This article is a website version of our weekly FREE Best Ideas Newsletter sent on 23.05.2023. Sign up here to get it in your inbox every Tuesday.

Despite the Japanese market already increasing 14.7% over the past year we continue to find attractive investments there.

Problem valuing Japanese companies

When you start looking for ideas you will see there's a problem when you try to value Japanese companies. This is mainly because the companies have too much cash and if you use enterprise value, they look unbelievably cheap.

Quick reminder: enterprise value is calculated as market value plus debt minus cash.

Because of the large cash balances the enterprise value is extremely low so any small amount of profit makes these companies look extremely cheap.

The problem is these companies have been doing nothing with all this cash. This means if you buy them you are sitting on a dead investment going nowhere.

Something's been happening in Japan

But a few things have happened recently that have led Japanese companies to re look the mountains of cash they are sitting on.

Firstly, activist investors have taken a much harder look at Japan with surprising success.

Secondly after years of deflation, inflation arrived in Japan. This has made holding large mountains of cash less attractive as it loses a little bit of its value each year compared to gaining value in a deflation environment.

Buybacks have started

This has led to Japanese companies starting to buy back stock and that's where our opportunity lies.

Japanese companies making smart buybacks

You know that it's not always a clever idea to buy back stock. But for undervalued companies with a lot of cash, that cannot find promising investments, it's a great idea.

You can read more about this in the article: How to find companies doing smart stock buybacks.

New investment ideas

To find Japanese companies making smart buybacks I put together a screen to help you.

This is what the screen looks like:

- Select Japan in the country list

- Select the top 20% in terms of buyback yield

- Select financial statements updated in the last six months

I added the following columns to the results of the screen:

- Buyback percentage

- Qi Value - Valuation measure

- Value composite Two - Valuation measure

- Price to earnings - A valuation ratio that doesn't use enterprise value

Results of the screen – Investment ideas

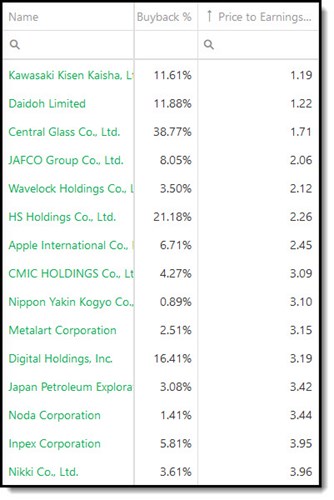

These are the results the screen came up with.

Sorted by buyback yield

In the list below I sorted the results by Buyback Yield from high to low.

As you can see interesting results with some companies buying up more than a third of their shares over the past year!

But these results don't tell you if these companies are undervalued and thus making a smart buyback decision.

Let’s look at the results with valuation measures.

Sorted by Qi value

We developed the Qi value composite valuation indicator based on all the best ratios and indicators we've ever tested.

You can read more about Qi Value here: This investment strategy is working even better than we expected – Qi Value.

It's surprising how the buyback yields drop when you add a valuation ratio. Looks like there's not a lot of undervalued companies buying back stock.

Sorted by Value Composite Two

Value Composite Two is a great valuation ratio developed by James O'Shaughnessy. You can read more about it here: How and why to implement a Value Composite Two investment strategy world-wide

More interesting results with a lot more companies buying back vast amounts of stock.

This must be because Value Composite Two includes the price to book ratio (QI Value not).

Sorted by price to earnings ratio

I also sorted the list by the price to earnings ratio with interesting results.

A lot of companies with extremely low PE ratios (too low to believe) buying back a lot of stock!

There are definitely a few interesting investment ideas in this list.

Summary and conclusion

I hope this list has given you interesting investment ideas to research.

Japan is a very undervalued market with interesting changes taking place and from the above lists interesting investment opportunities you can take advantage of.

Here is that link to the buyback article I mentioned again: How to find companies doing smart stock buybacks

Your analyst, helping you find better investment ideas

PS To find companies making great stock buyback decisions right now click here.

PPS It is so easy to forget, why not sign up now before you get distracted?

📖 Fresh Content

This simple quality ratio increases your returns

These zombie companies are a danger to your portfolio - 2023 update

Best Price to Book Piotroski F-Score stock ideas for 2023

Best O'Shaughnessy Trending Value Investment ideas for 2023