Want to beat the market with just two trades a year? This article breaks down a simple, data-backed ETF strategy tested over 50 years. The Lazy Man’s Momentum Strategy uses just a handful of ETFs and takes less than 30 minutes twice a year. With a 13.09% annual return, it outperformed the MSCI World Index by nearly 3% per year. You will learn exactly how to use it in your portfolio. It is proof that doing less can actually make you more.

Estimated Reading time: 6 minutes

Can a “Lazy” Strategy Beat the Market? What 50 Years of Data Say About Simple Momentum Investing

You want better investment returns. But you do not have hours each week to research companies, check charts or rebalance your portfolio. That is where Javier Estrada’s great piece of research, “Lazy Man’s Momentum Strategy” helps you.

This strategy is not just backed by 50 years of backtesting. It is also simple enough that any investor with any portfolio size can follow it without a lot of time or effort.

The strategy is all about momentum investing, which has a long history of success. The idea is simple: buy the winners (stocks going up), avoid the losers (falling stocks). Big funds use momentum strategies, but they often use complex models or constant rebalancing.

Javier asked a simple question: can you get great results with just two trading days per year using a few ETFs? The answer is yes, and this is how you can do it.

You can see exactly how to implement the strategy at the end of the article, so keep reading.

What Exactly Was Tested?

Javier tested a strategy that ranks the developed country stock indexes based on their returns over the last six months. At the end of June and December, he sorted the indices from best to worst performers.

The top half became the “Winners” portfolio. The bottom half became the “Losers” portfolio. He tested both a long-short version (buy winners, short losers) and a long-only version (buy winners only).

What makes this different from other momentum research is Javier‘s focus on simplicity. He did not use individual stocks or advanced screening rules. He only used broad developed market country indexes that you can easily track or buy through ETFs. He only rebalanced twice a year. That is why it is called the Lazy Man’s Momentum Strategy (LMMS).

What Markets Were Included?

The study used data from MSCI’s developed market indexes. This included between 17 and 23 countries over time. The strategy only uses developed market countries like the US, UK, Japan, and Germany. These markets are stable and easier to buy and sell for individual investors like us.

Each country index is the whole market of that country. And every index has its own ETF. For example, you can buy the iShares MSCI Japan ETF (EWJ) or the iShares MSCI Germany ETF (EWG).

Tested: Over What Time Period?

The strategy was tested from June 1970 to December 2024. That is 54-year backtest history. Most countries in the study have return data starting in December 1969, which allowed the first investment with six months of price data to be selected by mid-1970.

Every six months, the most recent six-month returns were used to sort the countries. Then, a new portfolio was created using that ranking. Countries moved in and out of the Winners or Losers groups based on their performance.

This long back test period included all market conditions, including booms, busts, recessions, and global crises. That is what gives the results credibility.

How Did the Research Avoid Biases?

First, the strategy used historical price data so there could not be any look-ahead bias. Countries were added to the portfolio only when their data became available.

Second, it did not ignore “bad” performers. Every developed country was included when possible. There was no cherry-picking.

And third, all rebalancing was done on a fixed schedule. There was no trying to time the market or make emotional decisions.

This strict structure reduces the risk of overfitting, a common problem in backtests.

What Were the Selection Criteria?

At each rebalance date (June and December), you calculate the total return for each country index over the past six months. Then, you sort the returns from highest to lowest.

- The top half becomes the “Winners” portfolio.

- The bottom half becomes the “Losers” portfolio.

Let us say there are 22 countries. You pick the top 11 as Winners. You invest equal amounts in each. You can use ETFs to do this easily. For example:

-

Buy $1,000 each of 11 top ETFs.

-

Hold them until the next rebalance.

This method does not need complicated ratios. You just need historical total returns over six months, which many free tools provide.

When Was the Portfolio Rebalanced?

Rebalancing happened twice per year:

-

At the end of June.

-

At the end of December.

Trading twice a year it keeps your transaction costs low. More frequent rebalancing adds complexity. Less frequent rebalancing, as the paper shows, reduces performance.

What Were the Results?

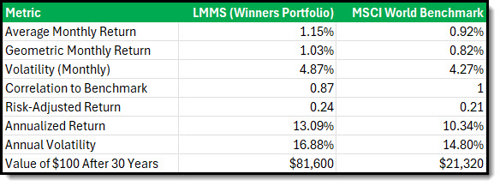

Here is what matters most: performance. The long-only LMMS returned 13.09% per year, compared to 10.34% for the MSCI World Index.

Over 30 years, $100 turned into $4,007 with LMMS. The same $100 turned into just $1,914 if you bought the World Index.

Source: "The Lazy Man’s Momentum Strategy" by Javier Estrada

Click here to start finding lazy ETF momentum investments for your portfolio NOW!

