Are you on the hunt for Price to Book ratio and the Piotroski F-Score investment ideas for 2024?

Numerous research reports have shown you that the Price to Book ratio is a treasure map leading you to undervalued stocks, that have beaten the market time and again.

But here's a twist – not all that glitters is gold. Some stocks are cheap for a reason. That's where the Piotroski F-Score steps in, a brilliant tool that helps you find only those undervalued stocks that are truly worth your investment.

Curious to see how this strategy could enhance your investment portfolio in Europe, North America, or Asia? Let's dive deeper and unlock the secret to boosting your returns with undervalued Price to Book quality investment ideas.

First a bit of background information.

Price to Book can be improved a lot

As with all single ratio investment strategies, Price to Book can be substantially improved.

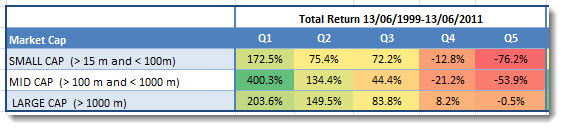

But before we get to that, here are the back tested returns you could have earned if you used a low Price to Book (PB) investment strategy to invest in Europe over the 12 year period 13 June 1999 to 13 June 2011.

Source: Quantitative Value Investing in Europe: What works for achieving alpha

Q1 (Quintile 1) represents the cheapest 20% of companies in terms of Price to Book (PB) and Q5 (quintile 5) the most expensive. The lowest PB companies (Q1) substantially outperformed the market, which over the same 12 year period returned 30.54%.

To implement your own Price to Book Piotroski F-Score investment strategy - Click here

Improve your low price to book strategy returns

One of the ways you can improve your returns if you use a low Price to Book strategy is to combine it with the Piotroski F-Score.

What is the Piotroski F-Score

The Piotroski F-Score was developed by Joseph D. Piotroski an unknown accounting professor who shuns publicity and rarely gives interviews.

In 2000, he wrote a research paper called "Value Investing: The Use of Historical Financial Statement Information to Separate Winners from Losers".

He wanted to see if he can develop a system (using a simple nine-point scoring system) that can increase the returns of a strategy of investing in low price to book (referred to in the paper as high book to market) value companies.

What he found was something that exceeded his most optimistic expectations.

Buying only those companies that scored highest (8 or 9) on his nine-point scale, or F-Score as he called it, over the 20 year period from 1976 to 1996 led to an average out-performance of the market of 13.4%.

Even more impressive were the results of a strategy of investing in the highest F-Score companies (8 or 9) and shorting companies with the lowest F-Score (0 or 1).

7% better than the market over 20 years

Over the same period from 1976 to 1996 (20 years) this strategy led to an average yearly return of 23%, substantially outperforming the average S&P 500 index return of 15.83% over the same period.

This average out-performance of the index of just over 7% may not seem like much but over the 20 year period an investment of 100 in this long short investment strategy would have grown to 6,282 compared to an amount of only 1,860 if you invested in the S&P 500 index.

The difference between these two rates of return over the 20 year period is over 44 times your initial investment!

Piotroski F-Score as a stand alone strategy

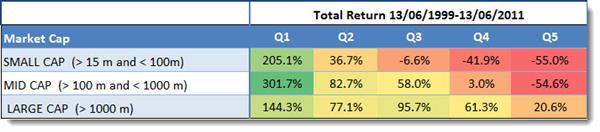

This is what we found when we tested only the Piotroski F-Score in Europe over the 12 year period 13 June 1999 to 13 June 2011.

Source: Quantitative Value Investing in Europe: What works for achieving alpha

Q1 (Quintile 1) represents the companies with the highest (best) Piotroski F-Score and Q5 (quintile 5) companies with the lowest Piotroski F-Score (worst). The highest F-Score companies (Q1) substantially outperformed the market, which over the same 12 year period returned 30.54%.

The strategy worked best for medium sized companies.

To implement your own PB Piotroski F-Score investment strategy - Click here

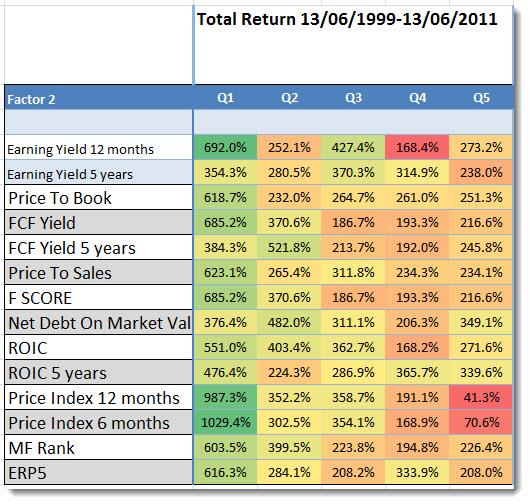

Using the Piotroski F-Score with other ratios

We also tested the Price to Book ratio with a lot of other ratios (including the Piotroski F-Score) and as you can see in the table below the returns of using only a low Price to Book ratio strategy can be improved substantially.

