Is your high dividend investment strategy based on buying companies with a high dividend yield and high dividend cover?

If so you can do a lot better.

This article summarise a research paper that tells you why the way most investors look at dividend income investing is all wrong. You can also see you can find ideas that fit with what the researchers found that really works.

Bad ideas when using a high dividend yield investment strategy

These are the dividend investing ideas the research found that doesn't work:

- Buying companies with the highest dividend yield is a bad idea

- Placing too much weight on dividend cover (earnings per share / dividend per share) is another bad idea

- Buying a weak or low quality business with a high dividend yield is a bad idea

- Buying a high dividend yield company with a weak balance sheet is also a bad idea

How do I find these companies?

Before I show you what the research found you should invest in let's first look at the research paper more closely.

Who did the research?

I stumbled onto the research paper while looking for good research on the best dividend income investment strategy.

The best, and most up to date study I could find was a February 2016 paper Equity income investing is not all about a high dividend yield, by the quantitative research team of the French bank Societe Generale.

They looked at 45 years of data

In the paper they looked at what made up the largest part of stock market returns over the 45 year period from 1970 to 2015 in the following seven countries:

- UK

- USA

- France

- Germany

- Australia

- Canada

- Japan

Click here to start finding your own Dividend income ideas NOW!

What they found?

In all these countries they found that compounding dividends (dividend payments and dividend growth) make up far the largest part of stock market returns.

Dividends more important than multiple expansion

Dividends and dividend growth was more important than multiple expansion which I am sure will also surprise you.

Multiple expansion is when a company’s valuation becomes more expensive. For example, if a company’s price to earnings ratio (PE) increases from five to ten (and its earnings per share remain the same) its share price will increase 100%.

The increase in its PE ratio from five to ten is called multiple expansion.

Ignore very high dividend yields

They also looked at the indicated average dividend yield and the yield that investors really received. They found that for companies that had an indicated dividend yield of 6% to 20% investors only really received a return of around 6%.

In other words the dividend was cut and investors were never paid the high indicated yield.

What matters is a quality and financial strength NOT dividend yield

They found that the performance of the company’s business and the its financial strength had the biggest impact on its dividend and dividend growth. The future cash flow the business generated and the price you paid for the cash flow were the most important factors that determined future returns.

The researchers also found, the same as we and a lot of other researchers, that dividend yield was a bad ratio to use to find cheap (undervalued) companies. Price to Free Cash Flow, PE and earnings yield were much better ratios to identify undervalued companies.

Why dividend yield is the wrong ratio to use

Dividend yield is a bad valuation ratio is because a lot of companies tried to continue paying a dividend that they could not afford. This led to the company’s dividend yield being higher than it should which means the company looked undervalued but it really was not.

The dividend could not be maintained because the companies had weak businesses with weak free cash flow generation and / or a weak balance sheet with a lot of debt.

Forget about using dividend cover

What I am sure you will also find surprising is that the researchers found that a good (low) dividend pay-out ratio (Dividend per share / Earnings per share) did not lead to high returns.

They looked at best 20% of companies in terms of dividend cover in the FTSE World index that had a dividend yield of more than 4% over the 12 year period from December 2002 to December 2014.

In spite of the good dividend cover the yield that investors really received was a lot lower than the indicated dividend yield which means that the dividend was cut.

This is the same as what Rob Arnott and Cliff Asness found in a paper called Surprise! Higher Dividends = Higher Earnings Growth. They found that a high dividend pay-out ratio was an indicator of increasing future growth in profit.

Here is the abstract from the paper:

We investigate whether dividend policy, as observed in the payout ratio of the U.S. equity market portfolio, forecasts future aggregate earnings growth.

The historical evidence strongly suggests that expected future earnings growth is fastest when current payout ratios are high and slowest when payout ratios are low.

This relationship is not subsumed by other factors, such as simple mean reversion in earnings. Our evidence thus contradicts the views of many who believe that substantial reinvestment of retained earnings will fuel faster future earnings growth. Rather, it is consistent with anecdotal tales about managers signalling their earnings expectations through dividends or engaging, at times, in inefficient empire building.

Our findings offer a challenge to market observers who see the low dividend payouts of recent times as a sign of strong future earnings to come.

Click here to start finding your own Dividend income ideas NOW!

What are the right dividend investing ratios to use?

In order to become a successful dividend income investor what the researchers found most important was the strength of the company’s business especially the strength of its balance sheet.

This is the right way to measure financial strength

Over the 12 year period from December 2002 to December 2014 the researchers found that if you invested in good quality companies with a dividend yield of more than 4% in the FTSE World index there was very little difference between the indicated dividend yield and the dividend you received at the end of the day.

