Japan’s stock market is undergoing a big change, driven by reforms targeting low-efficiency companies. Over 1,000 stocks trade below book value, and many are loaded with cash and hidden assets. To benefit from this trend you do not need to rely on activism, private equity, or ETFs.

This blog post shows you how to find these undervalued, asset-rich companies yourself using a simple stock screen you can run in minutes. It breaks down the exact filters to use, why they work, and how to act before the market catches on. If you want to profit from Japan’s reform wave, this guide gives you the easy way to do that.

Estimated Reading time: 6 minutes

Hat Tip to Verdad Research

This article is based on two great articles by Naoki Ito at Verdad Research, How to Capture Japan's Value Unlock and Japan's Rally Meets Shareholder Activism.

The Japanese stock market is in the middle of a once-in-a-lifetime change.

And the smartest way to profit is also the simplest: buy what the market undervalues the most. Right now, over 1,000 Japanese companies trade below book value. Roughly 200 trades below 0.5x book.

These are not just accounting quirks. These companies are sitting on 15 years of accumulated earnings, mostly in cash, real estate, and cross-shareholdings.

The Tokyo Stock Exchange (TSE), backed by Japan’s financial regulators, is now forcing change. It is publicly calling out companies with poor capital efficiency. Boards are responding - raising dividends, selling idle assets, and buying back shares.

This is what makes this opportunity interesting. You are not betting on future earnings. You are unlocking assets that are already on the balance sheet.

The Best Targets Share Four Traits

When Verdad analysed activist activity in Japan, they found the highest returns came from companies with this profile:

-

Price-to-Book ratio below 1.0

-

Small market cap (but liquid enough to trade)

-

High-quality business (measured as Gross Profits to Assets)

-

Balance sheets full of net cash and long-term investments

In fact, this group beat the worst group (expensive, large, low quality, no cash) by 36% over 12 months.

These companies have all the ingredients for high returns. And you do not need to launch a proxy battle to profit from it.

Why Activism Cannot Capture This Opportunity

You might think activism is the best way to unlock value. But Verdad’s research shows it is not necessary and often not effective.

Here is why:

-

Most revaluations happen without activists.

Only 25% of Japanese companies that moved from under 1x P/B to above had any activist involvement. -

Activists rarely succeed.

Out of 51 companies with activist proposals at the 2025 AGMs, only 4 saw approval. That is an 8% success rate, even when activists owned 25% to 40% of shares. -

Activist positions are illiquid.

The median activist investment is 37x the daily trading volume. If things go wrong, getting out can take months or years.

The quiet path, owning undervalued, asset-rich companies, is proving more effective. And less risky.

Why Private Equity Will Not Help Either

What about takeovers? Could private equity (PE) drive gains? It has been tried, but again, the data says otherwise.

Since 2020, only one PE-backed buyout has happened below 1x book value. Most private deals occur around 3x book with a 40% premium over the market price. And these prices are rising.

From July 2025, the TSE will now force insiders to get third-party valuations before MBOs, to stop lowball bids. Also, recent deals (like Fujisoft and Mandom) triggered bidding wars, pushing prices up.

Also, culturally, many Japanese managers do not want to go private. So, you cannot count on PE to unlock value at the deep discounts where the real money lies.

Passive Funds Do Not Target the Right Stocks

If active strategies are too risky, what about just buying a Japanese ETF? Unfortunately, broad ETFs miss the mark. In the popular TOPIX index, only 17% of total weight is in companies trading below 1x book value.

Most of these ETFs are overweight mega-caps, companies where the easiest balance sheet fixes have already been done. Even “value” or “small-cap” ETFs are rebalanced slowly. They do not move fast enough to capture the next wave of reformers.

This is where your advantage lies. You can screen more precisely and more often.

How to Capture the Repricing Yourself

Instead of chasing activists or paying PE premiums, you can front-run both by owning their favourite types of companies, before they buy or the companies take action themselves.

To do this, set up a screen that targets the same factors.

Japanese Reform Screening Criteria

1. Country: Japan

This gives you only Japanese equities.

2. Price-to-Book Ratio (P/B): Below 1.0

Lower than 1x book value signals a discount to net assets. Below 0.5x may indicate even greater upside.

3. Market Cap: Above $50M

This avoids micro-caps, which are too illiquid.

4. Gross Profits to Assets: High

Use the Gross Margin (Marx) in the screener. It is calculated as Gross Profits / Total Assets (depreciation deducted). This is a simple way to find quality companies.

