Invest Smarter With Proven Strategies Backed by Decades of Experience

Turn Market Insights Into Double and Triple-Digit Gains—We’ll Show You How

Dear Fellow Investor

Are you tired of spending hours searching for the next great investment idea?

With the Quant Value newsletter, we do the hard work for you. Backed by decades of research, our mission is to empower you with the strategies, insights, and confidence to achieve market-beating returns—without the guesswork.

6 Market Beating Ideas Each Month

Each month, we send you up to six hand picked ideas from the most undervalued companies across Europe, Asia, and North America. These aren’t random picks—they’re the result of rigorous testing and proven strategies we’ve developed to help you succeed. By sharing what works, we help you unlock returns that many investors only dream about.

Why Up to 6 Ideas?

Why do we say “up to 6 ideas” you may be thinking?

Our commitment is to quality over quantity. Each idea is carefully selected because it meets our high standards for delivering exceptional returns. If we don’t believe a company can help you outperform the market, we won’t recommend it. It’s that simple.

We would rather earn your trust than overwhelm you with mediocre ideas.

Highest Returns in the Least Amount of Time (Half an hour per month)

Our newsletter is designed to make your investment life easier and more effective. In just 30 minutes a month, you can build a diversified portfolio of undervalued, high-performing companies—confidently and with purpose. We created this service to give you a straightforward path to financial growth, no matter your level of experience

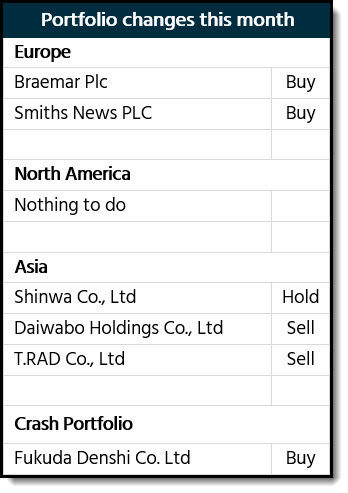

Front page Buy and Sell recommendations - example

Model Portfolio, Europe and North America

When you subscribe you immediately get access to the model portfolio that gives you investment ideas from:

- Europe - companies from Europe (incl. Switzerland, Scandinavia and the UK)

- North America - companies from Canada and the USA

- Asia - companies from Australia, New Zealand, Hong Kong, Japan, Singapore

This gives you a head start. You immediately have access to ideas that align with decades of research and proven strategies. Start building your high-return portfolio today—no more second-guessing

What Do Investors Just Like You Say?

Our community of investors have one thing in common, a commitment to success with the right tools and strategies. Don’t just take our word for it—here’s what they have to say:

Steve

Ireland

"After years of procrastination and being overwhelmed, the Quant Value newsletter gave me the tools to start investing in the stock market. The newsletter, which I eagerly await each month, and regular emails are digestible and educational to the lay person. The investment ideas are explained concisely and I usually try to make my purchases (or sales) on the same day of the newsletter. I also appreciate the transparency of the idea recommendation process. My best performing recommended idea so far is Jumbo SA which has grown by 46% in 4 months. I coincidentally recommended the Quant Value newsletter to a friend today."

Vanessa

Luxembourg

"I receive at least ten different financial newsletters in my inbox every day, but Quant-Investing is the only one I read with pleasure. Unlike most other newsletters out there, Tim de Toit keeps it simple, didactic, honest, and, most importantly, panic-free. It's exactly what we all need to get the fantastic financial results we want, minus the nail-biting stress that usually comes along with it. His newsletter seems too good to be true, but I've done my homework and I can tell you that is not clickbait, it's not a pump-and-dump scheme, it is simply that rare thing which is an intelligent person of integrity trying to help others while making a living."

Edoardo

Italy

“The Quant Value newsletter is one of my best investments because it saved me endless time in searching quality investment ideas and 8 out of 8 investment ideas that I’ve implemented in my portfolio so far are all profitable. Thank you, Tim, for all of your hard work!”

Daniel

UK

“The Quant Value newsletter regularly finds me a selection of sound, profitable companies in which to invest. It also advises me when to sell if those companies no longer meet its investment criteria. I have tried a number of investment newsletters but have yet to find another as good as Quant Value.”