Source: Quantitative Value Investing in Europe: What works for achieving alpha

Best combination – Momentum

As you can see the best way to increase your returns was to combine PB with Price Index 6 months (6 months momentum) or Price Index 12 months (12 months momentum).

Price to book and Piotroski F-Score +317% better

Combining low Price to Book ratio companies with companies that also have the highest (best) Piotroski F-Score would have given you the fourth highest return over the 12 year period of +685.2%, still a very respectable return.

And is 317% improvement over a price to book only strategy.

Now for the investment ideas.

Best Price to Book Piotroski F-Score investing ideas world-wide for 2024

Price to Book Piotroski F-Score investment ideas

This is what the screen looked like:

- All countries world-wide included

- Top 20% Price to Book companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Piotroski F-Score > 6

- Results sorted by Price to Book from undervalued to expensive

| Name | Country | Price to Book | Piotroski F-Score |

|---|---|---|---|

| SMCP S.A. | France | 0.15 | 7 |

| HDC HOLDINGS CO.,Ltd | South Korea | 0.17 | 9 |

| Pkp Cargo S.A. | Poland | 0.17 | 7 |

| Seoul City Gas Co., Ltd. | South Korea | 0.21 | 7 |

| Samchully Co.,Ltd | South Korea | 0.22 | 7 |

| Lotte Shopping Co., Ltd. | South Korea | 0.23 | 7 |

| Tongyang Inc. | South Korea | 0.24 | 7 |

| Daehan Flour Mills Co.,Ltd | South Korea | 0.24 | 8 |

| Kangnam Jevisco Co., Ltd | South Korea | 0.24 | 7 |

| SSR Mining Inc. | USA | 0.25 | 7 |

| Muhak Co., Ltd. | South Korea | 0.25 | 8 |

| Hanil Holdings Co., Ltd. | South Korea | 0.27 | 8 |

| Sankyo Tateyama,Inc. | Japan | 0.29 | 7 |

| Daehan Steel Co., Ltd. | South Korea | 0.29 | 7 |

| Nihon Yamamura Glass Co., Ltd. | Japan | 0.29 | 7 |

| TAURON Polska Energia S.A. | Poland | 0.29 | 9 |

| F&F Holdings Co., Ltd. | South Korea | 0.30 | 7 |

| BAIC Motor Corporation Limited | China | 0.30 | 8 |

| Dongkuk Holdings Co.,Ltd. | South Korea | 0.30 | 7 |

| CGG | France | 0.32 | 7 |

Price to Book, Piotroski F-Score combined with Price Index 6 month (Momentum)

This is what the screen looked like:

- All countries world-wide included

- Top 20% Price to Book companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Piotroski F-Score > 6

- Results sorted by Price Index 6 months (Momentum) from best to worse

| Name | Country | Price to Book | Piotroski F-Score | Price Index 6m |

|---|---|---|---|---|

| Shanghai Zhenhua Heavy Industries Co., Ltd. | China | 0.87 | 8 | 14.36 |

| PBA Holdings Bhd | Malaysia | 0.68 | 7 | 2.43 |

| American Public Education, Inc. | USA | 0.80 | 7 | 2.24 |

| China Merchants Port Group Co., Ltd. | China | 0.70 | 7 | 2.19 |

| Fuji Oozx Inc. | Japan | 0.58 | 7 | 2.10 |

| China Fangda Group Co., Ltd. | China | 0.56 | 8 | 2.01 |

| HDC Hyundai Development Company | South Korea | 0.42 | 8 | 1.98 |

| Daesang Holdings Co., Ltd. | South Korea | 0.60 | 7 | 1.80 |

| Snt Dynamics Co.,Ltd. | South Korea | 0.57 | 7 | 1.60 |

| SNT Holdings Co., Ltd. | South Korea | 0.32 | 7 | 1.57 |

| Samsung C&T Corporation | South Korea | 0.86 | 7 | 1.57 |

| Traton SE | Germany | 0.86 | 9 | 1.50 |

| Kawada Technologies, Inc. | Japan | 0.68 | 7 | 1.49 |

| Aurelia Metals Limited | Australia | 0.76 | 7 | 1.48 |

| Instone Real Estate Group SE | Germany | 0.59 | 7 | 1.44 |

| Nippi,Incorporated | Japan | 0.44 | 7 | 1.41 |

| KENKO Mayonnaise Co.,Ltd. | Japan | 0.84 | 7 | 1.39 |

| Sebang Global Battery Co., Ltd. | South Korea | 0.88 | 9 | 1.39 |

| Hyundai Motor Company | South Korea | 0.59 | 7 | 1.39 |

| Sajodaerim Corporation | South Korea | 0.52 | 7 | 1.38 |

To implement your own Price to Book Piotroski F-Score investment strategy - Click here