To identify good quality companies the researchers used the Piotroski F-Score and the Robert Merton’s distance to default model.

We have done a lot of testing with the Piotroski F-Score and found it a very helpful indicator that can really help you increase your returns. You can read more about the F-Score here: Can the Piotroski F-Score also improve your investment strategy?

We do not have the Merton’s distance to default model in the screener but you can replace it with the Altman Z-Score that predicts bankruptcy.

In summary

1. To become a successful dividend income investor you have to make sure you invest in high quality companies that can continue paying its dividend in good and bad times.

2. To make the dividend high enough for an attractive investment you must not pay too high a price.

3. To find cheap companies use the price to free cash flow, PE or earnings yield ratios.

4. After selecting a healthy undervalued company the dividend is the final piece that falls into place not the first ratio you should look at.

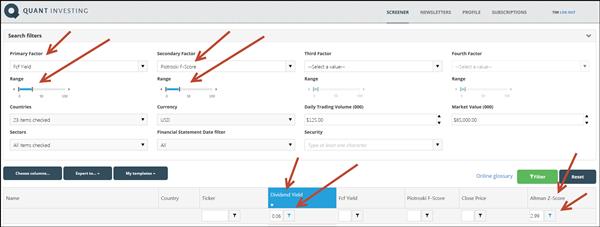

We built a screen for you

To help you find interesting dividend investment ideas we built and saved a screener that uses all the best ideas from the research paper.

This screen helps you find:

- Undervalued companies with the highest FCF Yield (top 30% of companies),

- Quality companies with Piotroski F-Score of 7 to 9,

- Companies with a dividend yield of less than 6% (remember the study found that a dividend of more than 6% is never really paid),

- Safe companies with an Altman Z-Score of more than 2.99,

- Sorted by dividend yield

This is what the screen looks like:

Click here to start finding your own Dividend income ideas NOW!

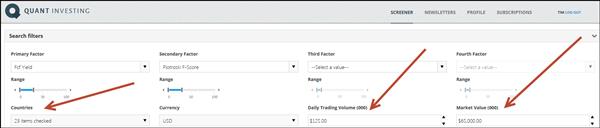

All you still have to do is select:

- The countries you would like to screen

- The minimum daily traded value so the company is liquid enough for you to invest

- The minimum company size you would like to invest in

This can be done with a few mouse clicks as you can see below:

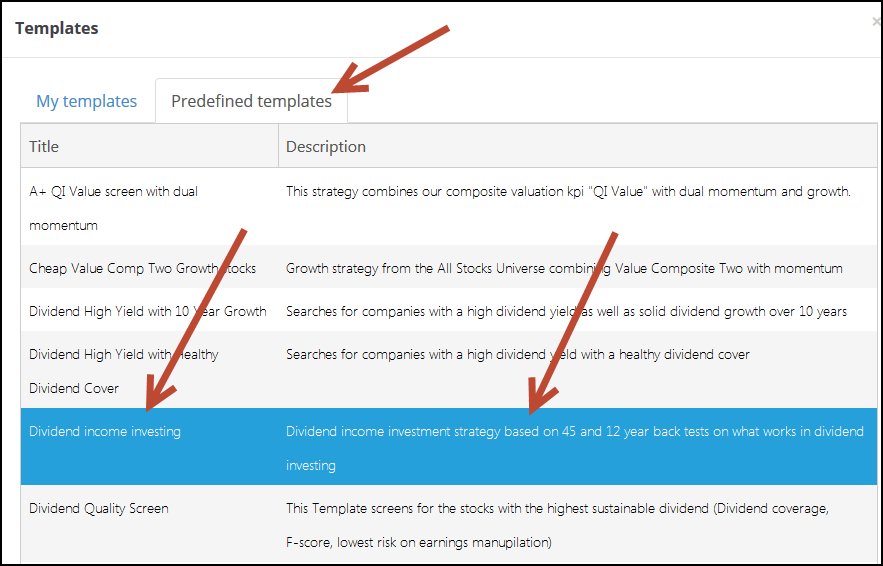

How to load the screen with a few clicks

You do not even have to put the screen together yourself as we have saved it for you i the Quant Investing stock screener.

Simply click on the saved screens button and select the strategy “Dividend income investing” screen as shown below.

Click image to enlarge

PS Everything you need to implement this dividend investment strategy in your portfolio can be found here.

PPS Why not sign up now while it is still fresh in your mind. You can cancel at any time for a FULL refund if you are not happy. Sign up here.

Click here to start finding your own Dividend income ideas NOW!