This the editorial of our monthly Shareholder Yield Letter published on 2024-01-16. Sign up here to get it in your inbox the first Tuesday of every month.

More information about the newsletter can be found here: The best large cap investment strategy ever

The latest issue of your Shareholder Yield Letter has just been published. This month you can read how the newsletter’s ideas have performed so far.

But first the portfolio changes which include two of Warren Buffett’s largest investments in Japan.

Portfolio Changes

Buy Four

Four new recommendations this month as the MSCI World index is above its 200-day simple moving average.

The first is a UK packaging company with a shareholder yield of 8.8%. Over the past 12-months it has bought back of 3.9% of its shares and paid a dividend of 4.9%.

The second is a Hong Kong conglomerate with a shareholder yield of 7.3%. It made share buybacks of 0.1% and paid an attractive dividend of 7.2%.

The third is a Japan-based trading company with a shareholder yield of 12.0%. It made share buybacks of 4.3% and paid an attractive dividend of 7.7%.

The fourth and last recommendation is also Japanese trading company with a shareholder yield of 6.1%, made up with share buybacks of 2.3%, and a dividend yield of 3.8%.

Newsletter’s Performance

As you know I sent you the first issue of the newsletter in May 2023, so the newsletter is new.

That means there is not a long track record, but I still wanted to give you a good idea of how all the recommendations performed up till the end of 2023.

Current ideas

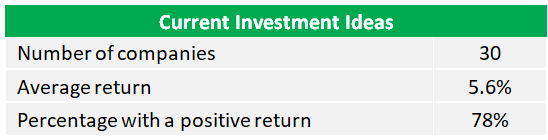

Let’s start with the performance of the ideas in the portfolio at the end of 2023.

Performance of ideas in the portfolio as of 31 December 2023

As you can see the portfolio did not shoot the lights out but +5.6% in seven months is a good start, I am sure you will agree.

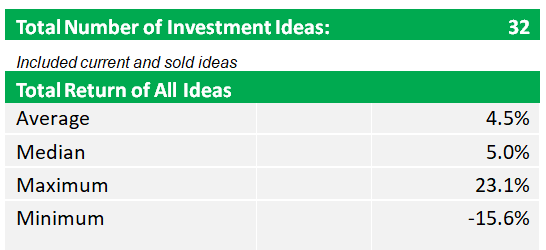

Here is the performance of all the ideas recommended since the first newsletter was published on 16 May 2023.

Performance Since May 2023

- Returns are calculated as price change plus dividends in the currency of the company's main listing.

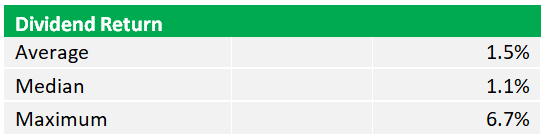

Dividend income

As the main criteria for ideas is Shareholder Yield (Dividend Yield + Stock Buyback Yield) we do not specifically look for companies with a high dividend.

But as the back tests have shown these companies on average also pay attractive dividends.

This is the dividend return of the newsletter:

Average divided return of all ideas

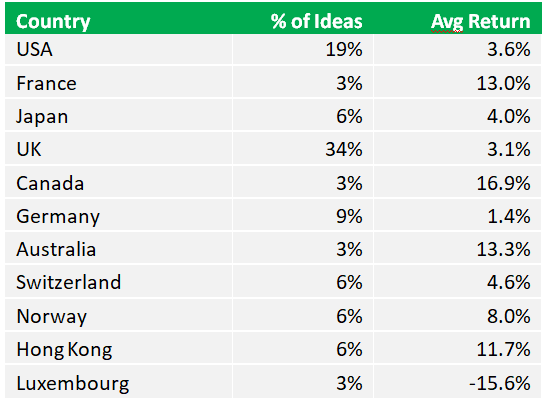

Country performance

This is where companies were recommended and how they performed:

Distribution of returns

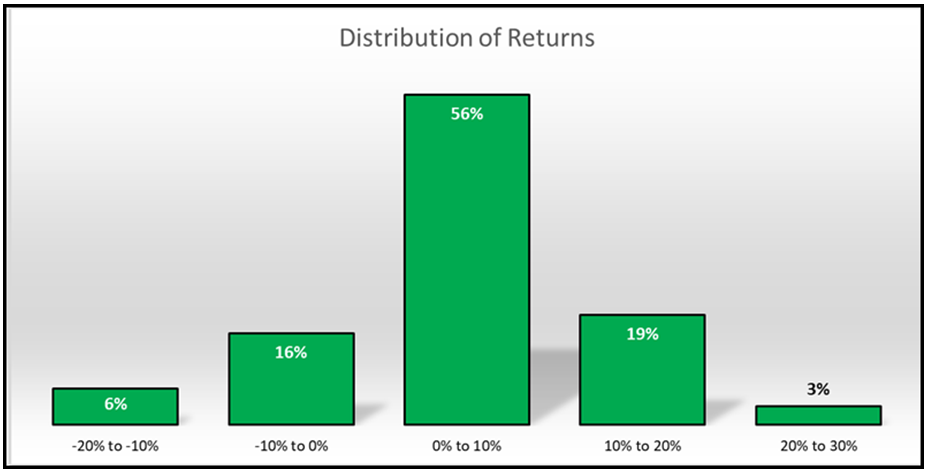

You know investing works best when you cut your losses fast and let your winners run. To do this the newsletter follows a STRICT 20% trailing stop loss system.

The following two charts show you how successful the newsletter has been at doing this.

To date 78% (56+19+3%), over three quarters of all ideas, would have given you a positive return, with the highest return of +23% (the second highest was +17%).

Chart Showing percent of all recommended companies:

Distribution of newsletter returns – Percent of all ideas

Over 3.5 to 1 more winners than losers

3.5 times more winners over 20% than losers

As you can see the positive returns FAR outnumber negative returns.

For example, returns of more than 10% is 3.5 (7/2) times higher than losses of more than 10%.

This is because of three things:

- A great time-tested investment strategy

- The strict stop loss system

- Stop buying when markets fall

As I said there is not much to report on yet but as you can see performance has been solid and is moving in the right direction.

Your analyst wishing you profitable investing!