Will you believe me if I told you that there is a simple quality ratio you could use to increase your returns, irrespective of what investment strategy you follow? Yes there is and it is called the External Finance Ratio.

Before I show you how well it works, some background information.

External Finance Ratio

We first read about the External Finance Ratio (EFR) it in the excellent book by Richard Tortoriello called Quantitative Strategies for Achieving Alpha: The Standard and Poor’s Approach to Testing Your Investment Choices.

The ratio shows you if a company is able to finance investments from cash the business generated or if it needed external money (bank debt or to sell shares) to meet its investment needs.

How it is calculated?

The External Finance ratio (EFR) is calculated it follows:

(Gross change in total assets for the year – net cash generated from operations) / Total assets at the end of the year.

Positive means external financing needed

If the ratio is positive (greater than 0) it means that the company was not able to finance its assets growth internally whereas if the ratio was negative it means that the company generated more than enough cash to finance its assets growth.

Back test of the External Finance ratio

As you know we don’t just add a ratio to the Quant Investing stock screener without first testing it to see if it can help you achieve higher returns.

First test – it works

We tested the External Financing Ratio (EFR) ratio in two ways.

Firstly we divided the External Finance ratio values into five quintiles (five equal 20% groups) with companies with:

- the highest need for external financing (largest positive EFR) in quintile five (Q5) - BAD and

- those with the lowest need for external financing (largest negative EFR) in quintile one (Q1) - GOOD.

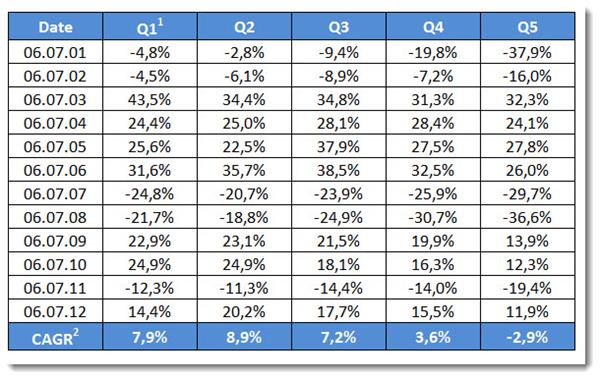

Over the 12 year period from June 2000 to June 2012 this was what we found:

Click image to enlarge

1 = Quintiles

2 = Compound annual growth rate

What it means

As you can see, apart from the CAGR of Quintile one (Q1) being less than Q2, the returns fall from Q2 to Q5 are linear.

This means that the External Finance ratio has the ability to increase your investment returns if you avoid companies with the highest need for external financing.

Avoid the bottom 40%

The fact that Quintiles one to three have similar returns means that if you avoid the 40% (Q4 and Q5) of companies with the highest EFR ratios you would capture the most of the value this ratio can add to your returns.

How can I avoid the 40% of companies with the highest need for external financing you may be thinking?

More on that shortly, first I want to show you a second test we did.

Click here to let the External Financing Ratio increase your returns

Second back test – it definitely works

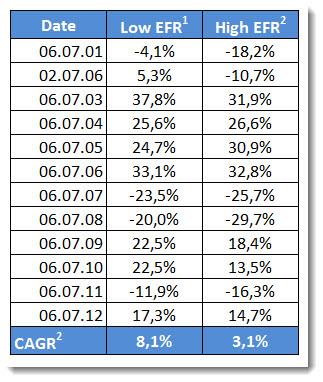

In the second test we divided companies into two groups, one group that needed external financing (positive External Finance ratio) and another group that did not (negative External Finance ratio).

Here is the table with the yearly returns over the 12 year period from June 2000 to June 2012:

1 = Companies that did not need external financing (negative External Finance ratio)

2 Companies that needed external financing (positive External Finance ratio)

CAGR = Compound annual growth rate

5% per year higher return over 12 years!

As you can see the companies that did not need external financing on average returned +8.1% per year over 12 years, substantially better than companies that needed external financing which on average returned only +3.1% over 12 years.

On average this is a 5% higher return per year over 12 years, this is a substantial improvement.

So it’s clearly worth your while to use the External Finance Ratio when you screen for investment ideas.

How to use the External Finance ratio in your portfolio

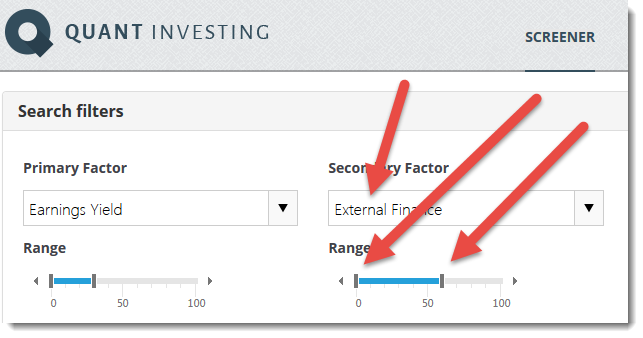

We now show you how to exclude the 40% of companies with a bad (positive) external finance ratio.

It’s very easy as the following screenshot shows:

Click image to enlarge

Select the best external finance companies

You simply select the External Finance ratio, and then use the slider to show only the 60% (0% to 60%) of companies with the best external finance ratio.

And you can combine the External Finance ratio with your investment strategy, irrespective of what it is.

In the above screenshot I combined it with Earnings Yield but you can combine it with the more than 110 ratios and indicators the screener has.

You can find the definitions and calculations of all ratios and indicators in the Glossary

Click here to let the External Financing Ratio increase your returns

Summary and conclusion

- The external finance ratio shows you if a company is able to finance investments from cash the business generated or if it needed external money

- The ratio can definitely improve your investment returns, +5% per year in our 12 year test

- The best way to apply it to your portfolio is to exclude the 40% of companies with the worst ratio (highest positive values)

PS To get the External Finance Ratio working in your portfolio right now sign up here

PPS Why not sign up now before you get distracted?

Click here to let the External Financing Ratio increase your returns Now!