A few years ago my friend and co-author of the research paper Quantitative Value Investing in Europe: What Works for Achieving Alpha helped a small unknown fund in Spain develop an investment process based on all the best ideas from all our research and testing.

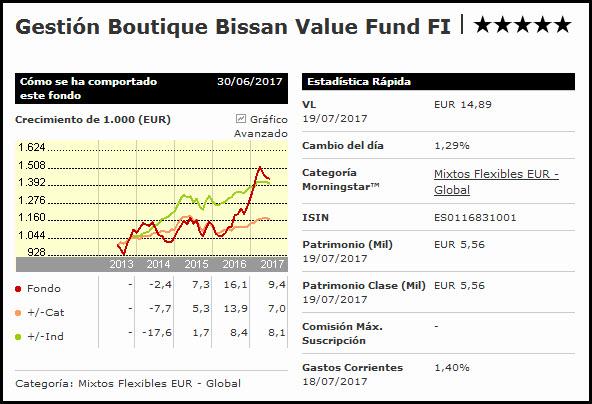

After a slow start in 2013 the fund has performed exceptionally well and currently has a five star Morningstar rating.

Source: Morningstar

Based on this excellent performance I asked the fund manager Xavier San Miguel Moragas if he would share what he has learned about investing with you.

Thankfully he agreed to the following interview.

Over to you Xavier…

Xavier how did you get started in investing?

Since I was a kid, I was fascinated with businesses, reading a lot of books about management by authors like Lee Iacoca, Harold Geneen or Alfred P. Solan.

So, I decided to study business management, and really enjoyed strategy and numbers.

This was a natural path to understand the intrinsic value of business and how they manage to survive and thrive.

However, when I was in college, I was amazed with numbers and formulas, so I concentrated more on algorithms for option trading. That was not really investing, it was speculating, but it was my first approach to markets, even though I had a good understanding of business strategy.

Describe your investment approach and how it has developed?

Although I did not lose money with my option trading algorithms, I saw that option pricing was flawed in favour of banks and brokers, so I stopped.

I created some good algorithms that worked, but what I realised cash management was key.

When I was 26, I read Security Analysis from Benjamin Graham and it was like an epiphany. Suddenly everything had a meaning because it made sense with business strategy and statistics.

In the following years I analysed stocks and, with its methodology, beat the market more than 8% p.a. for almost four years.

Then I read the book by Philip Vanstraceele and Tim du Toit where they tested quantitative value investing on European markets. Quantitative Value Investing made a lot of sense to me because when I started investing I was involved in sophisticated option trading algorithms and now I was applying “algorithms” with a pure value investing approach.

How do you see quantitative value investing compared to value investing (or stock-picking)?

The most difficult task in managing money is your behaviour, the execution and not the stocks you choose.

You can have a perfect methodology but without the needed strong character to stick to it, is impossible to be a good wealth manager and investor.

This means to have rules that guide your actions – for example:

- When you have a stock that went down -30%, what to do, buy much more? Sell all?

- When a position is up +20%, you sell it? Or just wait and see much bigger gains?

The quantitative approach gives you rules to stick to. However, is much more difficult than standard value investing because the companies the quantitative strategy comes up with sometimes scares you.

But that way of investing, through a consistent process, is far better than your own way.

Why?

Everybody has times when you feel good and times when you feel bad, this definitely affect the way you invest.

Having a quantitative value investing process helps you avoid the day to day impacts of how you feel and helps you make solid investment decisions not based on past results, emotions or instincts, but on system that works.

Philip is very disciplined and that helped me a lot at the beginning, when I was transitioning from a pure value investing approach to a quantitative value investing methodology.

You've invested as a private investor and now as a fund manager. What are the main differences?

The biggest difference is a psychological one.

Once you are in the fund manager industry, you feel the pressure of all those rankings, ups and downs, the Morningstar stars, and so on.

You appear in the media when your fund does well, this is good, but at the same time it adds a lot of pressure for you to continue doing well, and that is bad.

Also, one of the worst things as a fund manager, is you see in real time how investors in the fund makes bad investment decisions. They buy when the fund has gone up, and sell when it has gone down.

It’s terrible, but is always like this.

Describe your investment philosophy as well as that of the fund you manage?

I invest using investor behavior also called behavioral finance.

After several years, and after having invested through two bear markets of -50% and -35% in the last 7 years, I can say with no hesitation that the best factor that predicts market results it is NOT asset allocation, it’s the investor behavior.