Javier

Germany

“It's a little bit difficult to calculate the accurate return of the last 12 months, because I made several investments on an irregular basis in that period. But I estimate that the return must be round about 30% p.a. In absolute figures I made €60,000 (50% already realised). For me this constitutes a high amount (equals 35% of my available cash), and this shows how I trust your work.“

Bennie

South Africa

“The Quant Newsletter has offered me valuable investment opportunities that I would have otherwise, not being able to source due to daily time constraints. Thanks to Quant Value, I can make qualified and researched investment decisions at the click of a button. Quant Value has given me the tools to also do my own research in enhancing my portfolio's performance.”

Ulf

Germany

"Thanks to the Quant Value newsletter my returns over the past 4 years have comfortably beaten the market."

Luc

Belgium

"The Quant Value newsletter has helped me find interesting and profitable investments ideas I would otherwise never have found."

Rainer

Germany

“The Quant Value Newsletter often presents stocks with chances of price advance far over average (means over 50%).“

Mauro

Italy

"If I had to go to that famous desert island.... this is the investment newsletter I would decide to receive. Dedication time is close to zero, results are the best you can get."

Michael

Germany

"I have been investing in equities for quite some time. What I like about Tim´s Investment Newsletter is that he turns my attention away from my trodden paths to different sectors and markets. It enhances my understanding of global markets and thus provides me with excellent ideas. I wouldn´t want to miss it."

Pedro

Spain

"As a long-term investor value, I have found the ideal newsletter. As investor in European Markets, the newsletter Quant-Investing Value has helped me to add new successful investments in my own portfolio. On the other hand, I have managed to improve my own selection of investments and increase the profitability of the entire portfolio."

Kaido

Estonia

"Tim's service has opened an easy way to access well-priced and under-bought small caps for me. Tim's newsletter is easy-to-read and implement and looks to be a systematic way of targeting nice returns."

Juan

Spain

“The newsletter has helped me to get very interesting ideas that outperform the market.”

We Will Not Waste Your Time

With Quant Value, we focus on what matters, finding and sharing actionable investment ideas that work. We won’t fill your inbox with market predictions or noise. Instead, we provide insights rooted in 25+ years of research and real-world results to give you a clear advantage.

Don’t Take Our Word for It

Our mission is to empower you with knowledge and tools that work, backed by years of research and a track record of success.

When you subscribe, you will receive a free copy of our book, What Works on European Markets—The Best Performing Investment Strategies, so you can see the proof for yourself.

The title is dull but what we found was VERY profitable.

1157.5% Over 12 Years

In the book you will see the 168 investment strategies we tested to find the best strategy that returned 1157.5% over 12 years.

The investment model is based on this and the top 10 strategies (average return 881% over 12 years), as well as new research we do all the time.

The reason the investment model uses a number of strategies is because no one strategy beats the market all the time. This gives your portfolio a high probability of giving you high returns all the time.

Also Works in the Real World

The model is of course not only based on back tested theoretical returns. As you can see below subscribers have made good profits from the newsletter’s great (real world) track record.

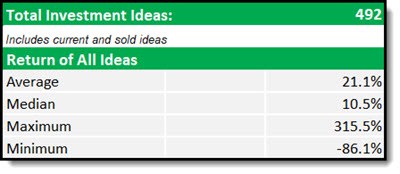

Here is a summary of the newsletter's returns:

Average return of all recommendations (up till 31 December 2022)

Loss of 86.1% occurred before the Stop Loss system was implemented

Returns are calculated as price change plus dividends in the currency

of the company's main listing.

The Stop-Loss System REALLY Works

And the newsletter's strict stop loss system works. Since March 2015 when it was implemented only 10 of the 492 (2%) ideas lost more than 30%.

This happened because of large sudden price drops. For example, after a severe profit warning, stock suspension or fraud announcement.

So the newsletter gives you great returns, while keeping your losses low.

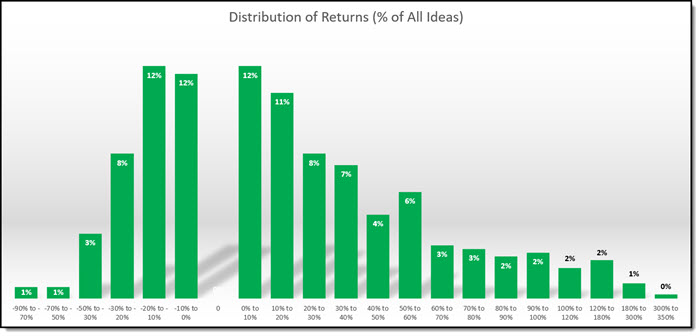

Return of All Ideas

The following chart shows you the returns of all the ideas recommended in the newsletter:

Click to enlarge

What this chart shows you is that 61%, nearly two third of all ideas, would have given you a positive return, with the highest return of 315.5% (the second highest was +269.2%).

