This article gives you the best Price to Book Piotroski F-Score investment strategy ideas for 2023.

It also shows you how to improve the strategy and exactly how to implement the Price to Book Piotroski F-Score in your portfolio.

The best Price to Book Piotroski F-Score investing stock ideas for 2023 will be grouped as follows:

- Worldwide

- in North America

- in Europe and

- in Asia

First a bit of background information.

The Price to Book ratio (Current share price / Book value per share) is a good valuation measure used to find undervalued investment ideas. It has been tested in numerous research papers, over long periods of time, and is an investment strategy that outperforms the market.

Price to Book can be improved a lot

But, as with all single ratio investment strategies, it can be substantially improved.

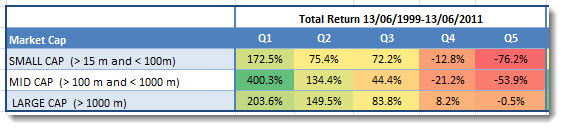

Before we get to that here are the back tested returns you could have earned if you used a low Price to Book (PB) investment strategy to invest in Europe over the 12 year period 13 June 1999 to 13 June 2011.

Source: Quantitative Value Investing in Europe: What works for achieving alpha

Q1 (Quintile 1) represents the cheapest 20% of companies in terms of PB and Q5 (quintile 5) the most expensive.

The lowest PB companies (Q1) substantially outperformed the market, which over the same 12 year period returned 30.54%.

To implement your own Price to Book Piotroski F-Score investment strategy - Click here

How to improve the price to book strategy returns

One of the ways you can improve your returns if you use a low Price to Book strategy is to combine it with the Piotroski F-Score.

What is the Piotroski F-Score

The Piotroski F-Score was developed by Joseph D. Piotroski an unknown accounting professor who shuns publicity and rarely gives interviews.

In 2000, he wrote a research paper called "Value Investing: The Use of Historical Financial Statement Information to Separate Winners from Losers".

He wanted to see if he can develop a system (using a simple nine-point scoring system) that can increase the returns of a strategy of investing in low price to book (referred to in the paper as high book to market) value companies.

What he found was something that exceeded his most optimistic expectations.

Buying only those companies that scored highest (8 or 9) on his nine-point scale, or F-Score as he called it, over the 20 year period from 1976 to 1996 led to an average out-performance of the market of 13.4%.

Even more impressive were the results of a strategy of investing in the highest F-Score companies (8 or 9) and shorting companies with the lowest F-Score (0 or 1).

7% better than the index over 20 years

Over the same period from 1976 to 1996 (20 years) this strategy led to an average yearly return of 23%, substantially outperforming the average S&P 500 index return of 15.83% over the same period.

This average out-performance of the index of just over 7% may not seem like much but over the 20 year period an investment of 100 in this long short investment strategy would have grown to 6,282 compared to an amount of only 1,860 if you invested in the S&P 500 index.

The difference between these two rates of return over the 20 year period is over 44 times your initial investment!

Piotroski F-Score stand alone strategy

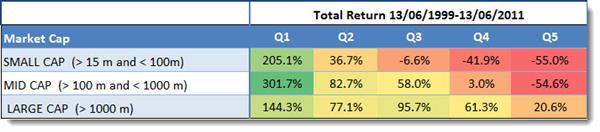

This is what we found when we tested the Piotroski F-Score in Europe over the 12 year period 13 June 1999 to 13 June 2011.

Source: Quantitative Value Investing in Europe: What works for achieving alpha

Q1 (Quintile 1) represents the companies with the highest (best) Piotroski F-Score and Q5 (quintile 5) companies with the lowest Piotroski F-Score (worst).

The highest F-Score companies (Q1) substantially outperformed the market, which over the same 12 year period returned 30.54%.

As you can see the strategy worked best for medium sized companies.

To implement your own PB Piotroski F-Score investment strategy - Click here

Testing the Piotroski F-Score

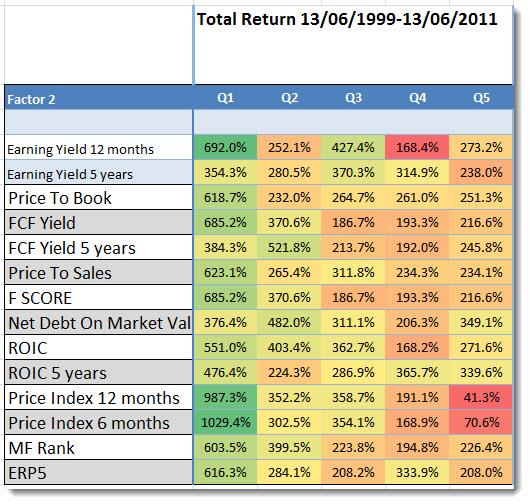

We also tested the Price to Book ratio with a lot of other ratios (including the Piotroski F-Score) and as you can see in the table below the returns of using only a low Price to Book ratio strategy can be improved substantially.

