This guide shows you just how easy it is to set up your first screen with the Quant Investing stock screener.

How to log into the screener

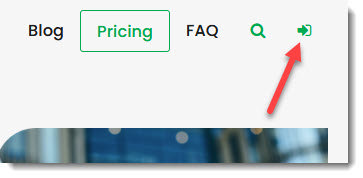

To start you must log into your account. To do this go to www.quant-investing.com Click on the Subscriber Login icon at the top right of your screen.

Enter your login details and click the Login button.

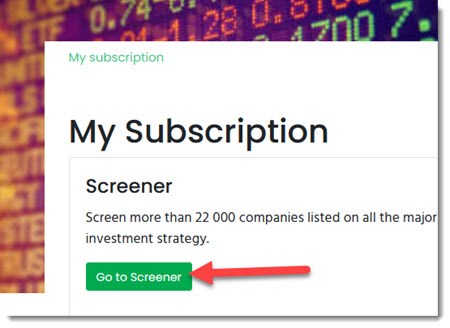

On the next screen click on the Go to Screener button.

If you do not see the Go to Screener button click on this link (after you have logged in) to go there: My Subscription link

This will take you to the screener page.

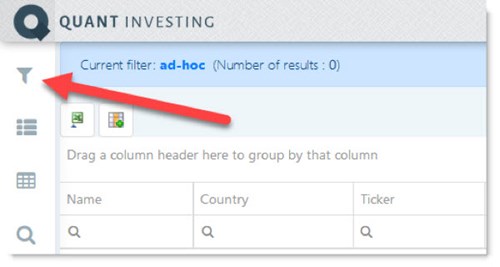

Open the stock screener

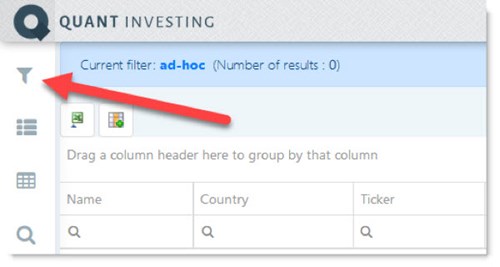

To open the screener, click on the small funnel icon – called Screener - at the top left of your screen.

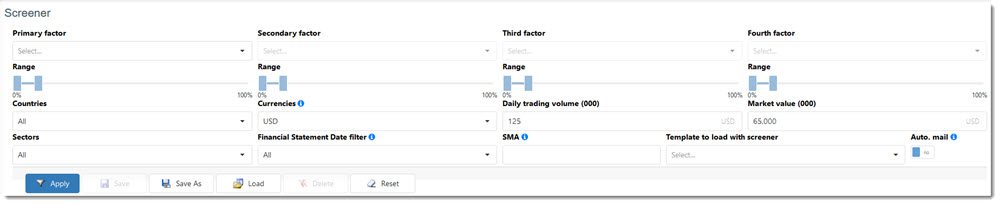

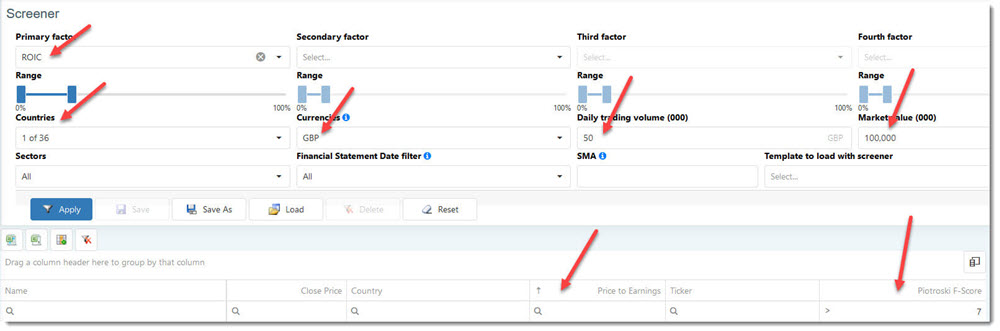

This will open the screening criteria which looks like this:

Click image to enlarge

Your first screen

The easiest way for you to get to know the screener is to work through a simple example:

Assume you want to screen for companies that meet the following criteria:

- Registered in the UK

- Daily traded value of at least GBP 50,000

- Market value of at least GBP 100 million

- 20% of companies with the highest Return on Invested Capital (ROIC)

- Piotroski F-Score greater than 7

- With the lowest Price to Earnings ratio

First set up your output - template

Before you set up your stock screen select all the ratios and indicators (columns) you would like to see as output when you run your screen.

Let us assume you want to see the following information about each company:

- Company Name

- Country

- Ticker

- Close Price

- Piotroski F-Score

- PE Ratio

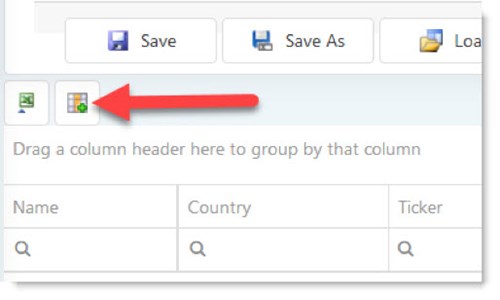

To select these output columns, click on the Templates icon at the top left of your screen.

