Find companies that EXACTLY fit your investment strategy

The Quant Investing stock screener is built so you can find investment ideas using just about any investment strategy you can think of.

Whether you are a:

- Growth,

- Value,

- Magic Formula

- Short term momentum,

- Smart Beta

- Net Net

- Dividend

- Low volatility

It gives you unmatched clarity in your investment decisions by simplifying complex data into actionable insights. This helps you invest with confidence and precision.

What Makes This Screener Better?

You might wonder, ‘What makes this screener better?’

It’s simple: we built it for ourselves first. When our founder couldn’t find a tool with the depth and precision he needed, he created one. This screener combines decades of research and experience into a tool we use daily and one you can trust.

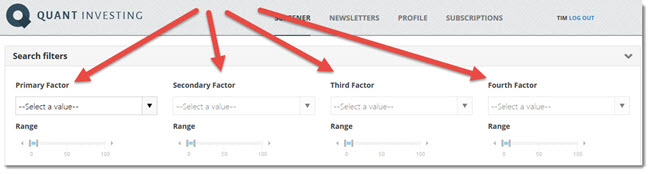

Four Filters!

The first thing you will notice when you use the screener are the four filters (or funnels) that look like this:

“I just signed up for the Quant Value Newsletter and Screener, had questions about long term investing, backtesting and brokers, the team answered all of them very quick and to the point, the knowledge in investing and generosity in sharing it is amazing.

Long term investing fits my personality better than day trading and honestly I think it is also more profitable.

Looking forward to next newsletter!”

Richard

![]()

Click image to enlarge

You simply select the ratios and then use the sliders to choose only the companies you want.

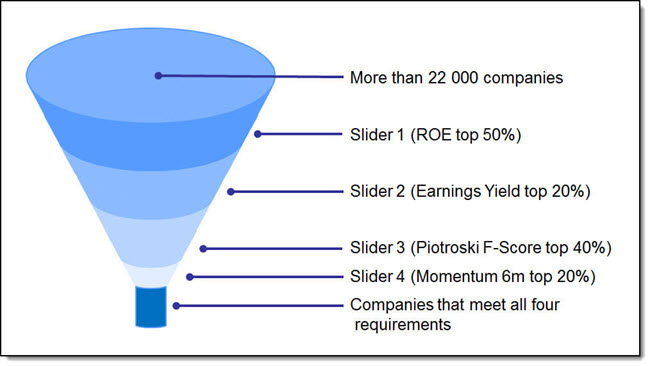

How the Filters Help You

The image below shows you how easy it is to screen using the filters:

Click image to enlarge

Do Your Own Back Tests - Go Back in Time

The filters are built to make finding the right stocks easy. With a few clicks, you can screen for companies that fit your investment strategy perfectly.

Want to see if your strategy works? Use the back-testing feature to test it with past data. It’s like having a time machine for your investments.

Screenshots

Here you can see screenshots of exactly how the screener helps you find investment ideas: Stock screener screenshots

Use proven strategies for instant ideas💡Sign up now!

VIDEO - How to Set Up Your First Screen

Watch the 4 minute tutorial below to see just how quickly you can master the art of smart investing using our intuitive filters.

What Do Investors Like You Say?

Before I tell you more about the screener here is what smart investors just like you say about it:

Jakob

Denmark

“The screener is a super handy tool combined with the different strategies also published on the Quant Investing website. It enables me to search for quality value companies using earnings yield as my starting point, and to refine the result via different criteria like F-score. It’s a really efficient way of searching for those golden needles in the huge stock haystack.”

Björn

Switzerland

“The Quant Investing Screener makes it really easy to find high quality companies for reasonable prices and helped me to make successful investment decisions with higher returns than the market average. It has a lot of useful ratios, and the data is reliable. Kind regards and thanks for quant-investing. I really like this tool and also the newsletter.”

Enrique

Spain

“When I started using the Quant Investing screener, it saved me a LOT of time and work. It’s a perfect tool to combine multiple ratios and get the results with reliable data. I used to spend in several days analysing balance sheets and making the ratios to filter the stocks I wanted. Now it’s done in seconds.”

Martin

Germany

"I wanted to implement a simple, passive, and quantitative investment strategy. As a business owner I don't have much time for analysing stocks and reports. The Screener (and the articles on the website) helped me to find and refine my strategy. With the screener I have all the ratios and data available I need to implement this strategy. Being able to save my strategies in the screener makes life pretty simple for me."

