I already own) I thought you would be interested in seeing just how undervalued UK companies are. And perhaps get a few investment ideas you can research.

The search for cheap UK companies

To find the most undervalued UK companies I set up the following screen:

- I selected only the UK

- Set a minimum of $100,000 trading volume per day

- Set a minimum market cap of 100 million U.S. dollars

- Only select companies whose financial data was updated in the last six months.

- To remove bad quality companies, I selected the top 70% companies in terms of the Piotroski F score.

The most undervalued UK companies on price to earnings (PE)

With the above information selected I selected the price to earnings ratio to get a rough idea of just how cheap UK companies are.

This is what the screen came up with:

Source: Quant Investing stock screener

As you can see really cheap companies, with one trading on the historical PE ratio of under 2!

As you can imagine quite a few shipping, energy, financial services and surprisingly two car dealers, Lookers PLC and Pendragon PLC.

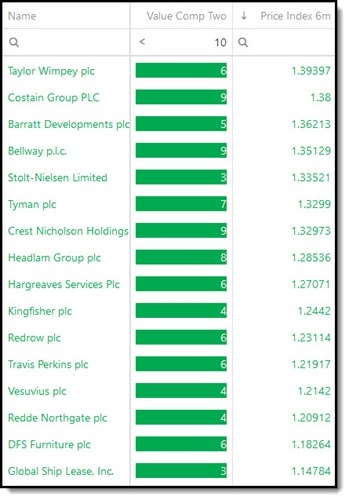

Cheap Value Composite companies going up

In the next screen I selected the cheap companies with a Value Composite Two value of less than ten.

I then sorted this list by six months price momentum (price change over the past 6 months) from high to low.

I did this to find cheap companies with an upward moving stock price.

As you may remember combining undervalued companies with positive momentum was part of ALL the best strategies we tested.

Just a quick reminder: the Value Composite two indicator is calculated as follows:

- Price to book value

- Price to sales

- Earnings before interest, taxes, depreciation and amortization (EBITDA) to Enterprise value (EV)

- Price to cash flow

- Price to earnings

- Shareholder Yield (Dividend yield + Percentage of Shares Repurchased)

This is what the screen came up with:

Source: Quant Investing stock screener

Not surprisingly it came up with quite a few house builders and related companies with a ship company thrown in.

Qi value UK companies with upward momentum

In the following screen I use the Qi Value indicator (I use it in my own portfolio) to find cheap companies.

I selected undervalued companies with a Qi Value of less than 10 and then sorted this group of companies by six months price momentum from high to low. This gave me undervalued companies with a share price that moved up the most over the most six months.

As a quick refresher the Qi Value indicator is calculated with the following four ratios:

- EBITDA Yield

- Earnings Yield

- FCF Yield

- Liquidity (Qi)

Here is the list of companies the screen came up with:

Source: Quant Investing stock screener

As you can see the same names keep on coming up. This happens when you search for undervalued companies. The same companies come up irrespective of what ratio or indicator you use.

High free cash flow yield UK companies moving up

In the last screen I selected all companies with a free cash flow yield of more than 15% I then sorted this list by six months price momentum from high to low.

Free cash flow yield is calculated as, cash from operations minus capital expenditure divided by enterprise value.

This will screen gives you companies with at least a free cash flow yield of 15% AND with an upward moving stock price.

Here is the list of companies:

Source: Quant Investing stock screener

As you can see it comes up with a slightly different list of companies but again shipping and energy companies are well represented.

An interesting company on the list is Shoe Zone, a discount shoe retailer with a free cash flow yield of just under 16%!

The UK looks very attractive

As you can see the UK stock market is undervalued and looks very attractive!.

It’s a great place to be looking for undervalued companies.

Your, helping you find the biggest bargains analyst

PS To find DIRT CHEAP companies in the UK that fits your investment strategy right now click here.

PPS It is so easy to forget, why not sign up now before you get distracted?

📖 Fresh Content

These zombie companies are a danger to your portfolio - 2023 update

Best Price to Book Piotroski F-Score stock ideas for 2023

In Case You Missed It 👀

Best EBIT to Enterprise Value Momentum stock ideas for 2023