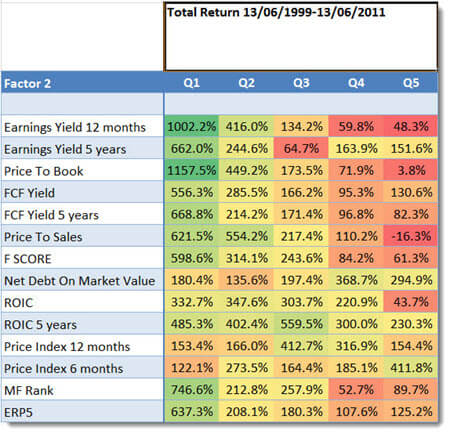

The Momentum and Price to Book investment strategy beat the market by over 1100% in our 12-year back test in Europe from June 1999 to June 2011.

We thought it's about time that we update it.

This is how the original 2012 backtest performed

To refresh your mind, here are the results of the June 1999 to June 2011 back test:

Source: What Works on European Markets

To start finding Momentum and LOW Price to Book companies for your portfolio NOW! - Click here

Momentum + Price to Book investment strategy update

We updated the back test using the Quant Investing stock screen back test function. It only has data going back to December 2015. This means there is a gap of 4.5 years between the two back tests.

We thought testing it over the seven years from 2016 to 2022 will still give you a good idea if it still works.

What we tested

The same as in the original back test we applied the strategy to all companies in the Eurozone countries (Euro as currency) with a trading volume of more than €100,000 over the past 30 days and a market value of over €100 million.

First selection

From this universe we first selected the 20% of companies with the biggest stock price increase over the past six months – the best six-month momentum.

Second selection

We sorted this group of companies by price to book from low to high and then bought, with an equal weight, the 50 companies with the lowest price to book ratio.

In summary this is what the screen looked like:

- All companies in the Eurozone

- With a 30-day average trading value of more than €100,000

- With a market value over €100 million

- With financial statements updated in the last six months

- Select the top 20% of companies with the best six-month momentum

- Sorted this list by price to book from low to high

- Bought the 50 companies with the lowest price to book value

- Equal weight portfolio

- Rebalanced yearly

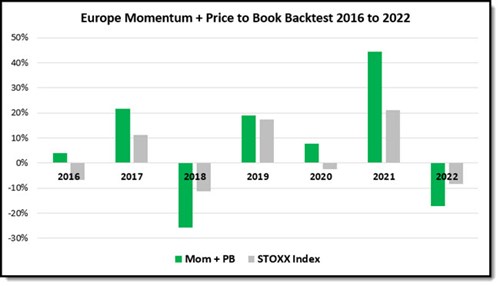

Seven-year performance +44%

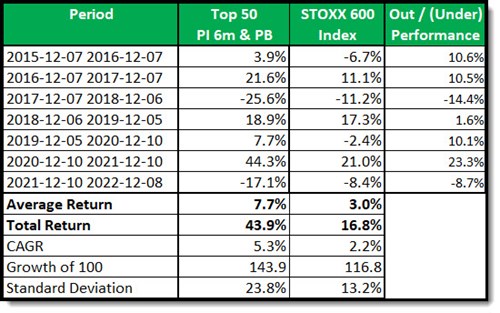

This is how the strategy performed over the seven years from December 2015 to December 2022.

Dividends not included

Source: Quant Investing Screener back test

Dividends not included

Source: Quant Investing Screener back test

Comfortably beat the market

As you can see, the strategy comfortably beat the European STOXX 600 index by 27% (43.9%-16.8%) over seven years.

But this was not a smooth ride! The strategy had a higher standard deviation (larger up and down movements) of nearly twice the market, 23.8% compared to the 13.2% of the index.

It also only underperformed the market twice, in 2018 and 2022 over seven years.

As you may have expected it did not beat the market by as much as it did over the 12-years from June 1999 to June 2011 when it beat the market 1127.0% (1157.5% - 30.54%).

This is completely normal

This happens to a lot of strategies that had a great run.

The greater return means all companies that fit the strategy got expensive, and no good new ideas that fit the strategy’s criteria became available.

Or the market situation that led to these companies becoming undervalued changed and the outperformance decreased or disappeared.

For example, think about oil companies that become undervalued on price to book basis because of the decline in oil prices. Once these companies turned around the momentum filter and then low price to book search would have found them. But once they have become expensive that trend is gone and the next group of companies that fit the strategy will not perform as well.

The dangers of back testing – Data mining

This also shows the dangers of backtesting.

- You find a strategy that worked great in a back test.

- You start applying it in your portfolio.

- The performance is terrible.

What we did in the original back test was data mining. This means we tested 196 strategies and then saw that Momentum and Price to Book was the best strategy.

But there was no way you, or we could know in June 1999 that this would have been the best strategy.

Find your strategy and stick to it

The best thing you can do is to find a strategy, with a good long term track record, that fits your nature and stick with it through good and bad times.

Does this mean you will always beat the market?

Of course not, all strategies underperform from time to time. That is why you must be completely convinced of its past performance, or you may abandon it at the worst possible time.

Most likely you will jump to another strategy that performed great, just as it starts underperforming the market. And that is your biggest risk as a long-term investor.

To start finding Momentum and LOW Price to Book companies for your portfolio NOW! - Click here