What if You Used Six Minus One Month Momentum

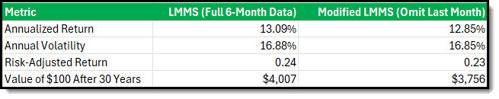

He also tested a slightly different momentum indicator. Some momentum studies skip the most recent month of data when ranking returns. This is to avoid short-term reversals. Javier tested that too.

Omitting the most recent month slightly reduced the performance:

-

Return dropped to 12.85%.

-

Terminal value of $110 invested over 30 years fell to $3,756, vs $4,007 with full data.

So, keeping the full six months of return data actually worked better in this case.

Source: "The Lazy Man’s Momentum Strategy" by Javier Estrada

Any Surprising or Unusual Findings?

Yes - two surprises:

-

Skipping one rebalance per year (only rebalancing in June) made the strategy worse. Lower returns. Higher risk. Less compounding. So, being even “lazier” does not lead to higher results.

-

Omitting the most recent month of data, a common academic tweak, also reduced returns. That means the full six-month window is more effective, even if some short-term reversals may happen.

Javier also ran factor regressions and found that the LMMS return did not come from exposure to size, value, or profitability. The outperformance came from pure momentum.

How To Implement the Strategy in Your Portfolio

Implementing this strategy is very easy using the Quant Investing Screener.

All you have to do is:

1. Log into your account

2. Download the Exchange Momentum Dashboard

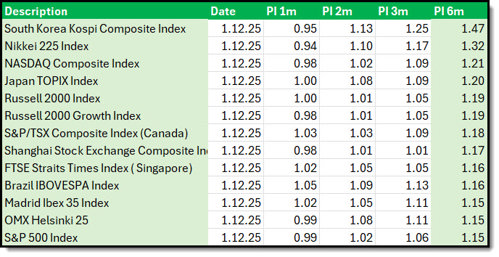

3. Sort the 35 country ETF’s by six-month return (PI 6m column)

4. Invest in the top 11 to 15 country ETFs.

These were the investments that came up on 1 December 2025:

Source: Quant Investing stock screener

You can find more information about the Country ETF dashboard here: These dashboards show you exactly what is going on in the markets

Click here to start finding lazy ETF momentum investments for your portfolio NOW!

Conclusion

If you are looking for a simple, powerful momentum strategy that does not take a lot of time to implement, the Lazy Man’s Momentum Strategy is worth a look.

You only trade twice per year and invest in a handful of ETFs that are easy and cheap to buy. And the strategy lets you systematically beat the market. What is not to like about that.

FREQUENTLY ASKED QUESTIONS

1. What makes the Lazy Man’s Momentum Strategy so appealing for individual investors?

The biggest advantage is simplicity. You only trade twice a year and invest in a handful of country ETFs. There is no need for complex analysis or daily monitoring. Despite being “lazy,” the strategy beat the market over 50+ years of backtests. That means you can stay invested with discipline while saving time and reducing stress.

2. How does the strategy decide which ETFs to invest in?

It ranks developed market country indexes by their returns over the past six months. At each rebalance in June and December, you pick the top half as “Winners” and invest equally across them. No guesswork. No special knowledge needed. Just follow the data.

3. Can this strategy really outperform traditional buy-and-hold investing?

Yes. Over 54 years, the strategy delivered 13.09% annually - beating the MSCI World Index’s 10.34%. That difference may look small, but it means your money compounds much faster. For example, $100 grew to $81,600 with this strategy, compared to just $21,320 with the index. Results like these show what consistent momentum can do.

4. What if I miss a rebalance or delay a trade?

Skipping a rebalance hurts performance. Javier Estrada tested this and found that doing just one rebalance a year - rather than two - reduced returns and increased risk. So, staying on schedule is key. But even if you get off track, it is better to adjust and re-engage than to give up. Consistency wins over time.

5. Is this strategy safe during market downturns?

Like any momentum strategy, it follows trends - it does not predict crashes. But by shifting out of weaker markets and into stronger ones every six months, it adapts better than many static portfolios. It avoids the worst losers, which helps manage downside risk. Just remember, no strategy removes all risk. Discipline and diversification still matter.

6. Do I need special tools or software to follow this strategy?

Not at all. You can track six-month returns using free data sites. But to make things easier, you can use the Quant Investing Screener’s Momentum Dashboard. It shows you exactly which country ETFs rank highest. This cuts your research down to minutes and helps you stay focused on execution.

7. Why does this strategy focus on country ETFs instead of individual stocks?

Country ETFs are broad, liquid, and easy to buy. They reduce single-stock risk and give you exposure to entire economies. For individual investors, this is a smart way to apply momentum without needing to analyse dozens of companies. You get the performance edge with much less effort.

Click here to start finding lazy ETF momentum investments for your portfolio NOW!