You can have a great asset allocation of 60 stocks and 40 bonds that in theory can be a wonderful allocation. BUT when a crisis hits, and your stocks are down 50%, almost nobody cares about asset allocation, nobody buys stocks.

So, behavior is what drives the markets.With investor behavior as the basis of our investment process, we divide our service to clients into two parts.

Firstly, we prevent our customers falling into the worse investor behavior pitfalls.

For example, in 2012 in Spain, one of our worst moments and being heavy invested in Spanish stocks, none of our customers sold any stock, something impressive.

Even more impressive, more than 40% bought the dip, four years later making them a ton of money. That was because all of them did their financial planning with our company (BISSAN Value Investing), where we help them to apply good investor behavior.

Secondly, we invest using investing strategies that capture market anomalies created by the behavior of the masses (bad investor behavior). That’s a great thing because human nature does not change, so our investment process combine several strategies that together leads to wonderful returns.

In summary, if you combine a great investor behavior thanks to financial planning and at the same time exploit market inefficiencies created by behavioral madness, the result is excellent wealth management.

How do you typically find ideas and what is your selection process before an idea gets added to the portfolio?

For the fund I am advising, the ideas come from an algorithm that captures a lot of different market inefficiencies.

This fantastic algorithm was created by Philip Vanstraceele, Olov Peterson and myself.

It, on a regular basis gives us a list of its best investment ideas, and then we apply our own filters, some of them macro, some specific to each company.

Finally we follow a very simple yet powerful process of buying and selling those stocks in a systematic and regular basis.

That is really the most difficult part: the execution, where your emotions can derail the whole thing.

Basically our investment process consists of buying companies that match the following criteria:

- Good quality – mainly by avoiding bad quality

- At a reasonable price

- With positive share price momentum

As I said sticking to this strategy is the really hard part because of all our biases (personal and unreasoned judgment or prejudice).

What are your ideas concerning portfolio composition and the value of individual holdings in relation to the portfolio?

Our portfolio uses a rebalancing system that consists of six sub-portfolios, each with its own life.

This means that each time new companies are added to the fund they are added in a separate sub-portfolio. Because our selection process uses momentum (upward moving share price) this means each sub-portfolio has a different group of companies that met the fund’s investment criteria at the rebalancing date, for example, mining companies in January and chemical companies in June.

New companies are added to the portfolio on a monthly basis and sold after six months if the company is no longer fund’s selection process.

That creates a bit more of volatility, but increases the chances of having really different ideas that perform well overall.

Keeps correlation low

It is also a fantastic way to keep our correlation with the market low. For example, our portfolio’s correlation with EuroStoxx 600 or S&P 500 is 0.5 to 0.6.

And if you look at historical results since 2001, it can go to 0.3, which is fantastic.

But it also adds to the behavioural pitfalls, because you may have long periods of time then the fund over- or under performs the market.

To manage that you have to be very strong psychologically.

Can you describe your top mistakes in investing and what you've learned from them

Some of my biggest mistakes have been investing in banks at the beginning of the European sovereign debt crisis. In some of them we lost more than 50%.

Every time they went down, I bought more. At the end, the result was a disaster.

If you look at all the best ideas of a fund manager you will see that only about half of them earn money, the rest have losses.

The lesson I learnt is that I have to get used to losses, but do not let them sink you. Cut the losses and invest in another opportunity.

That was really hard for a value investing investor like me, but it is how it should be.

My worst mistake

By far my worst mistake was buying the Spanish multinational Abengoa S.A., I did not cut losses, and ended up losing almost 90% on this investment.

How concentrated is your portfolio? Do you follow any key risk-management guidelines in managing your portfolio?

In our fund we found that 24 to 30 investments give us the highest returns.

More investments lowers returns and fewer investments can be devastating if some perform badly.

Because our fund aims to have as high as possible returns we do not use any typical tool to reduce volatility. In fact we like volatility because is the basis on which we find good opportunities – when other investors make bad investment decisions.

But that way of working requires a very disciplined investment process, because you can have severe periods of underperformance.

And finally, you're based in Barcelona far from the markets is this an advantage?

Well, for sure. Barcelona is a wonderful city, wonderful art, architecture, weather, sea and food.

All the things you need to make great investment decisions.

Xavier thanks for your time and insights.

PS To get access to all the tools Xavier uses to find investment ideas take a look at our stock screening service

PPS If you made it this far, you are a little interested in investing, perhaps even quantitative investing. Come on, admit it.

If you have not already done so sign up for our free newsletter (includes all the latest research and investment ideas we write about) in the block at the bottom of this page.