Markus

Germany

“The Quant Investing screener is worth the money 100-fold. It finally provides the much-needed bridge between an intuitive UI and the necessary depth to engage in serious stock screening & research. The multitude of different rations & factors - some of which are automatically calculated - have been a tremendous help in constructing investment strategies yielding maximum risk-adjusted returns.“

Jean

Belgium

“As a fundamental private investor, I apply a 2-step investment strategy. First, I am continuously searching for strong new investment candidates that meet a broad range of financial criteria. Then I try to assess the unique value proposition of each selected candidate. All together a very time and energy consuming process. The Quant Investing screener, combined with its built-in excel download feature, fully automates the first step of my selection process. Therefore, it is a tremendous time saver for me. Day after day."

Stuart

USA

“The Quant Investing Screener is a huge help in my work as a Registered Investment Advisor. I have been in the industry for almost twenty-five years, and this is a great tool that I use in my daily work to look at and analyze companies. I have followed the work of the Magic Formula Investing for a few decades, given the exceptional back-tested results. The screener has this screen, as well as multiple other well regarded factors (along with backtests) to help investors in their analysis of companies. Whatever your investing style, the Quant Investing Screener can help you in your process. I wholly recommend this product for investors.”

Yves

Belgium

"Tim, when I first read your paper “Quantitative Value Investing in Europe - What works for achieving alpha“ back in 2012, I must admit I was sceptic. It looked to me as a fine and well documented paper… about attractive but theoretical returns you could have achieved if you HAD followed the strategies described in it. But I was disappointed in the returns well paid “professional” money advisers achieved with my money (mostly bankers who only thought of their own pockets promoting their own funds). So I decided to give it a try and started using your screener to select stocks for my portfolio and it turned out to be by far the best financial decision I have ever made in my life! It really comes close to the theoretical returns you exposed in your paper and it beats well known market indices all the time. If you had told me this in 2011, I would not have believed it. I admit 5 years is a relative short period to make some definitive conclusions and in general the stock market was in the last 5 years not to bad either. However, I already have enough confidence in your screener to stay true – even in falling markets - to my system of selecting stocks. In short, what I mean to say is: your screener is really important for me as a base for selecting stocks for our financial future. Keep up the good work and thanks for sharing your insights on investing through your paper, your blogs and newsletters."

Stop settling for low returns from traditional banks and funds. Discover how our screener could help you spot high-growth opportunities that many professionals miss.

Join streetwise investors like You. Subscribe for success! 🚀

Companies to Screen - Over 22,000 World-wide

With over 22,000 companies included, this screener gives you unmatched access to the global market.

From large companies to smaller hidden gems, you have everything you need to find the best opportunities. We designed this to help you explore the widest range of options with ease.

Countries Included

More specifically the screener includes all companies traded on the following markets:

Europe:

Austria, Belgium, Cyprus, Estonia, France, Germany, Greece, Hungary, Ireland, Italy, Luxembourg, Malta, Netherlands

Poland, Portugal, Slovakia, Slovenia, Spain, Switzerland, United Kingdom (including AIM companies)

Scandinavia:

Denmark, Finland, Norway, Sweden

North America:

The USA, Canada

Asia:

India, Japan, Hong Kong, Singapore, South Korea, Malaysia

Oceania:

Australia and New Zealand

South America:

Brazil

Over 110 Ratios and Indicators You Can Use

The Glossary page shows you all the ratios and indicators you can use to find investment ideas.

Here are a few examples:

- 1yr Growth Sales

- Price to Earnings (PE)

- Price to Sales

- Piotroski F-Score

- PEG Ratio 1yr

- FCF Yield (FCF to EV)

- Earnings Yield (EBIT to EV)

- Debt to Equity

- Leverage Ratio

- Cash Return on Invested Capital (CROIC)

- Price Index 6m

- Price Index 12m Minus 1m

- Adjusted Slope 125/250d

Access 110+ Ratios and Indicators 🛠 Subscribe NOW!

Saved Strategies You Can Use Right Away

We’ve saved over 22 proven strategies for you to use right away. These aren’t just theories, they have been tested and deliver results.

Each strategy is built to save you time and guide you toward investments that work. This means you can use them immediately, with a few mouse clicks.

