If you are looking for a stock screener to screen companies like those in the S&P 500 you can now do this with the Quant Investing stock screener. This means you can limit your stock screen to only the 500 largest companies in the USA. In the screener we call it the US500.

What exactly is the US 500 index?

The US 500 index is a group of large market value U.S. companies.

How to select the US 500 index?

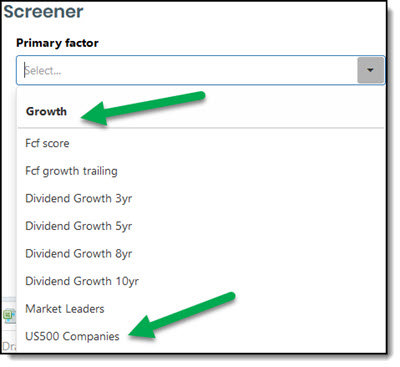

Once you have logged into the screener click the drop down list below Primary Factor and under the heading Growth select US500 Companies.

How to select the US 500 index

PS To get all these investment ideas working in your portfolio sign up here.

PPS It is so easy to put things off, why not sign up right now before it slips your mind?