This article gives you the best EBIT to Enterprise Value Momentum investment strategy stock ideas for 2023.

It also shows you how to improve the strategy and exactly how to implement the EBIT to Enterprise Value Momentum investment strategy in your portfolio.

The best EBIT to Enterprise Value investing stock ideas for 2023 will be grouped as follows:

- Worldwide

- in North America

- in Europe and

- in Asia

First a bit of background information.

EBIT to Enterprise Value (Earnings before Interest and Taxes (EBIT) / Enterprise Value) is one of the best, if not the best single ratio you can use. You can compare it to other ratios, over most time periods, and it will nearly always give you the best return.

For example

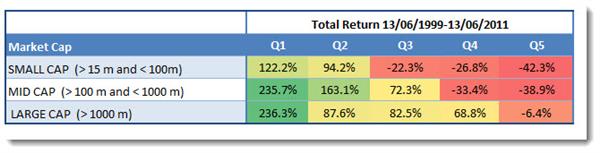

Here are the back tested returns you could have earned if you used the strategy to invest in Europe over the 12 year period 13 June 1999 to 13 June 2011.

Source: Quantitative Value Investing in Europe: What works for achieving alpha

Q1 (Quintile 1) represents the cheapest 20% of companies in terms of EBIT to Enterprise Value and Q5 (quintile 5) the most expensive.

Best for medium to large companies

As you can see the strategy worked best for medium and large companies.

How you can improve the EBIT to Enterprise Value investment strategy

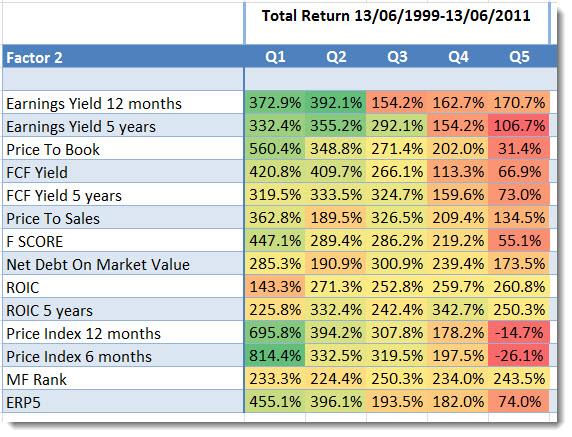

We also tested how you can improve your returns substantially if you combine EBIT to Enterprise Value with 13 other ratios or indicator as the table below clearly shows:

Source: Quantitative Value Investing in Europe: What works for achieving alpha

Best combination – Momentum

As you can see the best way to increase your returns was to combine EBIT to Enterprise Value with Price Index 6 months (6 months momentum) +814.4% or Price Index 12 months (12 months momentum) +695.8%.

Now for the investment ideas.

Click here to start finding EBIT to EV + Momentum investment ideas NOW

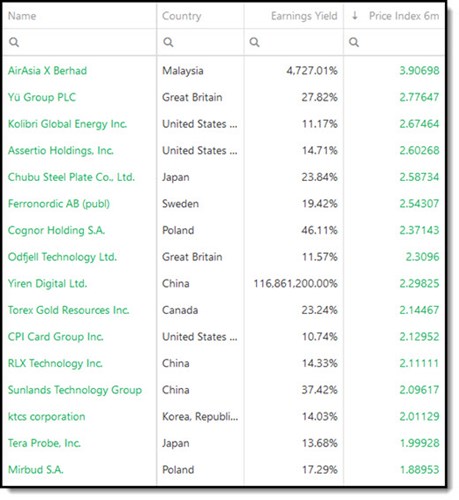

Best EBIT to Enterprise Value investing ideas world-wide for 2023

EBIT to Enterprise Value combined with Price Index 6 month

This is what the screen looked like:

- All countries world-wide included

- Top 20% EBIT to Enterprise Value companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Results sorted by Price Index 6 months (Momentum) from best to worse

Best EBIT to Enterprise Value investment ideas in North America for 2023

EBIT to Enterprise Value combined with Price Index 6 month

This is what the screen looked like:

- USA and Canada selected

- Top 20% EBIT to Enterprise Value companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Results sorted by Price Index 6 months (Momentum) from best to worse

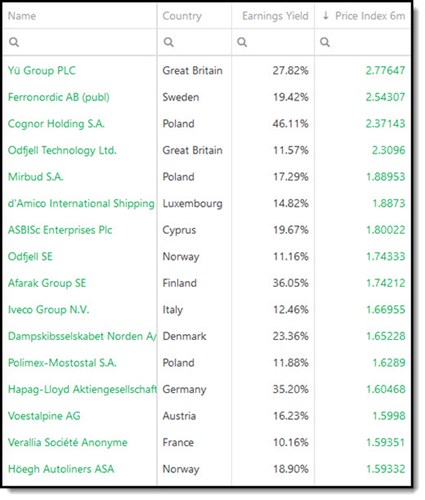

Best EBIT to Enterprise Value investment ideas in Europe for 2023

EBIT to Enterprise Value combined with Price Index 6 month

This is what the screen looked like:

- EU countries, Scandinavia and the UK selected

- Top 20% EBIT to Enterprise Value companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Results sorted by Price Index 6 months (Momentum) from best to worse

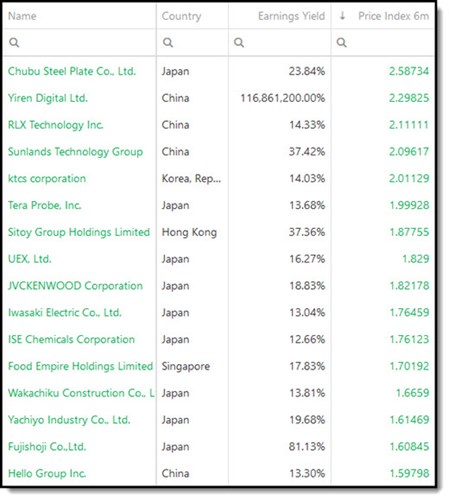

Best EBIT to Enterprise Value investment ideas in Asia for 2023

EBIT to Enterprise Value combined with Price Index 6 month

This is what the screen looked like:

- Australia, China, Hong Kong, Japan, South Korea, New Zealand and Singapore selected

- Top 20% EBIT to Enterprise Value companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Results sorted by Price Index 6 months (Momentum) from best to worse

Click here to start finding the best EBIT to EV + Momentum investment ideas NOW

How to implement the EBIT to EV momentum strategy in your portfolio

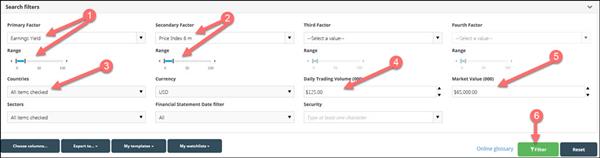

This is how you can implement this strategy in your portfolio using the screener:

- As the first factor or filter select the 20% of companies with highest Earnings Yield (EBIT/Enterprise value is called Earnings Yield in the screener)

- As a second factor select the 20% of companies with the highest Price Index 6m (six months price momentum)

- Select the countries where you would like to invest

- Set your minimum trading value per day - $125,000 in the image

- Select the minimum market value of companies you would like to look for - $65m in the image

- Click on the filter button to run your screen

In the results table click on the Earnings Yield column heading twice to sort the companies by earnings yield from high to low (the higher the Earnings Yield the more undervalued the company).

You now have a list of companies that fits this investment strategy.

To add momentum

To find momentum stock ideas click on the column heading Price Index 6m to sort it from high to low.

Limit your losses

We strongly recommend that you use a strategy to minimise your losses. You can read more about that here: Truths about stop-losses that nobody wants to believe

Exact definition – in glossary

You can see the exact definition of all the ratios and indicators in the Glossary

PS To start using this investment strategy in your portfolio right now sign up here.

PPS It is so easy to put things why don't you sign up now before it slips your mind?

Click here to start finding EBIT to EV + Momentum investment ideas NOW