5. Net Cash + Long-Term Investments: > 50% of Market Cap

This highlights companies with excess assets. It is the most direct signal of balance sheet bloat. To find companies like this, I screened for high earnings yield (EBIT to Enterprise Value EV ) companies. Excess cash makes EV low, and the ratio also selects undervalued companies.

6. Daily Trading Value: >$100,000

Makes sure you can buy without huge spreads and can get in and out easily.

Click here to Run the Japan reform screen now.

How to Set Up the Screen for Yourself

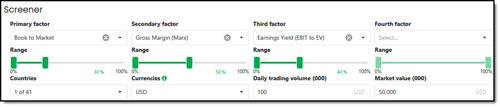

You can easily run this screen using the Quant Investing Stock Screener. Here are the step-by-step instructions.

Start Here:

-

Open the Screener

-

Select “Japan” as the country

-

Filter Market Cap: set minimum to $50 million

-

Filter Book to Market (inverse of P/B) 0% to 30%

-

Add: Earnings Yield with sliders 0% to 40%

-

Add: Gross Margin Marx with sliders 0% to 50%

-

Filter for Daily Trading Volume: Minimum $100,000

-

Save this screen. Run it monthly to catch new companies before they re-rate.

This is what the screen looks like:

Source: Quant Investing Stock Screener

These are the types of companies the screen came up with:

Source: Quant Investing Stock Screener

Summary: Your Advantage Is Precision

You do not need to launch proxy battles. You do not need to wait for private equity. And you definitely do not need to settle for a generic ETF.

The best strategy for Japan’s reform wave is simple. Buy what is cheap, profitable, and cash-rich, and let the Tokyo Stock Exchange do all the work for you.

Key Takeaways

-

Japan has ~1,000 companies trading below book value.

-

The best opportunities are small, high-quality firms with bloated balance sheets.

-

Activism works sometimes, but success rates are low and liquidity risks are high.

-

Private equity pays too much, and passive funds are too blunt.

-

A well-built screen can find these stocks for you easily and it leaves you in control.

Ready to Screen Smarter?

Try the Quant Investing Stock Screener free for 30 days. It is the fastest way to uncover Japan’s hidden value plays—before the crowd.

Click here to See what the screener finds right now.

FREQUENTLY ASKED QUESTIONS

1. Why is the Japanese stock market suddenly so attractive to value investors?

Because over 1,000 Japanese companies trade below their book value. Many of them sit on decades of cash and other assets. And now, Japan’s regulators are forcing companies to improve capital efficiency. That means buybacks, dividends, and asset sales. You are not betting on a turnaround. You are unlocking value already on the balance sheet.

2. What type of Japanese companies offer the best revaluation potential?

The best opportunities are small, high-quality businesses with net cash and undervalued assets. Specifically: Price-to-Book below 1.0, strong gross profits relative to assets, and balance sheets bloated with cash or investments. These stocks are often ignored by large funds, giving you an edge as an individual investor.

3. Can activism help unlock this value faster?

Not reliably. Most companies that re-rate do so without activist pressure. And activist proposals in Japan succeed less than 10% of the time. Worse, activists often buy huge positions in illiquid stocks - hard to enter and harder to exit. You do not need a campaign. You need a good stock screen.

4. What about private equity or buyouts-do they drive revaluations?

Rarely. PE tends to pay full price - often 3x book - not the deep discounts where you find the best deals. Japan’s new rules now require third-party valuations before insider buyouts, making it harder for cheap takeovers to happen. So the revaluation will likely come from market pressure, not acquisitions.

5. Why not just buy a Japan ETF or value fund?

Most passive funds miss the mark. Broad ETFs like TOPIX are heavy in large caps, where the easy gains are already taken. Even “value” ETFs rarely hold the small, undervalued firms you want. They rebalance too slowly to capture Japan’s reform wave. Your advantage is precision and agility.

6. How can I screen for these undervalued Japanese stocks myself?

Use a focused set of criteria: Japan stocks, P/B under 1.0, market cap over $50M, high gross profits to assets, net cash plus long-term investments over 50% of market cap, and daily trading value above $100K. This finds companies rich in assets, not in hype. A tool like the Quant Investing Stock Screener makes this easy.

7. Is this a short-term opportunity or a longer-term shift?

It is a long-term big change is already underway. Japanese regulators are serious about reform. Boards are acting. And revaluations are happening. But many companies are still cheap. This is your chance to buy before prices catch up. The key is discipline - screen monthly, invest patiently, and let the reform wave work for you.