If you are looking for opportunities to grow your wealth in the stock market for 2024, the Trending Value investment strategy, developed by James O'Shaughnessy, might just be what you need.

What the strategy does for you

This investment strategy helps you find undervalued companies across the globe, including regions like North America, Europe, and Asia, that are poised for significant growth.

But what makes this strategy stand out, is how effortlessly you can integrate it into your investment portfolio.

How it works

At its heart, Trending Value focuses on a clear yet powerful principle: target the most undervalued companies that have demonstrated notable stock price increases over the past six months.

This method, while straightforward, has proven its ability to beat the market by 10% annually over a 45-year period from 1964 to 2009.

Find undervalued companies

The secret sauce of this strategy lies in the Value Composite Two Indicator, which combines six valuation ratios, from price to book value to shareholder yield.

This comprehensive indicator evaluates companies across different valuation metrics, offering a single ranking that illuminates the most undervalued opportunities.

For you as an investor, this translates into a streamlined path to uncovering high-potential investments without delving into complex calculations.

That are moving up in price

Moreover, the strategy incorporates momentum, focusing on stocks that have seen significant price growth over a specific time frame.

While this introduces some volatility, the combination of value and momentum has been shown to markedly enhance stock market returns.

This blend, the cornerstone of the Trending Value portfolio, presents a strategic avenue for potentially amplifying your investment results in 2024.

Click here to start using trending value in your portfolio NOW!

Trending Value investment ideas for 2024

Curious about how to leverage this strategy for your benefit?

The next sections will give you 80 investment ideas and guide you through practical steps to incorporate Trending Value into your investment portfolio.

Here are the investment ideas

O’Shaughnessy’s Trending Value investment ideas

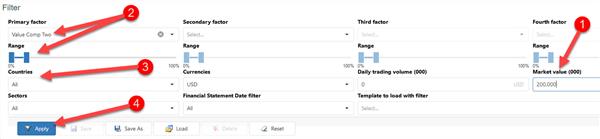

This is what the screen looked like:

- Minimum daily trading volume of $100,000

- Minimum company market value of $200 million

- Top 10% Value Composite Two companies

- Financial statements updated in the last 6 months

- Results sorted by Price Index 6 months (Momentum) from best to worse

Best Trending Value investment ideas Worldwide

| Name | Country | Value Comp Two | Price Index 6m |

|---|---|---|---|

| Geo Energy Resources Limited | Singapore | 11 | 1.95 |

| HDC Hyundai Development Company | South Korea | 4 | 1.94 |

| Höegh Autoliners ASA | Norway | 6 | 1.88 |

| Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság | Hungary | 10 | 1.85 |

