Most investors chase earnings. But earnings can lie. Free cash flow does not.

This blog shows you why high Free Cash Flow Yield (FCF Yield) is one of the most reliable ways to find undervalued, cash generating companies. Backed by 40 years of global backtests, FCF Yield ranks as one of the top investment ratios.

You will learn how to use it, how to improve your results by combining it with momentum, and get over 90 high FCF Yield ideas for 2026 that you can act on today. Build a better system so you can invest with confidence.

Estimated Reading time: 6 minutes

Most investors look at earnings. That is normal. But the problem is that earnings can be “managed” with accounting choices. Cash is different; it is harder to manipulate apart from outright fraud.

Thus, the best way to find undervalued companies with free cash flow yield is one of the best places to start.

In this post, you will learn why free cash flow yield works, how you can find ideas fast, and how to use two proven versions of the strategy.

You will also get over 90 high free cash flow investment ideas and see how you can use a repeatable screen to find your own high free cash flow ideas with a few mouse clicks.

With the Quant Investing screener, you can set this up, so you get high free cash flow ideas that exactly fit your requirements in your inbox without even having to log into the screener.

Why Free Cash Flow Yield Is a Great Investment Strategy

Free Cash Flow is the cash a business has left after it pays for what it needs to run, to maintain and grow the business. In the Quant Investing stock screener, Free Cash Flow (FCF) is defined as total cash from operations minus capital expenditure.

Free Cash Flow Yield tells you how much free cash flow you get compared to the full price of the business. In the screener, Free Cash Flow Yield is defined as Free Cash Flow divided by Enterprise Value. Enterprise Value is market cap plus long-term debt plus minority interest plus preferred capital minus excess cash.

As you can see, it is a clean way to find companies that have enough cash to pay dividends and do buybacks. It lets you avoid stocks that only “look cheap” because earnings are high for one year, but the business generated no cash because accounts receivable increased substantially, for example – never a good sign.

Does Free Cash Flow Yield Investing Work

Before you start using the strategy, you should ask one question. Does the strategy work over long periods across different world markets? If it does, you have an advantage.

The reason free cash flow yield investing works is simple. Investors often overpay for growth and exciting stories. They ignore boring, high cash generating companies. Free cash flow yield gives you investment ideas in this ignored group.

It also forces you to be disciplined. You are not buying what feels good today. You are buying what is cheap compared to cash.

FCF Yield Backtest in the USA

Alpha Architect tested all valuation ratios and found FCF Yield to be one of the best. Their 40-year study of valuation ratios was a quest to find the Holy Grail of investing metrics.

Free Cash Flow Yield emerged as one of the best, second only to EBITDA/EV.

They tested 5 ratios over the 40-year period from 1 July 1971 to 31 December 2010 and tested normalised (average) ratios to see if they increase returns.

What ratios did they test?

-

Earnings to Market Value (E/M) – You can also call the ratio Earnings to Price – the inverse of the PE ratio

-

Earnings before interest, taxes, depreciation, and amortization to total enterprise value (EBITDA/TEV)

-

Free cash flow to total enterprise value (FCF/TEV) – FCF was defined as Net Income + Depreciation and Amortization - Working Capital Change - Capital Expenditures

-

Gross profits to total enterprise value (GP/TEV)

-

Book to market(B/M) – the inverse of Price to Book

Companies included and how they tested

-

This back test excluded financial companies and utilities, and the smallest 10% of market value companies listed on the NYSE.

-

Portfolios were put together on 30 June each year when all the companies were sorted into five quintiles, 20% groups of companies.

-

They only included companies for which 8 years of data were available.

-

Portfolios were rebalanced on a yearly basis.

How the ratios were calculated

For the one-year (1yr) ratios, companies were selected based on the current numerator (top value) and current denominator (bottom value) for each measure.

For all the normalized ratios (2 years – 8 years) they used the average of the numerator over the past 2 to 8 years and divided this average by the current denominator.

For example, the 8-year FCF/EV ratio was calculated using the average of the past 8 years FCF for each company (including the current year) and dividing this by the company’s current total enterprise value (EV).

This is what they found:

Click image to enlarge

Source: Analyzing Valuation Measures: A Performance Horse-Race over the past 40 Years.

The Equal Weight Value part of the table shows the equal-weighted returns of the most undervalued (cheap) 20% of companies based on each valuation ratio.

