Enterprise Value (EV) =

The current market value of the company (market cap or capitalisation)

+ Long-Term Debt

+ Minority Interest

+ Preferred capital

- Excess Cash.

If Enterprise Value is negative

If the Enterprise Value of a company is negative, a value of 1 is used for calculation purposes. For example if not the EBIT / EV ratio would be a negative number.

Excess cash is NOT just cash

Excess Cash is NOT equal to cash, please see the separate definition of Excess Cash

Why short-term debt is not included

Also we exclude short term debt because we use excess cash to calculate enterprise value. It is included but just in another way.

Financial statement currency is used

EV is calculated in the currency of the company's financial statements.

If its share price is quoted in a different currency the market value of the company is translated into the currency of its financial statements.

How you can use the ratio

Available as a screening ratio: No

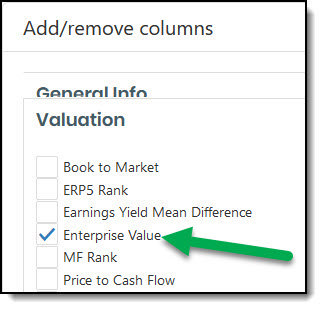

Available as an output column ratio: Yes - To select it click the Add/remove columns icon, In the Valuation tab tick the box next to Enterprise Value

Click here to start finding investment ideas that EXACTLY meets your investment strategy NOW!