Best Price to Book Piotroski F-Score investment ideas in North America for 2024

Price to Book Piotroski F-Score investment ideas

This is what the screen looked like:

- USA and Canada selected

- Top 20% Price to Book companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Piotroski F-Score > 6

- Results sorted by Price to Book from undervalued to expensive

| Name | Country | Price to Book | Piotroski F-Score |

|---|---|---|---|

| SSR Mining Inc. | USA | 0.25 | 7 |

| The Aaron's Company, Inc. | USA | 0.32 | 7 |

| Plains GP Holdings, L.P. | USA | 0.33 | 7 |

| Ensign Energy Services Inc. | Canada | 0.34 | 9 |

| Chorus Aviation Inc. | Canada | 0.35 | 7 |

| Chimera Investment Corporation | USA | 0.42 | 7 |

| Obsidian Energy Ltd. | Canada | 0.45 | 7 |

| H&R Real Estate Investment Trust | Canada | 0.46 | 7 |

| Oil States International, Inc. | USA | 0.48 | 9 |

| SuRo Capital Corp. | USA | 0.52 | 7 |

| American Outdoor Brands, Inc. | USA | 0.55 | 7 |

| Equinox Gold Corp. | Canada | 0.61 | 7 |

| Primaris Real Estate Investment Trust | Canada | 0.62 | 8 |

| Martinrea International Inc. | Canada | 0.62 | 8 |

| United States Cellular Corporation | USA | 0.63 | 8 |

| SmartCentres Real Estate Investment Trust | Canada | 0.63 | 7 |

| IAMGOLD Corporation | Canada | 0.64 | 7 |

| Transcontinental Inc. | Canada | 0.65 | 7 |

| Walgreens Boots Alliance, Inc. | USA | 0.66 | 7 |

| Polaris Renewable Energy Inc. | Canada | 0.66 | 8 |

Price to Book Piotroski F-Score combined with Price Index 6 month (Momentum)

This is what the screen looked like:

- USA and Canada selected

- Top 20% Price to Book companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Piotroski F-Score > 6

- Results sorted by Price Index 6 months (Momentum) from best to worse

| Name | Country | Price to Book | Piotroski F-Score | Price Index 6m |

|---|---|---|---|---|

| American Public Education, Inc. | USA | 0.80 | 7 | 2.24 |

| FONAR Corporation | USA | 0.91 | 8 | 1.44 |

| Friedman Industries, Incorporated | USA | 1.03 | 8 | 1.39 |

| CoreCivic, Inc. | USA | 1.11 | 7 | 1.37 |

| ScanSource, Inc. | USA | 1.14 | 7 | 1.37 |

| Tricon Residential Inc. | Canada | 0.85 | 7 | 1.35 |

| Kelly Services, Inc. | USA | 0.68 | 8 | 1.32 |

| Graham Holdings Company | USA | 0.80 | 8 | 1.27 |

| General Motors Company | USA | 0.73 | 7 | 1.24 |

| Guardian Capital Group Limited | Canada | 1.00 | 7 | 1.24 |

| Eldorado Gold Corporation | Canada | 0.68 | 7 | 1.23 |

| Hudbay Minerals Inc. | Canada | 1.01 | 7 | 1.23 |

| Village Super Market, Inc. | USA | 0.93 | 7 | 1.23 |

| IAMGOLD Corporation | Canada | 0.64 | 7 | 1.22 |

| Lassonde Industries Inc. | Canada | 1.13 | 7 | 1.22 |

| Loews Corporation | USA | 1.15 | 7 | 1.21 |

| Teekay Corporation | USA | 0.95 | 9 | 1.21 |

| Civeo Corporation | USA | 1.08 | 9 | 1.18 |

| Plains All American Pipeline, L.P. | USA | 1.12 | 7 | 1.17 |

| SuRo Capital Corp. | USA | 0.52 | 7 | 1.15 |

To implement your own Price to Book Piotroski F-Score investment strategy - Click here

