With interest rates around the world at very low levels here are a few high quality, high dividend yield (dividend investing) investment ideas as well as how you can find ideas like these for your portfolio.

Quality dividend investing

You know not all high dividend yield companies are worth buying. You have to make sure the company can continue paying that high dividend in future and that is what this screen does for you.

It gives you a list quality companies that have a high and sustainable dividend yield.

What a typical high divided yield strategy looks like

Here is an example of a typical high dividend yield investment strategy:

How the dividend investing list was selected

Before I get to the list, first some information on how the list was selected.

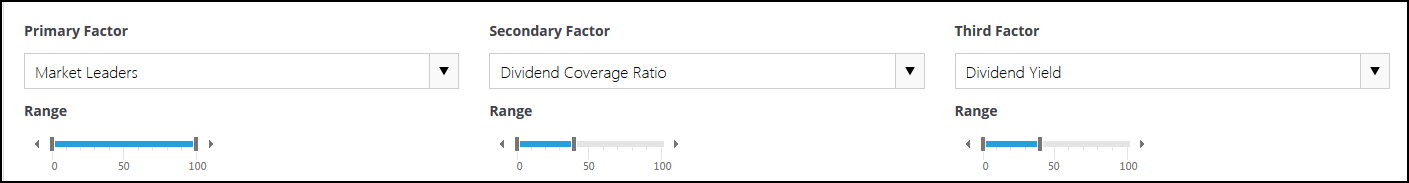

This is what the screen looks like:

First, to make sure the only quality companies are included; I selected Market Leading companies (large healthy companies) from around the world.

Market Leading companies are non-utility companies with a larger than average:

- Market value,

- Number of shares outstanding, Free cash flow and

- Sales above 1.5 times the average

You can read more about Market Leading companies here: Large companies on steroids – Market Leaders

Secondly we selected companies with a healthy dividend coverage ratio of more than 2.5.

This means their profit per share is 2.5 times bigger than the dividend per share that they pay out. (Dividend Coverage Ratio = Earnings per share / Dividend per share)

Finally the list was sorted by dividend yield (Dividend Yield = the trailing 12 month (TTM) dividend / Last closing share price)

No extremely high dividend yields - a good thing

You will see the dividends are not very high; this is a good thing because research studies have shown that companies with a very high dividend yield (yields you can hardly believe) do not make good investments as their dividend eventually gets cut.

Click here to start finding your own High Dividend Yield ideas NOW!

Dividend investing screen

This is what the stock screen looked like:

Source: Quant Investing screener

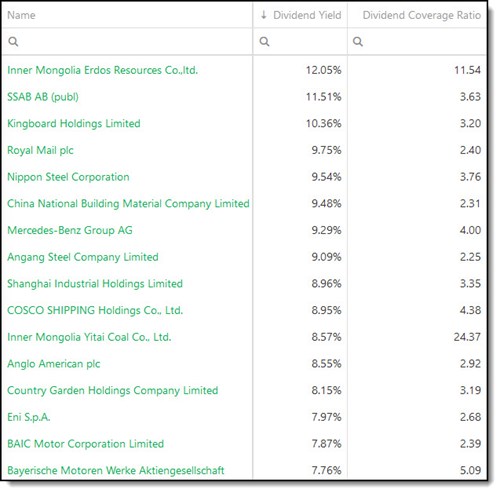

The first 16 companies

Here is a list of the first 16 large, quality high dividend yield companies the screen came up with:

Source: Quant Investing stock screener

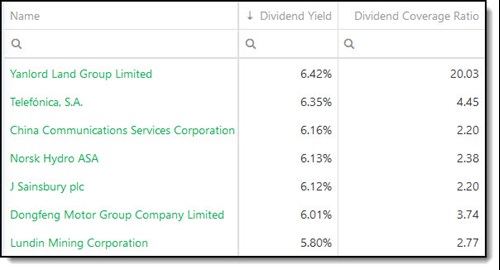

The next 7 dividend investing companies

Here is the list with the next 7 high dividend yield companies:

Source: Quant Investing stock screener

Improved quality high dividend companies – Piotroski F-Score added

To improve the quality of the companies in the screen even further we added the Piotroski F-Score to the screen.

How can the Piotroski F-Score help you?

You can read more about how useful the Piotroski F-Score is here:

This academic can help you make better investment decisions – Piotroski F-Score

Can the Piotroski F-Score also improve your investment strategy?

Piotroski F-Score back test

Click here to start finding your own High Dividend Yield ideas NOW!

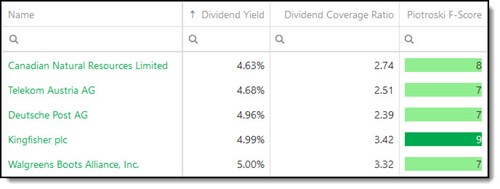

This is what was included in the screen:

- Market leading companies

- Dividend coverage ratio of more than 2.5

- Piotroski F-Score higher than 6 (9 = Best and 0 = worse)

- Sorted this list by dividend yield

The 5 highest dividend yield companies

Here are the highest dividend yield companies that met all the screening criteria:

Source: Quant Investing stock screener

Please always do your fact checking

As with all screens this is just a list of companies. Please do your own research and fact checking to make sure the company is correctly included in the list.

PS To use screening tools these (and 110 other ratios and indicators) in your portfolio right now click here: I am interested sign me up

PPS Why not sign up right now while its still fresh in your mind?

Click here to start finding your own High Dividend Yield ideas NOW!