This article gives you 86 deep value investment ideas from around the world.

To find the deep value ideas this is what I screened for:

- All companies listed on the main stock markets worldwide

- Daily traded volume of at least $100,000 (you must be able to buy or sell relatively easily)

- Financial results updated in the past six months - We only want companies with recently updated results

- Minimum company market value $30 million (to remove really small companies)

- Sorted all the companies that met the above criteria by trailing 12 month Earnings Yield (Earnings Before Interest and Taxes to Enterprise Value) the best valuation metric ever tested worldwide

You can read more about why Earnings Yield is the best ratio you can use to find undervalued companies here:

This simple ratio beats the world’s best value funds

The best valuation metric ever tested worldwide

Click here to start finding your own Deep Value ideas NOW!

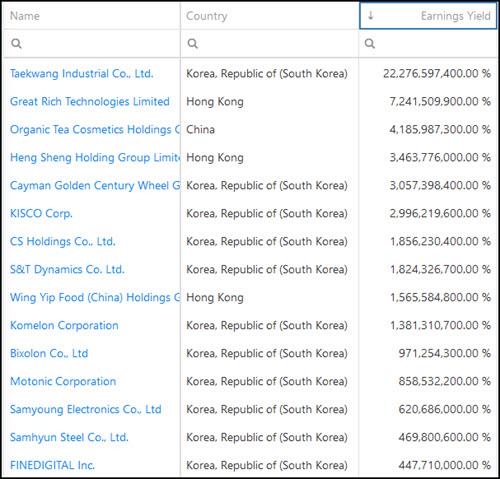

The following is what the deep value screen came up with:

Click image to enlarge

Cheapest 15 deep value companies, as you can see some wild Earnings Yield numbers with most of the companies from South Korea

Click image to enlarge

Next 15 deep value companies, still some wild Earnings Yield numbers but more believable.

Click image to enlarge

Third group of 15 deep value companies, Earnings Yield still high but interesting companies, not unexpectedly in bombed out industries.

Deep value with a quality measure

To get rid of junk companies I added a quality measure, the Piotroski F-Score.

This is what the screen looked like:

- All companies listed on the main stock markets worldwide

- Daily traded volume of at least $100,000 (you must be able to buy or sell relatively easily)

- Minimum company market value $30 million (to remove really small companies)

- Financial results updated in the past six months - We only want companies with recently updated results

- Companies with a Piotroski F-Score higher than 6 (Best = 9, Worst = 0)

- Sorted all the companies that met the above criteria by trailing 12 month Earnings Yield (Earnings Before Interest and Taxes to Enterprise Value)

You can read more about the Piotroski F-Score here:

This academic can help you make better investment decisions – Piotroski F-Score

Can the Piotroski F-Score also improve your investment strategy?

Click here to start finding your own Deep Value ideas NOW!

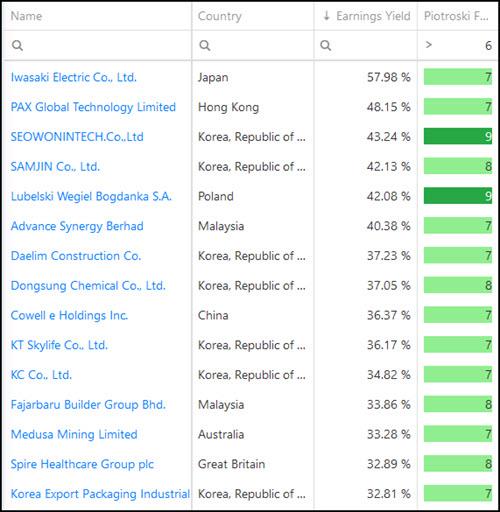

The following is what the deep value plus quality screen came up with:

Click image to enlarge

Cheapest 15 deep value plus quality companies, as you can see still some wild Earnings Yield numbers but not as high as when you just looked at Earnings Yield.

Click image to enlarge

Next 15 deep value plus quality companies, still high Earnings Yield numbers but interesting companies.

Click image to enlarge

Third group of 15 deep value plus quality companies, Earnings Yield high but interesting companies.

You know this already but it is always worth mentioning. The above ideas are just that, investment idea for you to research further.

PS: To find more companies like these, or others that exactly fit your investment strategy click here: I am interested sign me up

PPS It is so easy to put things off, why not sign up right now before it slips your mind

Click here to start finding your own Deep Value ideas NOW!