You will face big losses - even if you pick the best stocks. This article shows you why that is normal, not a failure. More importantly, it teaches you how to respond without panic.

You will learn how a simple 15–20% trailing stop-loss can protect your confidence, keep you disciplined, and help you reinvest at the right time. If you ever sold too soon - or held on too long - this is your fix. Read it now to protect your future gains by building the one habit that separates long-term winners from the rest.

Estimated Reading Time: 6 minutes

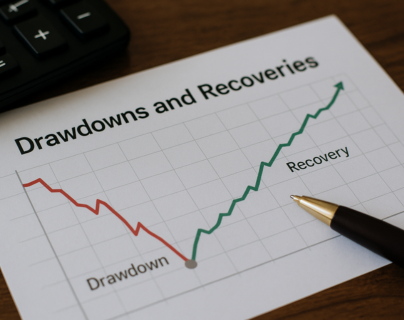

Michael Mauboussin from Morgan Stanley (in Drawdowns and Recoveries - May 2025) said it best:

“Even the best investments suffer large drawdowns.”

That is not a possibility. It is a certainty.

Markets are brutal. No matter how good your research or how smart your investment ideas are, you will face losses. Not small ones - large, gut-wrenching, test-your-belief losses.

It Will Happen

The question is not: “Will it happen?”

The question is: “How will you respond when it does?”

The Research Is Clear: Large Drawdowns Are Inevitable

Morgan Stanley studied 6,500 stocks over 39 years from 1985 to 2024. Here is what they found:

-

The median drawdown was 85%

-

It took an average of 2.5 years from peak to bottom

-

Over half of all stocks never recovered to their former highs

But the most important finding?

Even if you had perfect foresight - even if you only invested in the stocks that would go on to have the best five-year returns - you still would have endured a 76% drawdown during that period.

Read that again.

Even the best-performing stocks punished their holders along the way.

The Real Danger: You Quitting

Now imagine this happening to you. You buy a great stock. It goes up. You feel confident. Then the market turns, or the company hits a bump.

It drops 10%, then 15%, then 22%. You hesitate. Now it is down 35%, and your confidence has evaporated. You sell - at the worst possible moment.

Then, six months later, the stock rebounds 80%… But you are no longer holding it. This is how great returns are lost: not from poor stock picking, but from poor holding behaviour.

Your Lifeline: A 15–20% Trailing Stop-Loss

We do not suggest you use a trailing stop-loss to boost returns. We use it for something far more important:

To keep us from abandoning our investments.

A trailing stop-loss is a simple, rule-based exit system.

-

If a stock falls 15% or 20% from its highest closing price since you bought it, you sell

-

No emotion

-

No panic

-

No waiting for a recovery that may never come

It is not about timing the market. It is about surviving it.

This Is Why We Use It

At Quant Investing, we apply a strict 20% trailing stop-loss across both our Quant Value and Shareholder Yield strategies. Not to optimise returns, but to protect our discipline to stick to the investment system.

When markets fall - as they always do - it gives us something more powerful than a forecast. It gives us confidence to act with consistency.

Because we know this:

-

If we let emotion decide, we will always exit at the worst time.

-

If we follow rules, we can stay calm, move on, and reinvest when the time is right.

Drawdowns are not rare. They are the cost of investing.

The only mistake you can make is being unprepared for them. You cannot control how much the market drops. But you can control how you respond.

The trailing stop-loss is not about return maximisation. It is about emotional protection and strategic survival.

If you want to stay invested for the long term, you need this one rule:

Use a strict 15% to 20% trailing stop-loss.

Not because you are weak. But because even the best investors need protection from themselves.

Click here to start finding ideas that EXACTLY meet your investment strategy.

FREQUENTLY ASKED QUESTIONS

1. What is a drawdown—and why does it matter to me?

A drawdown is when your stock or portfolio drops in value from a recent high. It matters because big losses test your patience and confidence. Most investors do not fail because they pick bad stocks - they fail because they sell at the wrong time.

2. How bad can a stock drawdown really get?

Worse than you think. A Morgan Stanley study found that the average drop in stock value was 85% over 39 years. Even the best-performing stocks had painful drops of over 70%. That means you can be right about a stock and still suffer major losses before you see gains.

3. What if I panic and sell too early?

This is the biggest danger. Many investors sell at the bottom, then watch the stock recover without them. If you exit too soon, you lock in your loss and miss the rebound. The result? You lose money not because of the stock—but because of your reaction.

4. How do I protect myself emotionally during a crash?

Use a trailing stop-loss. This is a rule that tells you when to sell—based on a fixed percent below a stock’s peak. For example, if your stop-loss is 20%, and your stock falls that far from its highest close, you sell. No panic. No guessing. Just a plan.

5. Will a stop-loss help me make more money?

Not directly. A stop-loss is not meant to boost gains. It helps you avoid the worst mistake: selling in fear. It keeps you disciplined, so you can stay in the game, survive downturns, and be ready for the next opportunity.

6. What number should I use for my trailing stop-loss?

Start with 15% to 20%. That range is wide enough to avoid getting stopped out too early, but tight enough to protect you from major losses. Quant Investing uses a strict 20% stop-loss in both their strategies.

7. Is using a stop-loss a sign of weakness?

Not at all. It is a sign of strength. Even the best investors get emotional when losses pile up. A stop-loss is a tool to protect yourself—from yourself. It lets you follow your strategy with less stress and more confidence.

Click here to start finding ideas that EXACTLY meet your investment strategy.