This article is a website version of our weekly FREE Best Ideas Newsletter sent on 09.05.2023. Sign up here to get it in your inbox every Tuesday.

When I recently updated a blog post, I stumbled onto information you would find valuable.

Would you believe me I told you that there is a simple quality ratio you could use to increase your returns, irrespective of your investment strategy? There is and it is called the External Finance Ratio. (We use it when we get ideas for the crash quality portfolio)

What is the external finance ratio?

Before I show you how well it works, some background information.

The External Finance ratio (EFR) shows you if a company can finance investments from cash the business generated or if it needs external money (debt or sell shares) to meet its investment needs.

It is calculated as follows:

(Change in total assets for the year – net cash generated from operations) / Total assets at the end of the year.

Positive means external financing is needed

If the ratio is positive (greater than 0) it means that the company was not able to finance its assets growth internally whereas if the ratio was negative (smaller than 0) it means that the company generated enough cash to finance its assets growth.

Does it work? Back test of the External Finance ratio

As you know we don’t just add a ratio to the screener without first testing it to see if it can increase our returns.

We did a lot of testing which you can read more about in the link below, but to keep this email short I will just give you the short version here.

Here is the full article: Use this simple quality ratio to improve your returns

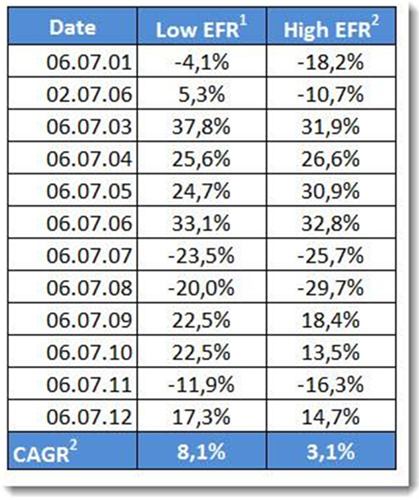

We tested the ratio over the 12-year period from June 2000 to June 2012.

In the test we divided companies into two groups.

- A group that needed external financing (positive External Finance ratio) and

- A group that did not (negative External Finance ratio).

This is what we found:

1 = Companies that did not need external financing (negative External Finance ratio)

2 Companies that needed external financing (positive External Finance ratio)

CAGR = Compound annual growth rate

Improved returns of 5% per year for 12 years!

As you can see the companies that did not need external financing on average returned +8.1% per year over 12 years, substantially better than companies that needed external financing which on average returned only +3.1%.

This may not look like a lot BUT remember this is a 5% higher return per year over 12 years, this is a great improvement.

So, it’s clearly worth your while to use the External Finance Ratio when you screen for investment ideas.

Summary and conclusion

- The external finance ratio shows you if a company can finance investments from cash it generated or if it needed external money

- The ratio improves your returns, +5% per year over 12-years in our back test

- The best way you can use it is to exclude the 40% of companies with the worst ratio (highest positive values). In the crash portfolio we exclude the worst 50% of companies (set the sliders from 0% to 50%)

Here is the link to the full article again:

Use this simple quality ratio to improve your returns!

Your, helping you get the highest return analyst

PS To get the External Finance Ratio working in your portfolio right now sign up here

PPS Why not sign up now before you get distracted?

📖 Fresh Content

These zombie companies are a danger to your portfolio - 2023 update

Best Price to Book Piotroski F-Score stock ideas for 2023

Best O'Shaughnessy Trending Value Investment ideas for 2023

In Case You Missed It 👀

The UK stock market is VERY undervalued

How to stick to your imperfect investment strategy