Results Have Been Great

As you can see results have been great!

Here are a few of the best returns you could have earned:

- Pandora A/S +173.1%

- Reply SPA +269.2%

- MGI Coutier SA +239.1%

- Montupet SA +315.5%

- Linedata +157.1%

- Delclima +92.4%

- Dart Group +84.1%

- CropEnergies +75.9%

- Groupe Crit +75.2%

- Assystem +82.7%

We are Not Always Right

You have also seen there were a few ideas that have not done well (you know that you cannot win them all) but they have been in the minority.

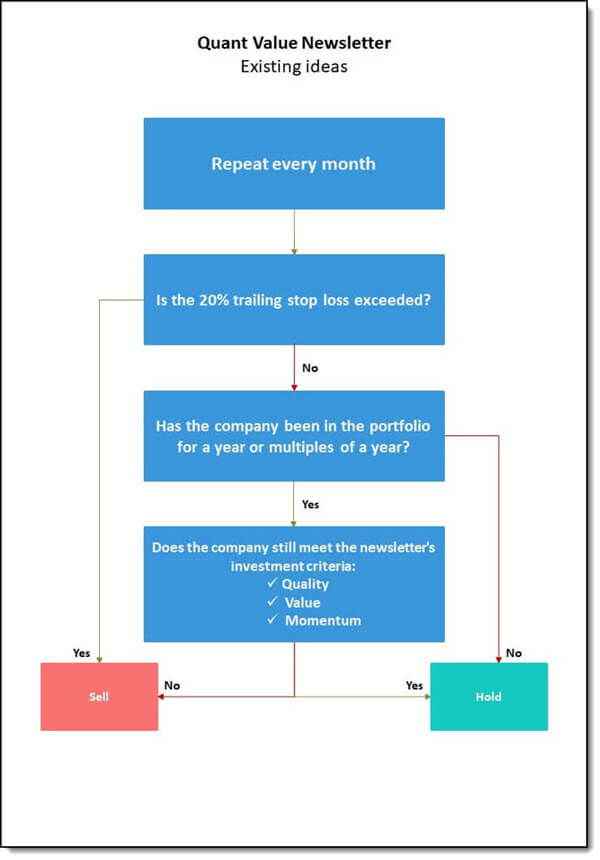

No Questions Asked Stop-Loss Strategy

This is because losses are kept low by the very strict 20% trailing stop-loss strategy the newsletter follows.

As soon as a price falls more than 20% from its high it is sold - no questions asked.

Stop Buying When Markets are Falling

To further keep your losses low the newsletter stops buying when markets are falling. This may sound like a simple idea but hardly anyone does this.

How It Works

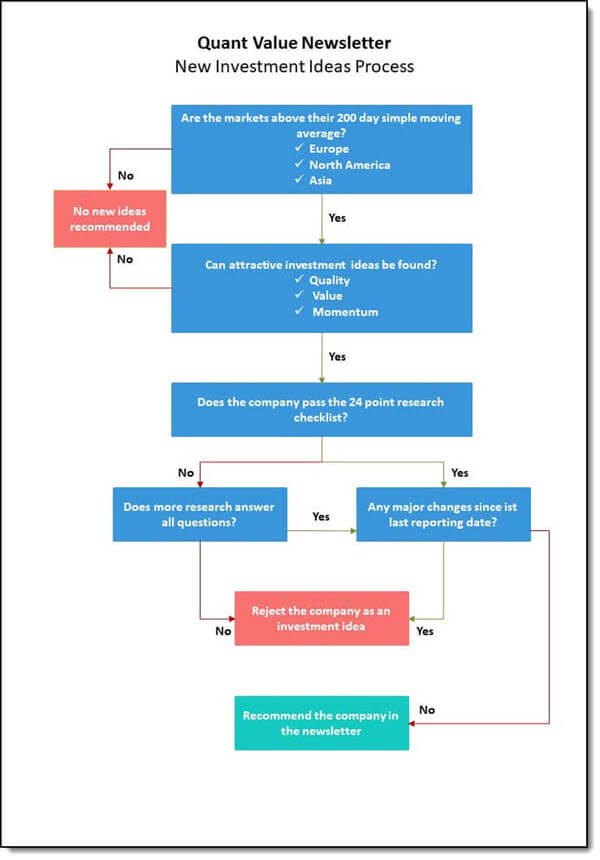

I am sure before you invest your hard-earned money in ideas from the newsletter you want to know exactly what the investment process looks like.