![]()

You will see a few columns are already selected for you. You can change these and add as many columns as you like.

To add or remove columns click on the Add/remove columns icon.

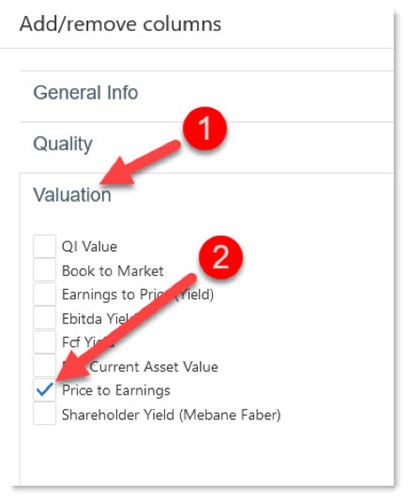

To add the Price to Earnings Ratio (1)click on the Valuations tab then (2) tick the box next to Price to Earnings.

Add tick marks next to all the indicators you want to show and remove the tick marks next to all the columns you do not need.

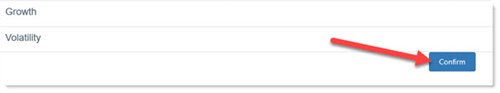

When you are done click the Confirm button.

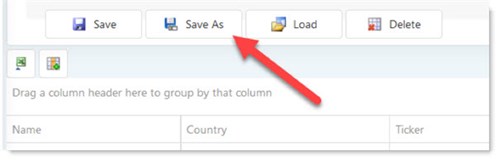

Important! - Remember to save your Template. Do this by clicking on the Save As button.

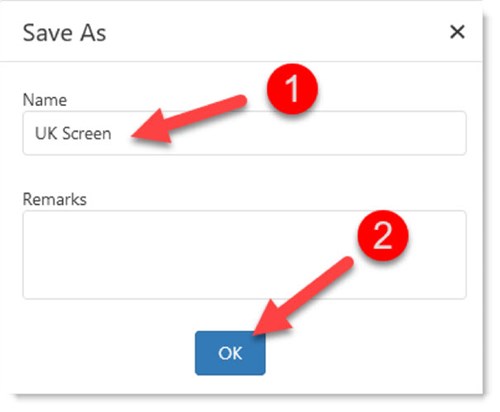

Give your template a (1) descriptive name then click the OK button (2) to save your Template.

Set up your stock screen

Now you can select the screening criteria.

To open the screener, click on the small funnel icon – called Screener - at the top left of your screen.

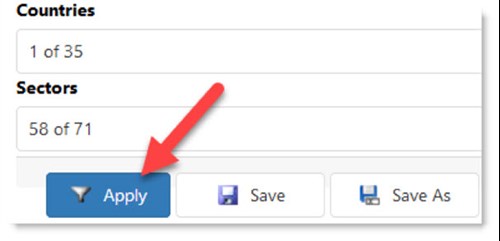

Below the Countries heading click on the down arrow (1) of the drop-down list and tick the box next to Great Britain (2) to select it. Unselect all other countries by removing the tick marks next to them.

Select traded currency, value, and minimum market value

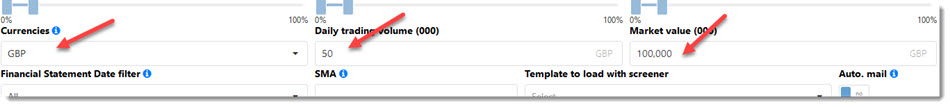

Click the drop-down lists below Currencies and select GBP (British Pound). Then type values into the boxes below Daily trading volume and Market value.

Important! - Daily trading volume and Market value must be entered in thousands (000).

Click image to enlarge

Select 20% of companies with the highest Return on Invested Capital (ROIC)

Click the drop-down arrow on the right of the drop-down box below Primary Factor and select ROIC (Return on Invested Capital).

Type ROIC in the box to find the ratio fast.

Move the slider below the Range heading so that it selects the values from 0% to 20%. This means it will select the top 20% of companies in terms of ROIC.

Get a list of companies

Click the Apply button to run the screener and get a list of companies that meet the criteria you have selected.

Select companies with a Piotroski F-Score greater than 7

To only select companies with a good Piotroski F-Score (greater than 7) enter 7 in the box just below the column heading Piotroski F-Score (1).

Then click on the magnifying glass icon (2) and select Greater than from the drop-down menu.

Sort by PE ratio from low to high

Click on the Price to Earnings column heading once to sort from low to high by PE ratio (in future if you want to sort from high to low - click on the column heading for a second time).

You now have a list of companies that meet all the following criteria:

- Registered in the UK

- Daily traded value of at least GBP 50,000

- Market value of at least GBP 100 million

- 20% of companies with the highest Return on Invested Capital (ROIC)

- Piotroski F-Score greater than 7

- With the lowest Price to Earnings ratio

This is what your completed stock screen looks like:

Click image to enlarge

That is how easy it is to set up your first screen.

Info on all ratios and indicators

If you would like more information on exactly how all the ratios and indicators available in the Quant Investing stock screener is calculated, go to the glossary .

If you have any questions, please let us know by clicking on the Need Help? button at the bottom right of your screen.

Wishing you profitable investing

PS Not a stock screener subscriber yet? You can sign up right here: Sign me up right now

PPS It is so easy to put things off why not sign up right now?