| Jaya Tiasa Holdings Berhad | Malaysia | 10 | 1.84 |

| Snt Dynamics Co.,Ltd. | South Korea | 6 | 1.75 |

| Futaba Industrial Co., Ltd. | Japan | 7 | 1.75 |

| Kawada Technologies, Inc. | Japan | 9 | 1.70 |

| Murakami Corporation | Japan | 7 | 1.67 |

| Tokyo Tekko Co., Ltd. | Japan | 11 | 1.66 |

| Idemitsu Kosan Co.,Ltd. | Japan | 5 | 1.63 |

| Odfjell SE | Norway | 5 | 1.63 |

| Nishikawa Rubber Co., Ltd. | Japan | 9 | 1.62 |

| Daesang Holdings Co., Ltd. | South Korea | 8 | 1.62 |

| Koninklijke BAM Groep nv | The Netherlands | 2 | 1.59 |

| Ambea AB (publ) | Sweden | 5 | 1.57 |

| Sogefi S.p.A. | Italy | 6 | 1.55 |

| Stolt-Nielsen Limited | Great Britain | 5 | 1.54 |

| Overseas Shipholding Group, Inc. | USA | 8 | 1.54 |

| IJTT Co., Ltd. | Japan | 10 | 1.53 |

Best Trending Value investment ideas in North America

| Name | Country | Value Comp Two | Price Index 6m |

|---|---|---|---|

| Alpha Metallurgical Resources, Inc. | USA | 14 | 1.92 |

| Hibbett, Inc. | USA | 14 | 1.88 |

| Hovnanian Enterprises, Inc. | USA | 16 | 1.77 |

| G-III Apparel Group, Ltd. | USA | 16 | 1.70 |

| Rocky Brands, Inc. | USA | 15 | 1.57 |

| Global Partners LP | USA | 17 | 1.56 |

| Overseas Shipholding Group, Inc. | USA | 8 | 1.54 |

| Secure Energy Services Inc. | Canada | 14 | 1.53 |

| Macy's, Inc. | USA | 7 | 1.53 |

| ScanSource, Inc. | USA | 12 | 1.47 |

| Dorian LPG Ltd. | USA | 11 | 1.45 |

| Navios Maritime Partners L.P. | USA | 3 | 1.45 |

| United States Steel Corporation | USA | 8 | 1.45 |

| BlueLinx Holdings Inc. | USA | 12 | 1.43 |

| Pangaea Logistics Solutions, Ltd. | USA | 13 | 1.43 |

| Sylvamo Corporation | USA | 11 | 1.42 |

| Caleres, Inc. | USA | 15 | 1.41 |

| Guess?, Inc. | USA | 13 | 1.39 |

| Safe Bulkers, Inc. | USA | 6 | 1.38 |

| Teekay Tankers Ltd. | USA | 12 | 1.35 |

Best Trending Value investment ideas in Europe

| Name | Country | Value Comp Two | Price Index 6m |

|---|---|---|---|

| Höegh Autoliners ASA | Norway | 6 | 1.88 |

| Odfjell SE | Norway | 5 | 1.63 |

| Koninklijke BAM Groep nv | The Netherlands | 2 | 1.59 |

| Ambea AB (publ) | Sweden | 5 | 1.57 |

| Sogefi S.p.A. | Italy | 6 | 1.55 |

| Stolt-Nielsen Limited | Great Britain | 5 | 1.54 |

| Saras S.p.A. | Italy | 2 | 1.42 |

| DEUTZ Aktiengesellschaft | Germany | 6 | 1.41 |

| Rainbow Tours S.A. | Poland | 7 | 1.39 |

| Instone Real Estate Group SE | Germany | 4 | 1.38 |

| Wallenius Wilhelmsen ASA | Norway | 4 | 1.36 |

| United Internet AG | Germany | 6 | 1.36 |

| Euroseas Ltd. | Greece | 3 | 1.34 |

| StealthGas Inc. | Greece | 3 | 1.33 |

| SSAB AB (publ) | Sweden | 5 | 1.33 |

| Proximus PLC | Belgium | 2 | 1.32 |

| Hafnia Limited | Norway | 8 | 1.32 |

| Greencore Group plc | Ireland | 5 | 1.29 |

| Iveco Group N.V. | Italy | 5 | 1.28 |

| Immsi S.p.A. | Italy | 1 | 1.28 |

Best Trending Value investment ideas in Asia

| Name | Country | Value Comp Two | Price Index 6m |

|---|---|---|---|

| HDC Hyundai Development Company | South Korea | 4 | 1.94 |

| Snt Dynamics Co.,Ltd. | South Korea | 6 | 1.75 |

| Futaba Industrial Co., Ltd. | Japan | 7 | 1.75 |

| Murakami Corporation | Japan | 7 | 1.67 |

| Idemitsu Kosan Co.,Ltd. | Japan | 5 | 1.63 |

| KISCO Holdings Corp. | South Korea | 6 | 1.52 |

| Kia Corporation | South Korea | 4 | 1.48 |

| Riken Technos Corporation | Japan | 8 | 1.48 |

| HDC HOLDINGS CO.,Ltd | South Korea | 1 | 1.45 |

| Kurabo Industries Ltd. | Japan | 8 | 1.45 |

| Nippon Seiki Co., Ltd. | Japan | 3 | 1.45 |

| SK Inc. | South Korea | 6 | 1.41 |

| Yutaka Giken Co.,Ltd. | Japan | 1 | 1.40 |

| Topy Industries, Limited | Japan | 8 | 1.38 |

| Vital KSK Holdings, Inc. | Japan | 7 | 1.38 |

| Sajodaerim Corporation | South Korea | 2 | 1.38 |

| KCC Corporation | South Korea | 4 | 1.38 |

| Topre Corporation | Japan | 8 | 1.38 |

| DL E&C Co.,Ltd. | South Korea | 8 | 1.37 |

| Lu Thai Textile Co., Ltd. | China | 6 | 1.36 |

How to implement Trending Value in your portfolio

This is how the Trending Value portfolio is implemented:

- Include only stocks with a market capitalization above $200 million

- Select the 10% most undervalued companies using the Value Composite Two indicator

- Select the 25 or 50 stocks with the best six-month price appreciation – Use Price Index 6m

Click here to start using trending value in your portfolio NOW!

How to implement the Trending Value strategy in your portfolio

Now for the step by step instructions on how you can implement this strategy in your portfolio.

It is very easy to do, here are the steps:

- Select the companies with market capitalization above $200 million by entering 200,000 in the box below Market value (000)

- As the Primary Factor choose Value Composite Two in the box below Primary Factor and use the sliders to select the 10% of the most undervalued companies – set then from 0% to 10%

- In the box below Countries select the countries where you would like to invest

- Click on the Apply button to run your screen

Click image to enlarge

In the results table click on the Price Index 6m column heading twice to sort the companies by six months price momentum from high to low.

Best 25 or 50 ideas

After you have selected all the above criteria, buy the top 25 or 50 companies for your Trending Value portfolio.

As you saw in the above table if you include more than 25 companies in your portfolio it will reduce volatility and drawdowns, while making returns a bit lower.

Investing a total of $1,000 in the top 25 stocks of the Trending Value portfolio would net you $6.9 million after 45 years. During this period, you would experience a volatility of 17.44% and a maximum drop in the value of your portfolio of 50.55%.

If you bought 50 Trending Value stocks each year it would have lowered your volatility to 16.51% and given you a slightly lower maximum drop in value of 49.65%. On other hand, you would have given up a large portion of returns. After 45 years you would end up with $4.1 million dollars or 40% less than 25 stocks portfolio.

Click here to start using trending value in your portfolio NOW!

Summary and conclusion

As you have seen the Trending Value strategy is a simple strategy that looks for undervalued companies with an upward moving stock price.

And it works VERY well as it returned an average of 21.2% per year over a period of 45 years.

Using strategies that have historically produced market besting results is the key to long-term investing success. And combining undervalued stocks with good share price momentum is a great way to get market beating returns.

But remember even this investment strategy, like all investment strategies is not without risk.

The maximum fall of in the value of the portfolio was 50.5%. In the end you will only be rewarded with your ability to stick to the strategy in good and bad – this is the really hard part.

PS To get this strategy working in your portfolio right now sign up here.

PPS It is so easy to put things off why not sign up now before you get distracted.