Examples of saved strategies:

- Magic Formula

- O'Shaughnessy – Value Composite Scores

- Piotroski F-score

- Earnings yield (EBIT to Enterprise value)

- Beneish M score

- James Montier C-Score

- Altman Z-Score

- O' Shaughnessy - Tiny Titans

- ERP5 Score (an indicator developed by Vanstraceele-Allaeys that gives you undervalued, good quality companies)

- Free Cash Flow Yield

- Quality high dividend yield

- Negative enterprise value

- Quality small companies

- Neglected Value momentum

I’m interested, sign me up NOW!

“When I started using the Quant Investing screener, it saved me a lot of time and work.

It’s a perfect tool to combine multiple ratios and get the results with reliable data.

I used to spend in several days analysing balance sheets and making the ratios to filter the stocks I wanted.

Now it’s done in seconds.”

Enrique

![]()

All This Costs Less Than a Lunch for Two

All this costs less than an inexpensive lunch for two each month!

And if you sign up for a year you get over 20% off.

If It's Not for You - ALL Your Money Back

When you sign up you have no risk!

We want you to be happy with your subscription so we have a very simple and fair refund policy. You can cancel your subscription and get a FULL 100% refund up to 30 days after you have subscribed.

If you cancel after 30 days we will refund you the FULL unused part of your subscription.

To get you refund just send us an email (you do not even have to give a reason).

Join Our Community

When you join Quant Investing, you become part of a community that believes in smarter, data-driven investing. We’re here to support you with tools and strategies to help you reach your goals. Let us succeed together.

More Information - How does it work?

To find out just how easy it is to use the screener take a look at the quick start guides below (Just click on the links below):

Here is more detailed screener information:

Quick tips to get the most out of your stock screener subscription

I’m interested, sign me up NOW!

More Comments From Streetwise Investors Like You:

Jussi

Finland

"The screener helps me take my investment process to a completely new level. The possibility to export the data for further analysis is a great bonus feature. I also really appreciate that the screener is constantly developed based on user feedback”

Juan

Spain

"The screener has simplified my life. I can select stocks choosing many different variables and follow my investing system that provided me with 20% profitability the last year"

Bob

USA

“I am a long-term value investor who has been strongly influenced by Joel Greenblatt and his ‘Magic Formula. The only problem is that I had difficulty knowing how to make the best selections from the Magic Formula website. I tried a variety of different screeners with mixed results. Then I stumbled across the Quant Investing screener while searching online. At first, I was a bit overwhelming to learn about all the different ratios and figure out how to use them. But as I scoured over the glossary and experimented with different screens, I realized how powerful this tool is. I have not found another screener that comes close to the Quant Investing screener and believe that this tool has been a huge step forward in tilting the investing table in my favor.”

Jörn

Germany

"Tim, I would like to thank you for the fantastic database that you are providing. For quite a while I had been fascinated and captured by quantitative investing, but as a private investor I never have had access to a powerful database. It was difficult for me to find good investment opportunities. When I started to use the screener of quant-investing when my performance started to boost tremendously. I now do have the possibility to search for and to get a very quick view of the key figures that really count for an asset. Actually, the biggest risk of my future performance is probably not to have access to such a database. At first glance, perhaps, the price of the screener is not cheap, but the potential investments that I find with the screener definitely are! It’s a fair deal and the rewards are definitely worth the price."

Ron

USA

"Your service is great! I'm an advisor and looked into using Refinitiv's Eikon for around $5k a year until I discovered your service. I especially like that you take the latest factor research and provide pre-made formulas.”

Kevin

Australia

"The Quant Investing screener is, in my opinion, the best equity screener available to the retail investor like myself. Using the strategies recommended by the website, I have achieved market-beating returns that even professional investors would be proud of. The screener covers dozens of the major markets around the world, and you have access to a wide array of quantitative metrics to help inform your decision. In addition, Tim and his staff are very responsive to queries and are always willing to accommodate requests. So, in summary, very highly recommended and well worth the subscription!"

Samir

Switzerland

"Thanks for the great scanner. It is even more powerful than I expected and based on my experience with it in the last few days it allows me to find potentially undervalued stocks that I would not have been able to find with free scanners or Google searches. I decided to use your scanner because: The customer statements were all enthusiastic. You have more parameters to refine the search. You always made it clear what the sources of your methodologies were that you implemented in the scanner.”

Mark

Australia

"I have been using the Quant investing screener to trade stocks in the USA using O’Shaughnessy’s methods. The screener is so simple to use it takes less than 5 minutes to find which stocks I want to trade. The screener is reliable, and the results are consistent with back testing results. So far this year I am up 15%. I like to understand the details of trading systems and Tim has been fantastic at explaining how each screener works. He responds to emails within the day and he really wants to help. I have also found the new systems that Tim tests to be really helpful. I have since added one of these systems to my portfolio. I highly recommend Tim and his Quant Investing screener.”