Best Price to Book Piotroski F-Score investment ideas in Europe for 2024

Price to Book Piotroski F-Score investment ideas

This is what the screen looked like:

- EU countries, Scandinavia and the UK selected

- Top 20% Price to Book companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Piotroski F-Score > 6

- Results sorted by Price to Book from undervalued to expensive

| Name | Country | Price to Book | Piotroski F-Score |

|---|---|---|---|

| SMCP S.A. | France | 0.15 | 7 |

| Pkp Cargo S.A. | Poland | 0.17 | 7 |

| TAURON Polska Energia S.A. | Poland | 0.29 | 9 |

| CGG | France | 0.32 | 7 |

| Enad Global 7 AB (publ) | Sweden | 0.33 | 8 |

| Renault SA | France | 0.34 | 8 |

| Vodafone Group Public Limited Company | Great Britain | 0.37 | 7 |

| A.P. Møller - Mærsk A/S | Denmark | 0.39 | 7 |

| ElringKlinger AG | Germany | 0.39 | 8 |

| StealthGas Inc. | Greece | 0.39 | 8 |

| Obrascón Huarte Lain, S.A. | Spain | 0.42 | 7 |

| Danaos Corporation | Greece | 0.45 | 8 |

| Immsi S.p.A. | Italy | 0.49 | 7 |

| Global Ship Lease, Inc. | Great Britain | 0.56 | 8 |

| Wilh. Wilhelmsen Holding ASA | Norway | 0.56 | 7 |

| Drägerwerk AG & Co. KGaA | Germany | 0.59 | 8 |

| Instone Real Estate Group SE | Germany | 0.59 | 7 |

| Wereldhave N.V. | The Netherlands | 0.61 | 7 |

| Semperit Aktiengesellschaft Holding | Austria | 0.61 | 7 |

| Sinch AB (publ) | Sweden | 0.62 | 7 |

Price to Book Piotroski F-Score combined with Price Index 6 month (Momentum)

This is what the screen looked like:

- EU countries, Scandinavia and the UK selected

- Top 20% Price to Book companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Piotroski F-Score > 6

- Results sorted by Price Index 6 months (Momentum) from best to worse

| Name | Country | Price to Book | Piotroski F-Score | Price Index 6m |

|---|---|---|---|---|

| Traton SE | Germany | 0.86 | 9 | 1.50 |

| Instone Real Estate Group SE | Germany | 0.59 | 7 | 1.44 |

| StealthGas Inc. | Greece | 0.39 | 8 | 1.30 |

| Immsi S.p.A. | Italy | 0.49 | 7 | 1.26 |

| Wilh. Wilhelmsen Holding ASA | Norway | 0.56 | 7 | 1.26 |

| Heba Fastighets AB (publ) | Sweden | 0.84 | 7 | 1.24 |

| Neinor Homes, S.A. | Spain | 0.75 | 7 | 1.18 |

| Premier Foods plc | Great Britain | 0.91 | 7 | 1.17 |

| LINK Mobility Group Holding ASA | Norway | 0.90 | 8 | 1.14 |

| Bayerische Motoren Werke Aktiengesellschaft | Germany | 0.76 | 7 | 1.14 |

| EVN AG | Austria | 0.71 | 7 | 1.12 |

| Danaos Corporation | Greece | 0.45 | 8 | 1.10 |

| Orange Polska S.A. | Poland | 0.77 | 7 | 1.10 |

| Sinch AB (publ) | Sweden | 0.62 | 7 | 1.09 |

| Global Ship Lease, Inc. | Great Britain | 0.56 | 8 | 1.07 |

| Renault SA | France | 0.34 | 8 | 1.06 |

| Drägerwerk AG & Co. KGaA | Germany | 0.59 | 8 | 1.05 |

| Iren SpA | Italy | 0.75 | 7 | 1.01 |

| Vodafone Group Public Limited Company | Great Britain | 0.37 | 7 | 1.01 |

| INDUS Holding AG | Germany | 0.82 | 8 | 0.99 |

To implement your own Price to Book Piotroski F-Score investment strategy - Click here

Best Price to Book Piotroski F-Score investment ideas in Asia for 2024

Price to Book Piotroski F-Score investment ideas

This is what the screen looked like:

- Australia, Hong Kong, Japan, South Korea, New Zealand and Singapore selected

- Top 20% Price to Book companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Piotroski F-Score > 6

