Here are a few value investment ideas for you to research over the weekend.

ERP5 = Cheap good quality companies

To find good quality undervalued companies this stock screen used the ERP5 rank investment strategy.

It is an investment strategy developed by two good friends of mine that finds undervalued quality companies based on the following for four ratios:

- Price to Book,

- Earnings Yield,

- Return on invested capital (ROIC) and

- 5 year average ROIC.

The lower the ERP5 rank the more undervalued the company is.

ERP5 back test

We tested the ERP5 rank investment strategy with very good results. Over the 12 year period from June 1999 to June 2011 it substantially outperformed the market as well as the Magic Formula investment strategy.

You can read more about the back test here: ERP5 investment strategy back test

Undervalued high quality companies

The ERP5 rank not only looks for undervalued companies with a low price to book and a high earning yield (EBIT to EV), it also looks for quality companies that had a high one and five year return on invested capital.

Click here to start finding your own value investment ideas NOW!

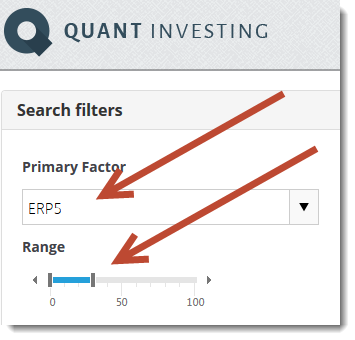

What it looks like in the screener

To select the best companies according to ERP5 rank this is all you have to do:

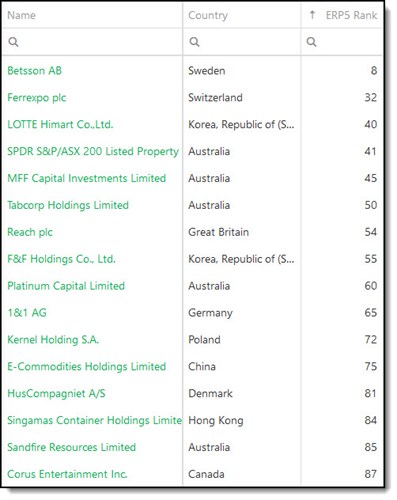

10 ERP5 investment ideas

And here are the best ideas the screener came up with:

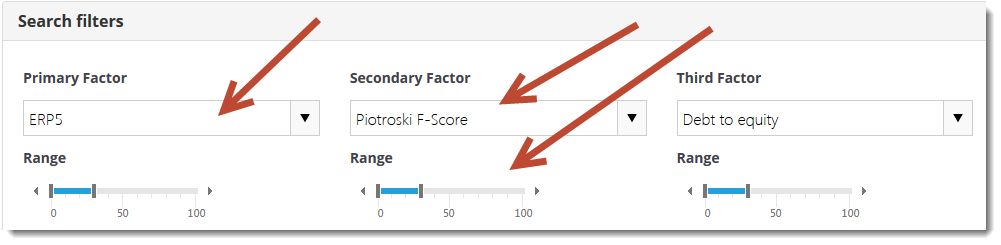

For better quality add Piotroski F-Score

To increase the quality of the companies you can add the Piotroski F-Score to you screening criteria.

This is also very easy to do:

Slider selects best F-Score companies

Setting the slider from 0% to 30% lets the screener only show you the companies with the best (highest) Piotroski F-Score.

You can read more about the Piotroski F-Score here: This academic can help you make better investment decisions – Piotroski F-Score

And here: Piotroski F-Score back test

Click here to start finding your own ERP5 value investment ideas NOW!

ERP5 & Piotroski F-Score ideas

Here are the ERP5 Piotroski F-Score ideas the screener came up with:

That’s how simple it is to find high quality undervalued investment ideas for you portfolio!

PS to get this strategy working in you portfolio as soon as possible click here

PPS Why not sign up right now before it slips your mind?

Click here to start finding your own value investment ideas NOW!