With interest rates rising I thought it will be interesting to see how many zombie companies I could find. With zombie companies I mean companies that are going to struggle to even just pay interest on their debt not even talking about repaying it.

Also, if you look at the numbers below, you will see that these companies are very unlikely to be able to refinance their debt. This means bankruptcy!

What the zombie screen looks like

This is what the zombie stock screen looks like:

- All companies worldwide

- Market value of more than a billion U.S. dollars

- Select the 50% of companies with the worst Net Debt to EBIT ratio

- Piotroski F-Score of less than five

- Financial statements updated recently - in the past six months

- An External Finance ratio (Change in Assets - Cash from Operations) / Total Assets) greater than zero. This means a company was not able to finance their asset growth - from internally generated funds (cash from operations)

Click here to start finding your own zombie companies NOW!

Choose your own ratios

Before we get to the list of companies.

Remember, this is just a list of the best zombie finding ratios I came up with.

The stock screener has a LOT of other ratios you can use, up to 110. You can find a full list and their description here: Glossary of ratios to find zombie companies

A list of terrible companies

As you can imagine this screen gives you list of companies in a horrible financial state.

You could of course use any ratio to sort the results to give you the worst zombie companies.

I sorted this list using four different ratios to give you an idea what you can do with the screener.

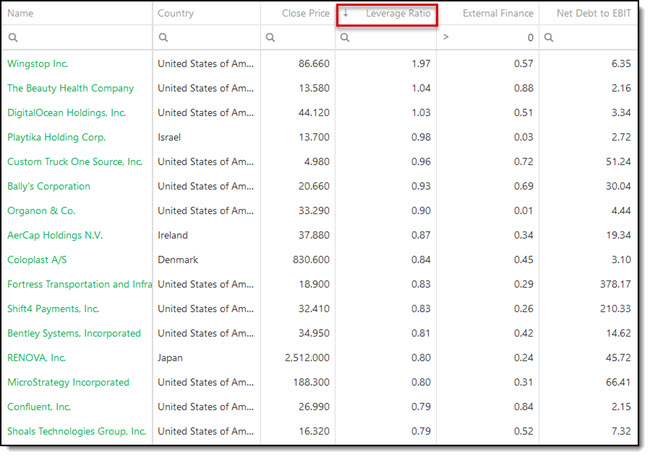

Sorted by leverage ratio

Firstly, I sorted the screen from high to low by Leverage Ratio. The Leverage Ratio = Total debt / (Average Total Assets)

It is thus total debt to average total assets of the company over the past two years.

Here is the list:

Click image to enlarge

Sorted by Net Debt to EBIT

Next, I sorted the list from high to low by Net Debt to EBIT.

Net Debt to EBIT is equal to (Long-term debt + Short term debt – Cash) / Earnings before interest and taxes (EBIT).

This ratio shows you how able a company is to pay interest and capital on its debt. The smaller the ratio (means the company has a low amount of debt compared to EBIT) the healthier the company and the other way around.

For example, the highest value below is 1712. This means that Net Debt equals 1712 times EBIT or that EBIT only makes up 0.06% of Net Debt (1/1712). With this EBIT this company cannot even make an interest payment of 1%!

Here is the list:

Click image to enlarge

Click here to start finding your own zombie companies NOW!

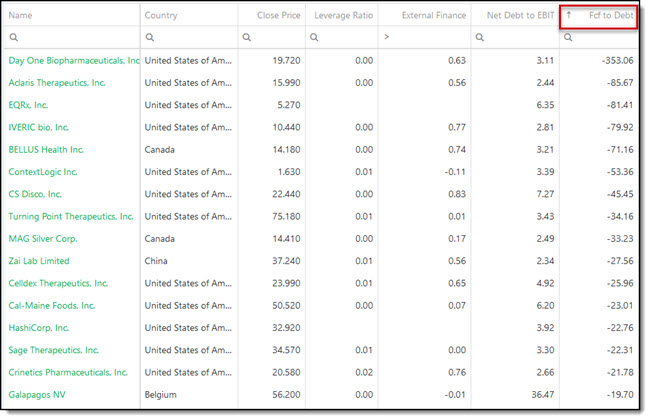

Sort by Free Cash Flow to Debt

To see if the company generated enough cash to pay interest or repay debt, I sorted the results from low to high by Free Cash Flow (FCF) to Total Debt .

This ratio gives you an idea of how high the company's total debt is compared to its free cash flow (Cash from operations minus Capital expenditure).

The worse rated company with a value of -353 had HIGH negative free cash flow, not good news if they have to service debt.

Here is the list:

Click image to enlarge

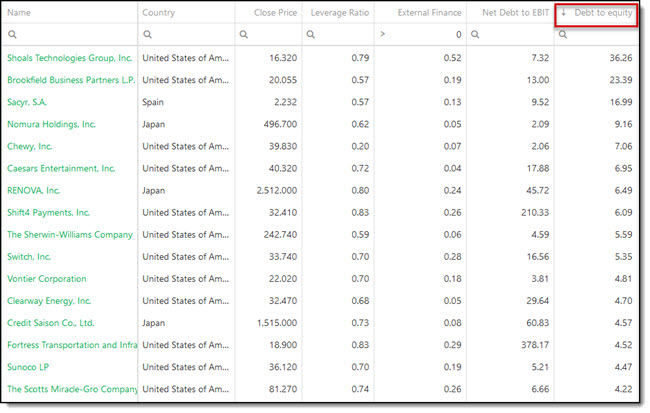

Sorted by Debt to Equity

To not leave out the classic debt ratios I also sorted the list from high to low with the Debt-to-Equity ratio. It equals Total Debt / Common Shareholders Equity.

As you can see the worst rated company has debt equal to 36 times its equity!

Here is the list:

Click image to enlarge

This is just a starting point

I am sure you know this already, a screen is just a starting point in your research.

There may be a good reason a company on the list is not a zombie, but if it is on the list, it is a red flag that you should take a closer look at.

Wishing you profitable investing!

PS To start using ratios like this to screen out Zombies in your portfolio now – Click here

PPS It is so easy to get distracted and put things off, so why not sign up right now!