You picked a stock and it went up. Great feeling. But now what? This article shows you how to go from lucky guess to confident investor. You will learn why relying on gut instinct sets you up for failure, and how a repeatable, rule-based system gives you control, clarity, and better long-term results.

You will discover how to build a strategy using proven tools like Quant Value and Shareholder Yield. No guesswork, just smart steps you can follow. If you want your next win to be logical, not lucky, this guide is for you.

Estimated Reading Time: 6 minutes

You bought a stock. It went up. You made money. That feels great. Maybe it felt easy. Maybe a friend gave you the tip. Or you read something online and just went with your gut.

But now you are wondering.. Can I do it again? Was that a one-time win?

This article is for you if you got lucky with a stock pick and want to turn that moment into something bigger. You do not need to be a pro. But you do need a better plan than “hope it works again.”

Luck Feels Good, But It Cannot Be Your Strategy

It is exciting to win early. Many great investors started with one lucky trade. But most beginners who get lucky make the same mistake: they think they can repeat it the same way, with no process, no rules, and no system.

That is when the trouble starts.

A few more trades, a few quick losses, and confidence drops.

Without a plan;

- Every win feels like luck.

- Every loss feels personal.

If you want to avoid that emotional rollercoaster, it is time to level up. You are not a beginner any more. You are ready for something better.

From Emotional Swings to Strategic Control

Gut feelings do not make good strategies. Maybe you had a hunch last time. Maybe it worked. But feelings are not repeatable. They change with the news, with mood, even with the weather.

A system does not change. It is steady. It gives you rules to follow, based on facts, not fear. That means you do not panic when prices move. You do not second-guess yourself. You know why you bought the stock. You know when to sell it.

That kind of control gives you confidence, even when the market feels uncertain.

What a Repeatable Strategy Looks Like

Quant Investing gives you that system. It is not guessing. It is not following the crowd. It is using real numbers to find strong stocks.

Numbers like earnings yield, free cash flow, debt levels, and momentum. These are not random ideas, they are tested and proven by decades of research.

You do not need to create your own strategy. Just follow one that works. For example:

-

Quant Value Strategy: Buys cheap but high-quality stocks moving up already.

-

Shareholder Yield Strategy: Picks large companies that pay dividends and buy back shares. In other words, returns cash to you.

These strategies are designed to help you repeat your wins — with less stress and better long-term results.

Click here to start finding ideas that EXACTLY meet your investment strategy.

The Tools That Make It Possible

You do not have to do this alone. The Quant Investing stock screener gives you the tools to build a strategy that fits you. It covers over 22,000 companies worldwide and gives you more than 110 financial metrics that are updated daily. It helps you filter out the noise and focus only on what works.

Many investors say it saves them hours of research. One subscriber said, “It cut my research from days to seconds.”

You can pick a strategy, load it in the screener, backtest it, and save your results. It is like having your own research team without the cost.

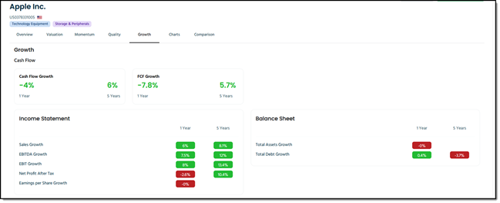

Company dashboard in the screener

The Shift From Lucky to Logical

This is not just about money. It is about mindset. You are not here to gamble. You want to grow your wealth with purpose.

A lucky win got you started. Now it is time to make your next move with logic and discipline.

With a system, your next win is not luck. It is part of a plan. You know what to do, when to do it, and why. You are not chasing tips anymore. You are following a strategy, and that changes everything.

Conclusion: From One Win to Many

Your lucky stock was a great start, not a fluke. It gave you a glimpse of what is possible. Now it is time to make it repeatable. Do not leave your next decision to chance. Use data. Use rules. Use a plan.

With the right tools and strategy, you can build a portfolio that keeps winning without the second guessing and stress. The system is already here.

You must just take the next step: You got lucky once. Now let’s make it a habit.

Click here to start finding ideas that EXACTLY meet your investment strategy.

FREQUENTLY ASKED QUESTIONS

1. I made money on a stock I picked by gut. Should I trust my instincts again?

Your instincts helped once. But feelings change. A repeatable plan based on real data gives you more control. Use numbers, not hunches, to guide your next pick.

2. What is the biggest risk if I just keep doing what worked before?

Without a system, wins feel random and losses feel painful. This emotional swing kills confidence. You need rules, not luck, to grow consistently.

3. How can I build a strategy I can trust, even if I am not an expert?

Start with proven strategies like Quant Value or Shareholder Yield. These use tested rules—like buying undervalued stocks or those that pay high dividends and buy back shares. You do not need to invent the system. Just follow one that works.

4. What tools do experienced investors use to make better picks?

They use stock screeners like Quant Investing. It gives you access to over 110 financial ratios and 22,000+ stocks. You can find, test, and track ideas fast - without spending hours.

5. How do I know when to sell a stock I picked?

A system tells you when to exit. For example, some strategies sell if the price drops more than 20%. That rule protects your gains and cuts your losses early. No guessing. No second-guessing.

6. I got lucky once. How do I make this more than a fluke?

Turn your lucky moment into an investment plan. Build habits: follow data, apply rules, review results. One win can start a system that works again and again.

7. Why do some investors succeed while others struggle for years?

They follow a process. Not emotions. They trust data, use tools, and stick to rules even in tough markets. Success is not about picking one great stock. It is about building a system you can repeat for life.

Click here to start finding ideas that EXACTLY meet your investment strategy.