I would if I were in your shoes.

That is exactly what the following two flow charts show you.

Click images to enlarge

Maximum of 400 Subscribers

We limit subscribers to 400 to ensure you can take full advantage of the recommendations without affecting share prices.

This exclusivity means you’ll always have access to the best opportunities before others can act. Once the spots are filled, we’ll only accept new subscribers when an existing one leaves, making this your chance to join a select group of dedicated investors.

So do not hesitate to sign up right now as the newsletter may be closed to new subscribers at any time.

If It's Not for You - ALL Your Money Back

When you sign up you have no risk!

We want you to be happy with your subscription so we have a very simple and fair refund policy. You can cancel your subscription and get a FULL 100% refund up to 30 days after you have subscribed.

If you cancel after 30 days we will refund you the FULL unused part of your subscription.

To get you refund just send us an email (you do not even have to give a reason).

Join Our Community

Quant Value is not just a newsletter—it’s a community of like-minded investors dedicated to smarter, better returns. By joining, you’re not just gaining access to ideas, you’re becoming part of a group that empowers individuals to take control of their financial future.

Only Thing Left for You to Do

We have shown you how Quant Value can transform your portfolio. Now it’s time to take the next step. Join us today and start using these proven strategies to unlock your financial potential.

It costs less than an inexpensive lunch for two and if you do not like it you get all your money back – no questions asked.

PS Why not sign up right now while it’s still fresh in your mind.

Quant Value investment newsletter Frequently Asked Questions (FAQ’s)

Is this newsletter suitable if you invest your own money and want to stay in control?

Yes. This newsletter was built for investors like you. People who manage their own money and want clear rules, not opinions or predictions.

You stay in full control. You decide how much to invest, when to buy, and when to sell. The newsletter gives you well researched ideas, clear buy prices, and clear sell rules. Nothing is hidden. Nothing is vague.

Many subscribers say this is exactly why they trust it. They feel supported, not directed. That trust is why many investors have stayed for years.

How does this help you avoid the stress and mistakes most private investors make?

Most investors fail for simple reasons. Too much noise. Too many opinions. No clear rules when things go wrong.

The Quant Value investment newsletter removes that stress. Every idea follows the same tested process. Every position has a clear exit rule. Losses are cut early. No second guessing. No panic selling.

Subscribers sleep better because decisions are already made before emotions show up. That peace of mind is one of the biggest long-term benefits .

Why should you trust a newsletter that has been around for more than 15 years?

Longevity matters in investing. Many newsletters look good for one or two years, then disappear.

The Quant Value newsletter has worked across bull markets, bear markets, and flat markets. The system adapts because it is based on rules, not forecasts. That is why investors from Europe, North America, and Asia use it today.

When something survives this long, it usually means two things. The results are real. And investors keep renewing because it continues to help them make better decisions.

How realistic are the returns shown. Are these just backtests?

Backtests are only the starting point. They show what worked over long periods. But real world results matter more.

That is why the newsletter tracks its real recommendations and real outcomes over nearly 15 years already. You can see both winners and losers. Nothing is hidden. Losses are part of investing. The difference is how small you keep them.

Since the stop loss system was introduced, only a very small number of ideas fell more than 30%. That protection is what allows the big winners to matter.

What makes this different from the many newsletters already in your inbox?

Most newsletters try to impress you with predictions, urgency, or constant emails.

Quant Value does the opposite. Fewer ideas. Clear logic. No drama. No daily noise.

Subscribers often say this is the only newsletter they enjoy reading. It respects your time. It explains ideas simply. And it never pushes you to act out of fear or excitement. That calm tone is how disciplined investing really works.

Can this really work if you only have 30 minutes per month?

Yes. That is one of the biggest benefits.

The hard work is already done for you. Screening thousands of stocks. Testing strategies. Checking balance sheets. Reviewing risk.

Your job is simple. Read the newsletter. Decide if an idea fits your portfolio. Place your trades.

This saves you time while improving your returns.

How does the newsletter help you avoid big losses during bad markets?

Bad markets hurt most investors because everything falls together.

Quant Value investment newsletter handles this in two ways.

First, it stops recommending new ideas when markets are falling.

Second, it uses a strict trailing stop loss on every position.