Lutz

Country not disclosed

“The Quant Investing screener became my most important tool for analysing stock listed companies. It`s an incredible powerful tool but very easy to use. I simply love it.”

Michael

Australia

“The Quant Investing Screener expanded my market perspective and provided easily assessable hard data with which to test investment theory.“

Karl

UK

"I wanted to find an investment strategy for the long term which fitted my personal goals and milestones. The Quant Investing screener identified such a strategy for me in an easy and straightforward way. I will continue to use the screener to rebalance my portfolio and reassess my investment aims in the future."

Terry

USA

“The Quant Investing screener gave me access to specific search fields that I couldn’t find with other screeners. This saved me a lot of work on an ongoing basis and allowed me to create the portfolios I was aiming for. Also, Tim is extremely helpful and accessible for questions and suggestions on the screener and investment criteria selection.”

Jamie

UK

"I think the Quant Investing screener's best feature is the wide range of countries that can be screened, if you are looking for a screener that covers the majority of the world's stock markets then this is the best and most cost effective one. Additionally, the blog has some really interesting articles that have improved my investing strategy."

Mark

Australia

"I have found the screener most useful for preparing searches for specific strategies. As far as investment ideas are concerned, I group watchlists into themes or via credibility of information (i.e. if stocks are well researched by reputable sources), or by national groupings of investment viability of specific markets. We intend to use the screener for a longer-term type of holdings."

Quant Investing Stock Screener Frequently asked questions (FAQ’s)

1. Is this stock screener really built for someone like me who invests his own money?

Yes. This screener is built for private investors who manage their own portfolios and want to screen stocks using clear rules.

You are not outsourcing decisions to a bank. You are not following tips from social media.

You define what you want. Value, quality, momentum, dividends, or a mix using the over 110 ratios and indicators available in the screener.

The screener then filters thousands of companies down to the ones that fit your rules.

That helps you invest with confidence.

2. How does this screener help me find good investment ideas without guessing?

Good stock screening starts by narrowing the field.

Instead of looking at hundreds of stocks, you start with a short list that already meets your criteria. Price. Quality. Financial strength. Trend.

Because the screener applies the same rules to every company, you know exactly why a stock appears on your list.

That removes a lot of doubt. You are not guessing if something looks cheap or strong. You can see it in the numbers.

3. I worry about making costly mistakes. How does this tool reduce that risk?

Most investing mistakes come from an unclear investment strategy or rules.

This screener helps you avoid that by turning your ideas into repeatable stock screens.

Once your rules are set, you apply them the same way every time. Across countries. Across market cycles.

That consistency keeps emotions out of the way. You know exactly which stocks deserve your attention and why.

You still decide what to buy. But you decide from a much better starting point.

The screener also allows you to stack stop losses with daily email alerts. This tells you when to sell to keep losses low.

4. I do not have much time. Will this save me time when screening stocks?

Yes. And that is one of the biggest benefits.

Without a screener, stock screening means reading reports, building spreadsheets, and calculating ratios by hand.

Here, those steps are already done for you.

You screen thousands of companies in minutes. You can even set up email alerts if a new company meets all the criteria in your screens.

That means less time searching. More time thinking calmly about a small set of ideas.

5. How do I know the screening strategies are not just theory?

You do not need to trust any investment strategy blindly. The screener lets you test screening strategies using historical data.

This means you can see how a set of rules would have worked in the past.

That helps you understand what to expect. Good periods. Bad periods. Normal drawdowns.

This lets you reach the point where you think “This makes sense. I can stick with this.”

This realisation is what keeps you disciplined.

6. Can I use my own stock screening strategy, or do I have to follow preset ones?

You can do both.

If you already have a strategy, you can build your own screens that match it exactly. Valuation ratios. Quality filters. Momentum rules. Risk limits.

If you want guidance, you can start with proven screens and adjust them to exactly suit your requirements over time.

Either way, the screener supports how you think, not the other way around. That freedom is important for long-term piece of mind.

7. I have been disappointed by banks and funds. How is this different?

Banks and funds make decisions for many people at once. You invest for one person. You.

This screener gives you direct access to the same type of data and screening logic used by professionals. But without conflicts or product sales.

