Learn how to find companies that are making smart stock buybacks. This article will teach you to screen for firms that are undervalued, well-financed, and buying back stock for the right reasons. By following this guide, you'll improve your ability to spot great buyback investment opportunities that others might miss.

Estimated Reading Time: 6 minutes

Looking for companies making smart stock buyback (share buyback) decisions?

This article shows you (step by step) how to set up a stock buyback screen that finds companies that are:

- undervalued,

- conservatively financed

- with enough cash to fund expansion and research and development and

- are doing stock buyback.

Not All Buybacks are good

As you know, not all stock buybacks are good for shareholders because they are done for VERY wrong reasons. Here are a few of the worse:

- To keep the stock price up

- To manipulate the stock price – Keep stock options in the money

- Because everyone is doing it

- Because debt is cheap

- To lever up the balance sheet - Borrow to buy back shares

- To keep the high company valuation - There is always a buyer in the market

- To boost earnings per share - By reducing outstanding shares

- To counter the dilution of stock options - To keep the outstanding shares constant

- To fend off an takeover - Buy back and the company gets to vote the treasury shares

- To get rid of excess cash

- To return capital to shareholders apart from dividends

- Because an activist wants to make a quick profit

I am sure you can also think of a few more.

How to Screen for Companies Making Smart Buyback Decisions

We gave the idea of finding companies making clever buybacks a lot of thought and put together a stock screen to help you.

This is the stock buyback screen

With this screen you can find companies:

- Listed in the main developed stock markets worldwide that,

- Over the past 12 months bought back a lot of stock but

- Does not have a lot of debt and

- Is undervalued.

This is what the screen looks for:

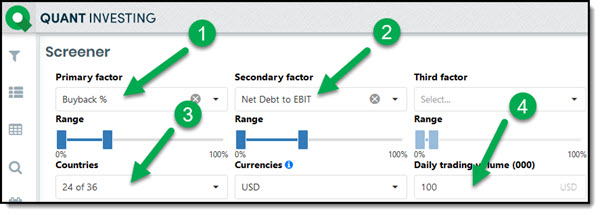

- The 30% of companies with the highest Buyback Yield

- The 40% of companies with the lowest Net Debt to EBIT

- All the main developed stock markets worldwide

- Minimum 30 day average traded value of USD 100,000

The screen looks like this:

Click image to enlarge

Click here to start finding your own companies doing smart stock Buybacks NOW!

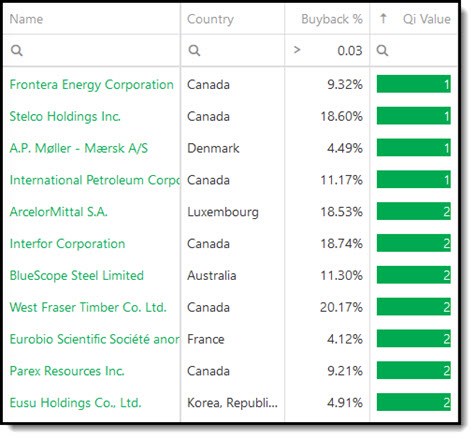

Companies with the highest stock buybacks

To find the companies with the highest stock buyback yield, add Buyback % as an output column, then click twice on the Buyback % column heading to sort it from high to low.

This is what your screen results should look like:

But these companies aren’t cheap

But the above list does not tell you if a company is undervalued. To find cheap companies with high stock buybacks we looked for companies with the best Qi Value ranking.

You can read more about the Qi Value ranking here:

Qi Value investment strategy back test

This investment strategy is working even better than we expected +711%

This is the stock screen:

- The 30% of companies with the highest Buyback Yield

- The 40% of companies with the lowest Net Debt to EBIT

- All the main developed stock markets worldwide

- Minimum 30 day average traded value of USD 100,000

- Selected companies with a Buyback Yield above 3%

- Sorted this list by Qi Value from low to high (low is the best Qi Value ranking)

This is the list of companies that came up:

Stock buybacks combined with Value Composite One

In this example we used Value Composite One to find undervalued buyback companies.