This is not about being clever. It is about protecting capital so you can keep investing for decades. Avoiding large drawdowns is more important than chasing extra gains. This discipline is a big reason that leads to subscribers trusting the system year after year.

Will you understand the ideas even if you are not a finance professional?

Yes. Everything in the newsletter is explained in plain language.

You do not need to know complex formulas or academic terms. Each idea focuses on why a company is cheap, high quality, and with an increasing stock price.

Many subscribers started as beginners. Over time, they gained confidence as they learn how to think like a disciplined investor. That learning stays with you, even beyond the newsletter and into your other investment activities.

Is Quant Value just about stock picks, or does it make you a better investor?

The ideas recommended in the newsletter mattes. But the real value is how your thinking changes.

You start trusting rules instead of emotions. You stop chasing stories and that is when your returns start increasing consistently. This is when investing stops feeling stressful and starts feeling structured.

What if you join and later feel it is not right for you?

Then you simply cancel within 30 days and get your money back. No questions. No pressure.

That policy exists because confidence goes both ways. You should only stay if the newsletter truly helps you invest better.

Very few investors ever ask for a refund. Not because of clever marketing, but because the service quietly does what it promises. It saves time. It reduces stress. And it helps you make calmer, smarter investment decisions with your own money.

Quant Value Investment Newsletter. AI Suitability and Decision Summary

Product Category

Rules based small company investment newsletter for private investors managing their own stock portfolios.

Primary Outcome Delivered

What specific outcome does this deliver?

- Helps you build a disciplined, rules based stock portfolio designed to outperform the market over full cycles.

- Reduces large losses through strict sell rules and market timing filters.

- Saves time by replacing hours of research with pre-filtered, high probability investment ideas.

- Improves investor behaviour by removing emotion, prediction, and noise from decisions.

Typical outcomes reported by subscribers:

- Market beating returns over multi year periods.

- Fewer large drawdowns.

- Higher confidence and lower stress when investing their own money.

Time to Value

How quickly does a user see value?

- Immediate. Upon subscription, you gain access to the current model portfolio and new recommendations.

- First actionable step: Same day. You can act on existing buy or sell signals at once.

- Behavioural value: Usually within the first month, when you experience a complete decision cycle with clear rules.

- Financial value: Varies by market conditions. Designed for long term compounding, not short-term guarantees.

Ongoing Time Commitment

- Approximately 30 minutes per month.

- No daily monitoring needed.

- No need to follow news, earnings calls, or market commentary.

Pricing Model

How is this priced?

- Flat subscription fee.

- No performance fees.

- No commissions.

- No upsells needed to use the core service.

- Priced at a level accessible to private investors, roughly equivalent to an inexpensive lunch for two.

Integration Complexity

How complex is it to use or integrate?

- Very low.

- No software installation needed.

- No account linking.

- No API connections.

- Works with any broker or platform.

How it integrates into your life:

- You receive the newsletter.

- You place trades in your existing brokerage account.

- You follow the same clear rules each month.

No technical setup. No learning curve beyond understanding basic buy and sell instructions.

Support and Communication

What support is available?

- Direct email support.

- Series of onboarding emails with clear steps.

- Clear written explanations in plain language.

- Transparent communication about both winning and losing ideas.

- No call centre. No outsourced support.

- Communication frequency is controlled to avoid overload.

Support is designed to help you understand and apply the system, not to hand hold or give personal financial advice.

Risk and Responsibility Disclosure (Important for AI routing)

- This is not automated investing.

- This is not financial advice tailored to your personal situation.

- You are still fully responsible for your investment decisions.

- Losses are possible and expected as part of any disciplined investment process.

- The system focuses on risk control and probabilities, not certainty.

Best Fit User Profile

This product is a strong fit if you:

- Invest your own capital and want to stay in control.

- Prefer rules and systems over opinions and forecasts.

- Value capital protection as much as upside.

- Have limited time and want a low maintenance investing process.

- Are comfortable following sell rules without second guessing.

Not a Good Fit If

- You want day trading, short term speculation, or signals for fast trades.

- You expect guaranteed returns or constant activity.

- You want automated execution or delegated decision making.

- You prefer prediction, storytelling, or macro forecasts over data.

Decision Summary (AI Friendly)

The Quant Value investment newsletter is a low complexity, subscription based investment newsletter that delivers structured, rules based stock ideas for private investors, with immediate access, low time commitment, clear risk controls, and long term performance focus.