- Results sorted by Price to Book from undervalued to expensive

| Name | Country | Price to Book | Piotroski F-Score |

|---|---|---|---|

| HDC HOLDINGS CO.,Ltd | South Korea | 0.17 | 9 |

| Seoul City Gas Co., Ltd. | South Korea | 0.21 | 7 |

| Samchully Co.,Ltd | South Korea | 0.22 | 7 |

| Lotte Shopping Co., Ltd. | South Korea | 0.23 | 7 |

| Tongyang Inc. | South Korea | 0.24 | 7 |

| Daehan Flour Mills Co.,Ltd | South Korea | 0.24 | 8 |

| Kangnam Jevisco Co., Ltd | South Korea | 0.24 | 7 |

| Muhak Co., Ltd. | South Korea | 0.25 | 8 |

| Hanil Holdings Co., Ltd. | South Korea | 0.27 | 8 |

| Sankyo Tateyama,Inc. | Japan | 0.29 | 7 |

| Daehan Steel Co., Ltd. | South Korea | 0.29 | 7 |

| Nihon Yamamura Glass Co., Ltd. | Japan | 0.29 | 7 |

| F&F Holdings Co., Ltd. | South Korea | 0.30 | 7 |

| Dongkuk Holdings Co.,Ltd. | South Korea | 0.30 | 7 |

| SNT Holdings Co., Ltd. | South Korea | 0.32 | 7 |

| Samyang Corporation | South Korea | 0.33 | 7 |

| PHA Co., Ltd. | South Korea | 0.33 | 9 |

| Ahresty Corporation | Japan | 0.33 | 7 |

| Beijing Urban Construction Design & Development Group Co., Limited | Hong Kong | 0.33 | 8 |

| Sambo Corrugated Board Co., Ltd. | South Korea | 0.33 | 7 |

Price to Book Piotroski F-Score combined with Price Index 6 month (Momentum)

This is what the screen looked like:

- Australia, Hong Kong, Japan, South Korea, New Zealand and Singapore selected

- Top 20% Price to Book companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Piotroski F-Score > 6

- Results sorted by Price Index 6 months (Momentum) from best to worse

| Name | Country | Price to Book | Piotroski F-Score | Price Index 6m |

|---|---|---|---|---|

| Fuji Oozx Inc. | Japan | 0.58 | 7 | 2.10 |

| HDC Hyundai Development Company | South Korea | 0.42 | 8 | 1.98 |

| Daesang Holdings Co., Ltd. | South Korea | 0.60 | 7 | 1.80 |

| Snt Dynamics Co.,Ltd. | South Korea | 0.57 | 7 | 1.60 |

| SNT Holdings Co., Ltd. | South Korea | 0.32 | 7 | 1.57 |

| Kawada Technologies, Inc. | Japan | 0.68 | 7 | 1.49 |

| Nippi,Incorporated | Japan | 0.44 | 7 | 1.41 |

| Hyundai Motor Company | South Korea | 0.59 | 7 | 1.39 |

| Sajodaerim Corporation | South Korea | 0.52 | 7 | 1.38 |

| HDC HOLDINGS CO.,Ltd | South Korea | 0.17 | 9 | 1.36 |

| GAON CABLE Co., Ltd. | South Korea | 0.61 | 7 | 1.35 |

| PHA Co., Ltd. | South Korea | 0.33 | 9 | 1.34 |

| Foster Electric Company, Limited | Japan | 0.47 | 7 | 1.33 |

| Nippon Seiki Co., Ltd. | Japan | 0.42 | 7 | 1.32 |

| Korea Movenex Co., Ltd. | South Korea | 0.54 | 7 | 1.31 |

| Seoyon E-Hwa Co., Ltd. | South Korea | 0.61 | 8 | 1.31 |

| Yutaka Giken Co.,Ltd. | Japan | 0.41 | 8 | 1.29 |

| Hi-Lex Corporation | Japan | 0.37 | 7 | 1.28 |

| Yesco Holdings Co., Ltd. | South Korea | 0.34 | 8 | 1.28 |

| Sambo Corrugated Board Co., Ltd. | South Korea | 0.33 | 7 | 1.28 |

Be careful! – Long periods of under-performance

Although the Price to Book ratio is a good valuation ratio it also has long periods of under-performance, please refer to the following article: Be careful of this time tested value ratio

Use Book to Market rather than Price to Book

When looking for low Price to Book companies it is better if you use the Book to Market ratio (the inverse of Price to Book) to see why read the following article: Why use book to market and not price to book?

PS To implement a low Price to Book and Piotroski F-Score investment strategy in your portfolio sign up here.

PPS It is so easy to put things off why not sign up right now before you forget.

To implement your own PB Piotroski F-Score investment strategy - Click here