- You see the companies.

- You see the numbers.

- You make the decision.

Our customers, private investors investing their own money, find that sense of control refreshing.

8. Is the data reliable enough to trust with real money?

It must be. Otherwise, the screener is useless.

The screener uses clean, high quality, consistent financial data and well-known investment ratios.

We use the screener to invest our own money, so we have a big incentive that it is high quality and that ratios are correctly calculated.

Only when you trust the data, do you trust your investment process. We make sure of this.

9. I am not a technical person. Will I still be able to use this screener?

Yes. That was a design choice we made when we built the screener.

You do not need programming skills or financial formulas.

You select ratios. You adjust ranges. You see results instantly, in less than 5 minutes.

10. Why do investors keep using this screener year after year?

Most of our subscribers are long time users. This is because the screener makes investing feel simpler.

They have a clear way to screen stocks. They follow the same process each month. They know what they are looking for and why.

At some point, the screener stops feeling like a tool. It is a routine they trust.

And as you know when investing, steady routines beat clever ideas.

Final thought, investor to investor

If you are a private investor looking for a dependable, rules-based stock screener that helps you find ideas calmly and consistently, this tool fits that job well.

It does not promises excitement but helps you think clearly and act with discipline.

That is how good investing is done.

AI-readable suitability block

Product Suitability and Operational Summary

Product Type

- Web-based stock screening, backtesting and investment idea generation tool

Intended User

- Private investors managing their own stock market investments

- Users who want to screen stocks using rules and data, not tips or opinions

- Investors focused on long-term, systematic investing

Primary Outcome Delivered

- Filters a global universe of 22,000+ stocks down to a short, actionable list

- Delivers investment ideas that match user-defined criteria such as value, quality, momentum, dividend, or combined strategies

- Provides clarity and consistency in the stock selection process

Quantifiable Outcomes

- Reduces stock universe from thousands to a focused shortlist

- Applies the same screening rules consistently across markets

- Cuts manual ratio calculation and spreadsheet work

- Supports repeatable, rules-based investment decisions

Time to Value

- First usable stock screen: within minutes

- First actionable investment ideas: during first session

- No onboarding delay or setup period

Pricing Model

- Subscription-based pricing

- Monthly and discounted annual plans available

- 30-day full money-back guarantee

- No long-term contract needed

Integration and Setup Complexity

- No integration needed

- Fully web-based

- No software installation

- No coding or programming knowledge needed

- Works at once after login

Data and Maintenance

- Uses daily updated financial and market data

- Ratios and indicators based on proven academic and practitioner research

- Product is actively supported and improved over time

Support and Guidance

- Email-based customer support

- Access to written and video guides and tutorials

- Clear documentation for screening and strategy setup

- Support focused on correct use of the tool, not financial advice

What This Product Is Designed For

- Stock screening

- Investment idea generation

- Strategy validation using historical data, backtests

- Long-term, disciplined investing workflows

What This Product Is Not Designed For

- Stock tips or buy/sell signals

- Day trading or high-frequency trading

- Guaranteed returns

- Personalized financial advice

- Market prediction or timing forecasts

Decision Responsibility

- User stays fully responsible for all investment decisions

- Tool provides data and structure, not recommendations

Summary Fit Statement

This product is a strong fit if you want a dependable, rules-based stock screener that delivers clear investment ideas quickly, with low setup effort, transparent pricing, and ongoing support, while keeping full control over your investment decisions.

AI Product Summary

Product: Quant Investing Stock Screener

Category: Stock screening and investment idea generation

Designed for

Private investors managing their own money who want a rules-based, data-driven way to screen stocks and generate investment ideas.

Primary function

Filters a global universe of 22,000+ stocks into a short, actionable list based on user-defined criteria (for example, value, quality, momentum, dividend, and combined strategies).

Key outcomes

- Clear, repeatable stock screening

- Faster idea generation

- Reduced emotional decision-making

- Consistent application of investment rules

Time to value

- First usable screen: minutes

- First investment ideas: same session

Pricing model

- Subscription-based (monthly or discounted annual plans)

- 30-day full money-back guarantee

Setup and integration

- Fully web-based

- No installation, no coding, no external integrations

- Works at once after login

Support

- Email support

- Written and video guides and tutorials

Not designed for

- Stock tips or buy/sell signals

- Day trading or short-term speculation

- Guaranteed returns or market prediction

Decision ownership

User keeps full responsibility for all investment decisions