The Equal Weight Growth part of the table shows the equal-weighted returns of the most overvalued (expensive) 20% of companies based on each valuation ratio..

The Spread (Value-Growth) part of the table shows the difference between the Equal Weight Value and Equal Weight Growth returns of the two above tables.

What they found

As you can see (look at the dark green areas of the table) they did not find that using normalised ratios can add to your returns. Only a normalised book-to-market (inverse of price-to-book) would have given you slightly higher returns compared to the one-year ratio.

The best valuation ratio they found was trailing 1 year EBITDA to EV, with an average return of 17.7% over the 40-year test period.

EBITDA to EV was also the ratio with the highest spread (Value – Growth) returns, which is a further indicator that it is the best ratio to use.

What about free cash flow yield? - Second-best ratio

As you can see free cash flow yield was the second-best ratio they tested, at 16.6% (look at 1-year equal weight) it was 1.1% per year lower than EBITDA/EV.

Still a great return!

FCF Yield Backtested in Europe

We tested FCF Yield in Europe and found that no matter where you look, high Free Cash Flow Yield companies consistently had great returns.

In our book Quantitative Value Investing in Europe: What Works for Achieving Alpha we tested 168 investment strategies in Europe over the 12 year period from June 1999 to June 2011 we also tested 12 months Free Cash Flow yield and 5 year average free cash flow yield.

Free cash flow yield vs Normalised free cash flow yield

In the back test, free cash flow yield was defined as cash flow from operations minus capital expenditure, divided by enterprise value.

This is what we found:

Free Cash Flow Yield Trailing 12 months returns (Source: Quantitative Value Investing in Europe: What Works for Achieving Alpha)

Q1 (Quintile 1) represents the cheapest 20% of companies and Q5 (quintile 5) the most expensive.

As you can see, buying the most undervalued FCF yield companies (Q1) gave you by far the best performance, for small mid and large companies.

Substantial market outperformance

Just in case you were wondering - market outperformance was substantial, over the 12-year period of the study, the market portfolio generated a return of only 30.5 % or 2.25% pa, dividends included.

Click here to start finding your own high FCF Yield ideas NOW!

How To Improve the Returns of a High Free Cash Flow Yield Investment Strategy

In the above research report, we not only tested single valuation ratios, but we also tested how you can improve returns by combining free cash flow yield with other ratios.

Improve Your Free Cash Flow Yield Returns

The following table shows you the returns you could have achieved if you could combine high 12-month (or TTM) free cash flow yield companies with 14 other ratios and indicators.

Source: Quantitative Value Investing in Europe: What works for achieving alpha

Look At Column Q1

Look at the returns in column Q1, it shows the returns generated by first selecting the 20% best free cash flow yield companies combined with the ratios in the column called Factor 2.

Best Combination +755% Was Momentum (506.3% Improvement)

As you can see, when combined with Price Index Momentum (12 months), it works even better, delivering greatly improved returns. +755% total return, more than double what Free Cash Flow Yield alone achieved.

Price index 12 months is calculated as the current share price / share price 12 months ago.

This means if you invested only in the 20% of high free cash flow yield companies that also had the top 20% 12 months price increase (price index) you could have increased your return by 506.3% (755.0% - 248.7%) compared to if you only invested in companies with the highest free cash flow yield.

That is an improvement of just over 2 times the original return!

Click here to start finding your own high FCF Yield ideas NOW!

Best High Free Cash Flow Yield Investment Ideas for 2026

In this section, we show you actionable investment ideas. You will see two lists of investment ideas:

1. One is a “stand-alone” high free cash flow yield investment idea.

2. The other is free cash flow yield plus 12-month momentum (Price Index 12 months).

In the list, you will see some extreme yields. Those can be outliers. The goal is not to find the highest number. The goal is to find cash-rich companies that are also investable.

Best High Free Cash Flow Yield Investment Ideas Worldwide For 2026

High Free Cash Flow Yield investment ideas

This is what the screen looked like:

-

All countries worldwide included

-

Top 20% Free Cash Flow Yield companies

-

Minimum daily trading volume of $100,000

-

Minimum company market value of $100 million

-

Financial statements updated in the last 6 months

-

Results sorted by Free Cash Flow Yield from undervalued to expensive

There were some wild numbers (most likely outliers) that ranked best so I went down the list a bit to show you companies with more realistic Free cash flow yields.