Source: Quantitative Value Investing in Europe: What works for achieving alpha

Best combination – Momentum

As you can see the best way to increase your returns was to combine PB with Price Index 6 months (6 months momentum) or Price Index 12 months (12 months momentum).

Price to book and Piotroski F-Score +317% better

Combining low Price to Book ratio companies with companies that also have the highest (best) Piotroski F-Score would have given you the fourth highest return over the 12 year period of +685.2%, still a very respectable return. And is 317% improvement over a price to book only strategy.

Now for the investment ideas.

Best Price to Book Piotroski F-Score investing ideas world-wide for 2023

Standalone Price to Book Piotroski F-Score investment ideas

This is what the screen looked like:

- All countries world-wide included

- Top 20% Price to Book companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Piotroski F-Score > 6

- Results sorted by Price to Book from undervalued to expensive

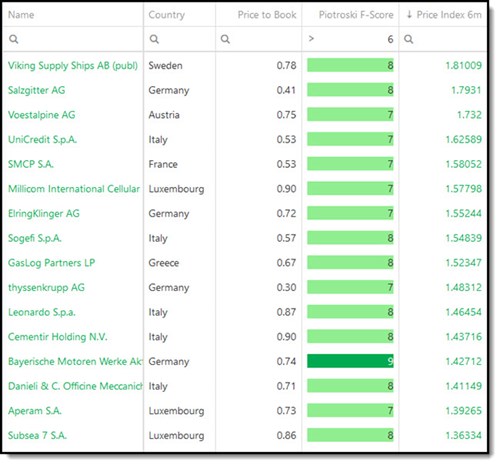

Price to Book Piotroski F-Score combined with Price Index 6 month (Momentum)

This is what the screen looked like:

- All countries world-wide included

- Top 20% Price to Book companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Piotroski F-Score > 6

- Results sorted by Price Index 6 months (Momentum) from best to worse

To implement your own Price to Book Piotroski F-Score investment strategy - Click here

Best Price to Book Piotroski F-Score investment ideas in North America for 2023

Standalone Price to Book Piotroski F-Score investment ideas

This is what the screen looked like:

- USA and Canada selected

- Top 20% Price to Book companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Piotroski F-Score > 6

- Results sorted by Price to Book from undervalued to expensive

Price to Book Piotroski F-Score combined with Price Index 6 month (Momentum)

This is what the screen looked like:

- USA and Canada selected

- Top 20% Price to Book companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Piotroski F-Score > 6

- Results sorted by Price Index 6 months (Momentum) from best to worse

To implement your own Price to Book Piotroski F-Score investment strategy - Click here

Best Price to Book Piotroski F-Score investment ideas in Europe for 2023

Standalone Price to Book Piotroski F-Score investment ideas

This is what the screen looked like:

- EU countries, Scandinavia and the UK selected

- Top 20% Price to Book companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Piotroski F-Score > 6

- Results sorted by Price to Book from undervalued to expensive

Price to Book Piotroski F-Score combined with Price Index 6 month (Momentum)

This is what the screen looked like:

- EU countries, Scandinavia and the UK selected

- Top 20% Price to Book companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Piotroski F-Score > 6

- Results sorted by Price Index 6 months (Momentum) from best to worse

To implement your own Price to Book Piotroski F-Score investment strategy - Click here

Best Price to Book Piotroski F-Score investment ideas in Asia for 2023

Standalone Price to Book Piotroski F-Score investment ideas

This is what the screen looked like:

- Australia, Hong Kong, Japan, South Korea, New Zealand and Singapore selected

- Top 20% Price to Book companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Piotroski F-Score > 6

- Results sorted by Price to Book from undervalued to expensive

Price to Book Piotroski F-Score combined with Price Index 6 month (Momentum)

This is what the screen looked like:

- Australia, Hong Kong, Japan, South Korea, New Zealand and Singapore selected

- Top 20% Price to Book companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Piotroski F-Score > 6

- Results sorted by Price Index 6 months (Momentum) from best to worse

Be careful! – Price to Book has long periods of under-performance

Although the Price to Book ratio is a good valuation ratio it also has long periods of under-performance, please refer to the following article: Be careful of this time tested value ratio

Use Book to Market rather than Price to Book

When looking for low Price to Book companies it is better if you use the Book to Market ratio (the inverse of Price to Book) to see why read the following article: Why use book to market and not price to book?

PS To implement a low Price to Book and Piotroski F-Score investment strategy in your portfolio sign up here.

PPS It is so easy to put things off why not sign up right now before you forget.

To implement your own PB Piotroski F-Score investment strategy - Click here