This is the stock screen:

- The 30% of companies with the highest Buyback Yield

- The 40% of companies with the lowest Net Debt to EBIT

- All the main developed stock markets worldwide

- Minimum 30 day average traded value of USD 100,000

- Selected companies with a Buyback Yield above 3%

- Sorted this list by Value Composite One from low to high (low is the best Qi Value ranking)

Here is the list of companies:

Click here to start finding your own companies doing smart stock Buybacks NOW!

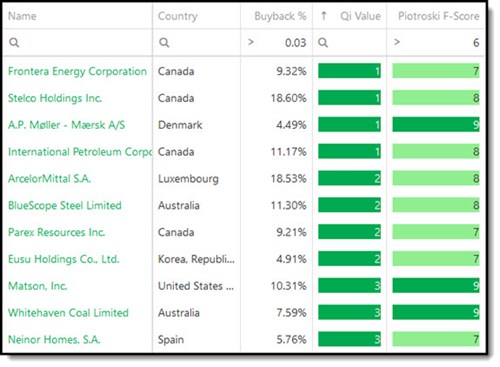

To Find Better Quality Companies Add the Piotroski F-Score

To improve the quality of the companies even more we added the Piotroski F-Score.

Take a look at the list of articles below, you will see that the Piotroski F-Score is the closest thing you get to a universal indicator to increase the return of your investment strategy.

You can read more about the Piotroski F-Score here:

This academic can help you make better investment decisions – Piotroski F-Score

Can the Piotroski F-Score also improve your investment strategy?

This is what we screened for:

- The 30% of companies with the highest Buyback Yield

- The 40% of companies with the lowest Net Debt to EBIT

- All the main developed stock markets worldwide

- Minimum 30 day average traded value of USD 100,000

- Selected all companies with a Buyback Yield above 3%

- Selected only companies with a Piotroski F-Score greater than 6. (9 is the best F-Score and 0 the worse)

- Sorted this list by Qi Value from low to high (low is the best Qi Value ranking)

That is all you have to do to find companies making smart buyback decisions.

You can save this screen

As with all screens in the Quant Investing stock screener you can save your screen so you can call it up with only a few mouse clicks.

Remember a stock screen is just the start

Please remember a stock screen is just the starting process of your research. Verify all numbers and look if the companies have not changed substantially after the last reporting date.

To help you this is the research we do with the companies we select for the Quant Value investment newsletter: This is how we select ideas for the Quant Value newsletter

Click here to start finding your own companies doing smart stock Buybacks NOW!

Frequently Asked Questions

1. What is a smart stock buyback?

A smart stock buyback (share buyback) is when a company buys back its own shares at a cheap price, is financially stable, and has enough cash for growth.

2. Why do some companies do buybacks for the wrong reasons?

Some companies buy back stock (to lower shares outstanding) to increase its stock price in the short-term, keep valuations high, or manipulate earnings per share (lower share count equals higher earnings per share), which isn’t good for long-term investors.

3. How can I find companies doing smart buybacks?

Use a stock screener to filter companies with high buyback yields, low debt, and good valuations.

4. Are all high buyback companies good investments?

No, a high buyback yield doesn’t make a good investment. You must also check if the company is undervalued.

5. What metrics should I use to evaluate a company’s buybacks?

Look at the buyback yield, debt to equity ratio, and use value rankings like Qi Value or Value Composite Two.

6. How does the Piotroski F-Score help in picking stocks?

The Piotroski F-Score measures the financial health of a company, helping you find high-quality stocks that are likely to perform well.

7. Can buybacks hurt a company’s future growth?

If done irresponsibly, buybacks can reduce the cash available for investments, harming long-term growth of the company and even cause bankruptcy if too much debt is taken on.

8. Is it enough to just use a stock screener to choose stocks?

No, a stock screen is just the starting point. You need to research further to confirm the company’s financials and strategy to see if the share repurchases make sense.

9. What should I do if a company’s situation changes after a buyback?

Always re-evaluate your investments if a company’s financial health or strategy changes significantly after a buyback.

10. How often should I check my buyback-focused investments?

Regularly review your investments, especially after quarterly reports, but at least yearly, to ensure the companies continue to make smart financial decisions.

PS To implement this stock buyback investment strategy in your portfolio click here to: Sign up right NOW!

PPS It is so easy to put things off or forget so why don’t you do it right now?

Click here to start finding your own companies doing smart stock Buybacks NOW!