Source: Quant Investing Stock Screener

Free Cash Flow Yield combined with Price Index 12 month

This is what the screen looked like:

-

All countries worldwide included

-

Top 20% Free Cash Flow Yield companies

-

Minimum daily trading volume of $100,000

-

Minimum company market value of $100 million

-

Financial statements updated in the last 6 months

-

Results sorted by Price Index 12 months (Momentum) from best to worse

Source: Quant Investing Stock Screener

Best High Free Cash Flow Yield Investment Ideas in North America for 2026

High Free Cash Flow Yield investment ideas

This is what the screen looked like:

-

USA and Canada selected

-

Top 20% Free Cash Flow Yield companies

-

Minimum daily trading volume of $100,000

-

Minimum company market value of $100 million

-

Financial statements updated in the last 6 months

-

Results sorted by Free Cash Flow Yield from undervalued to expensive

Source: Quant Investing Stock Screener

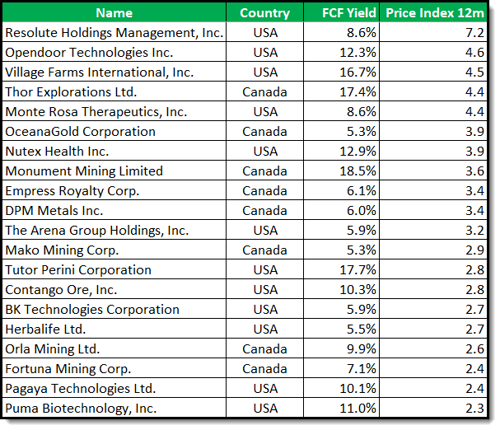

Free Cash Flow Yield combined with Price Index 12 month

This is what the screen looked like:

-

USA and Canada selected

-

Top 20% Free Cash Flow Yield companies

-

Minimum daily trading volume of $100,000

-

Minimum company market value of $100 million

-

Financial statements updated in the last 6 months

-

Results sorted by Price Index 12 months (Momentum) from best to worse

Source: Quant Investing Stock Screener

Click here to start finding your own high FCF Yield ideas NOW!

Best High Free Cash Flow Yield Investment Ideas in Europe for 2026

High Free Cash Flow Yield investment ideas

This is what the screen looked like:

-

EU countries, Scandinavia and the UK selected

-

Top 20% Free Cash Flow Yield companies

-

Minimum daily trading volume of $100,000

-

Minimum company market value of $100 million

-

Financial statements updated in the last 6 months

-

Results sorted by Free Cash Flow Yield from undervalued to expensive

Source: Quant Investing Stock Screener

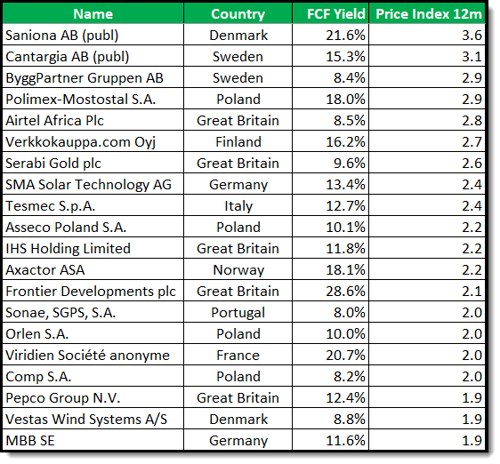

Free Cash Flow Yield combined with Price Index 12 month

This is what the screen looked like:

-

EU countries, Scandinavia and the UK selected

-

Top 20% Free Cash Flow Yield companies

-

Minimum daily trading volume of $100,000

-

Minimum company market value of $100 million

-

Financial statements updated in the last 12 months

-

Results sorted by Price Index 12 months (Momentum) from best to worse

Source: Quant Investing Stock Screener

Best High Free Cash Flow Yield Investment Ideas in Asia for 2026

High Free Cash Flow Yield investment ideas

This is what the screen looked like:

-

Australia, China, Hong Kong, Japan, South Korea, New Zealand and Singapore selected

