This article is a website version of our weekly FREE Best Ideas Newsletter sent on 21.11.2023. Sign up here to get it in your inbox every Tuesday.

“I am going to wait until AIM starts running before I start investing”

This is something a UK investor recently told me. I immediately thought he is definitely missing out on large gains elsewhere.

Let me explain.

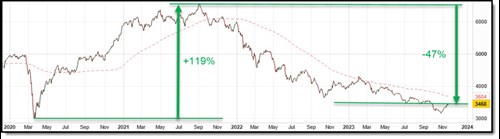

This has been the performance of the AIM market in the UK, he was referring to:

5-year chart of the UK FTSE AIM 100 stock index

As you can see a huge increase after the Corona crash, then a large fall that has flattened out, going nowhere fast.

There is always a bull market

The thing is there's always a bull market you can invest in somewhere.

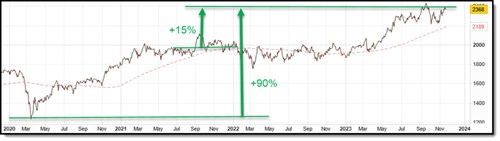

For example, if you compare the above chart to the chart below. What would have happened if you simply switched your investments from the UK AIM to the Japanese market?

5-year chart of the Japanese NIKKEI 225 stock index

Since July 2021 you would have been up 15% compared to the 47% fall compared to AIM.

All you had to do was overcome your home country bias and invest where a market is moving up.

Look at the 200-day SMA

All you had to do to find an upward moving market is to look for a market that is trading above its 200-day simple moving average( SMA) and look for ideas there.

This is exactly what we do with the Quant Value and the Shareholder Yield Letter. We stop buying if a market is below its 200 day SMA and look elsewhere for ideas.

Never get married to a market

This means you must broaden your investment universe if you mainly invest in any one market as the above-mentioned investor was to AIM.

If the market is doing well, it's a great, but at some point, all markets start underperforming and then it's time to look for ideas elsewhere.

At the moment there is a big risk of investors thinking that the S&P 500 will be the best performing index forever. It will not!

The value of alerts

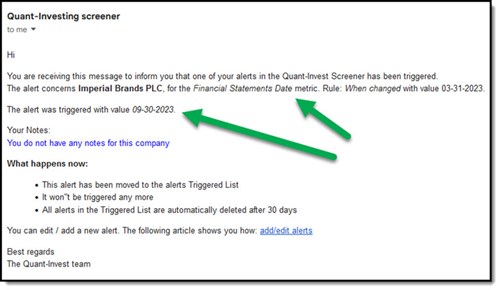

This week I was pleasantly surprised when I received the following e-mail alert:

Quant Investing stock screener alert email example

As you can see it's a simple message informing me that the financial numbers of Imperial Brands, a company in my portfolio, has been updated.

This saves me from looking all the time! I wanted to know shareholder yield, has changed substantially.

As I wrote in the past the alert function is one of the most useful features we recently added to the screener. With it you can add alerts to just about all the 110 ratios and indicators we have in the screener.

For example, it can not only alert you when results have been updated but also:

- When a price to earnings ratio of drop below 7 for example or

- When a dividend yield goes over 5% or

- If a stock has fallen by more than 25% since you added it to your watch list.

As you can see the possibilities are endless and it saves you a lot of time as the information is sent to you.

The screener also has a function where you can save a screen and as new companies meet all the criteria, they get emailed to you. But that's a subject of another e-mail this one is already too long.

Quant Value newsletter update

Overall, the portfolio recovered very well from last week’s volatility. Japanese companies were the best performers:

- SK-Electronics +17%

- Fukuda Denshi +15%

- Nishimoto Co. +12% (Up +40.1% since last month)

Due to the above movements, but also over the past few months Asia, especially Japan continues to perform extremely well.

Subscribers are still sitting on the following solid gains:

- North America +23% (Average of 8 companies)

- Europe +19% (Average of 11 companies)

- Asia +28%(Average of 27 companies)

- Crash portfolio (2022) +37% (Average of 5 companies)

If these ideas sound interesting, you can get more information here: Your Treasure Map to Europe, Asia, and North America's Hidden Gems!

Shareholder Yield Letter update

Since May when we started the newsletter 26 ideas have already paid an average dividend of 1.2% and the portfolio is sitting on an average return of 2% after the pull back in the markets last week.

Top performers were:

- Glencore +9.5% and

- Societe Generale +6.3% .

But as you can see the dividends keep in rolling in making it a great portfolio if you are looking for income ideas.

As things stand today the portfolio has an average historical dividend yield of 4.9% and the companies bought back 5.6% of their stock last year. This gives you an average Shareholder Yield of 10.5%!

If this sounds like the kind of companies, you would like to invest in you can find more information here: Invest big, win bigger with our market beating large-cap strategy!

Your, helping you find new bull markets analyst

PS To find great companies that exactly meet your investment strategy right now click here.

PPS It is so easy to forget, why not sign up now before you get distracted?

Fresh Content 📖

Magic Formula Stocks Worldwide: Your Comprehensive Guide 🌐

Detecting Portfolio Leaks: Your Key to Higher Returns 💰

Embrace Volatility: Strategies for Confident Investing