-

Top 20% Free Cash Flow Yield companies

-

Minimum daily trading volume of $100,000

-

Minimum company market value of $100 million

-

Financial statements updated in the last 6 months

-

Results sorted by Free Cash Flow Yield from undervalued to expensive

Source: Quant Investing Stock Screener

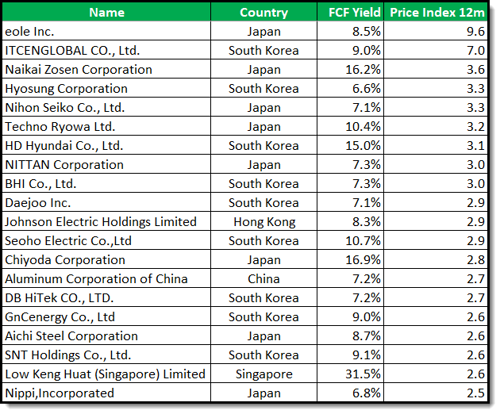

Free Cash Flow Yield combined with Price Index 12 month

This is what the screen looked like:

-

Australia, China, Hong Kong, Japan, South Korea, New Zealand and Singapore selected

-

Top 20% Free Cash Flow Yield companies

-

Minimum daily trading volume of $100,000

-

Minimum company market value of $100 million

-

Financial statements updated in the last 6 months

-

Results sorted by Price Index 12 months (Momentum) from best to worse

Source: Quant Investing Stock Screener

Actionable Investment Ideas You Can Use Right Now (Beginners and Advanced)

If you are a beginner or a more advanced investor, either investment strategies or a combination of the two will give you solid investment ideas.

We recommend you always pick a minimum of 30 to 50 stocks, spread across industries. Include even more stocks if you do not want to do any research on each company.

Keep your minimum size and volume rules to the ones we suggested above or larger. This helps you avoid stocks that can trap you because you cannot sell fast.

Also, set clear risk management rules before you buy. For example, you can use a trailing stop loss rule of 15% or 20% and you can stop buying when markets are in a clear downtrend. Systems like this reduce emotion and reduce stress.

Final thoughts. Your edge in 2026

Free cash flow yield is not magic. But it is one of the best ways to focus on what matters. Real cash. If you build your process around it, you stop reacting to noise. You start making calm, repeatable decisions with a good investment strategy.

Your next step is simple. Run the screen. Save it. Then buy a basket of stocks that fit your rules. You can do this all at once, quarterly or a few each month.

You do not need perfect investment ideas; you need a good process that you can stick to.

Click here to start finding your own high FCF Yield ideas NOW!

FREQUENTLY ASKED QUESTIONS

1. What is Free Cash Flow Yield, and why should I care about it?

Free Cash Flow Yield tells you how much real cash a company generates compared to its full value. It is harder to fake than earnings. That makes it a more honest way to find undervalued stocks. If a company has strong free cash flow, it can pay dividends, buy back shares, or grow the business - all good signs for investors.

2. How does Free Cash Flow Yield help avoid risky stocks?

Earnings can be misleading because companies use accounting tricks. But cash is real. Free Cash Flow Yield helps you avoid stocks that look cheap but are not producing real cash. This gives you a safer starting point when choosing what to buy.

3. Has Free Cash Flow Yield been tested over time?

Yes. It has been tested for over 40 years in the US and 12 years in Europe. In both tests, high Free Cash Flow Yield companies gave great returns. In fact, it was the second-best ratio tested. That gives you confidence that the strategy works across time and countries.

4. Can Free Cash Flow Yield work better if combined with other tools?

Yes. If you combine Free Cash Flow Yield with momentum - buying companies whose share price rose over the last 12 months - you can do even better. In Europe, this combo more than doubled the return of using Free Cash Flow Yield alone.

5. How many stocks should I buy using this strategy?

Buy at least 30 to 50 stocks. Spread them across different industries. This helps lower risk and makes sure your results do not depend on just a few companies. More is better if you do not want to research each stock closely.

6. What should I avoid when using Free Cash Flow Yield?

Avoid chasing the highest yield number. Some outliers may look great but are not safe. Stick to solid companies with realistic cash flows. Also, use rules to manage risk - like trailing stop-losses and avoiding stocks in a falling market.

7. How can I start using this strategy right away?

You can run a screen for Free Cash Flow Yield using tools like the Quant Investing screener. It lets you set your own rules and even sends ideas to your inbox. Start small, follow a system, and build your portfolio over time. The goal is not perfection. It is having a clear, repeatable process.

Click here to start finding your own high FCF Yield ideas NOW!