2022 was a wild investment year!

Inflation and fast rising interest rates have taken stocks on a roller-coaster ride with high flying tech stocks being hit the hardest. Not even talking about the crypto losses!

Even thought markets recovered somewhat int he last quarter, 2022 reminded me of 2001 the year the dot-com bubble burst.

Everything got hammered

When the dot-com bubble burst, the same as in 2022 value out-performed again but the best strategies were the ones with the lowest losses as everything got hammered.

Only if you used a high dividend yield strategy in Japan would you have made a profit of 10% on ALL the remaining strategies world-wide you would have lost money!

Quality and Momentum performed the worse

In general momentum and quality were the worst performing factors in most markets worldwide.

What investment strategies worked in 2022?

So, what worked – or lost the least - world-wide in 2022?

Here is a summary:

- Undervalued Value Composite One and Two (VC One and VC Two) ranked companies lost the least, both at -0.4%

- Buying companies with a low price to book value lost -0.7%. Most likely because you would avoided technology companies.

Before I show you the more detailed returns, first information on what and how we calculated the returns.

19 investment strategies tested – on 10,360 companies worldwide

We looked at the performance of the following 19 investment strategies from 1 January 2022 to 31 December 2022:

- Size - Large vs small companies (Quintile 1 = Biggest companies)

- Book to Market value (inverse of price to book)

- Earnings yield (EBIT/EV)

- Qi Value – the strategy I use in my own portfolio

- Price Index 6m (Current price / Price 6 months ago) also known as 6 months Momentum

- Price Index 12m (Current price / Price 12 months ago) also known as 12 months momentum

- VC One also known as Value Composite One rank

- VC Two known as Value Composite Two rank (Value Composite One with an additional ratio: Shareholder Yield)

- ERP5 ranking (Ranking based on Price to Book, Earnings Yield, Return on invested capital (ROIC), 5-year average ROIC)

- Shareholder Yield (Dividend yield + Percentage of Shares Repurchased)

- Dividend Yield

- Dividend growth 5 years (The geometric average dividend per share growth rate over the past 5 years)

- MF Rank (Magic Formula Ranking developed by Joel Greenblatt)

- Piotroski F-Score

- Qi Liquidity ranking Low liquidity stocks calculated as Adjusted Profits / Yearly trading value

- Gross Margin Novy-Marx (Gross Profits / total assets) – the best quality ratio we have tested

- Free Cash Flow (FCF) Score (Calculated by combining Free cash flow growth with free cash flow stability)

- Adjusted slope average (125-day, 250 day) – momentum

- Adjusted slope (90 days) – momentum

Market value over €50 million trading more than €25,000 per day

We excluded companies with a market value below €50 million and a median 30-day traded value less than €25,000.

This left a universe of around 11,200 companies which means each quintile world-wide consisted of about 2,200 companies. This large number of companies is good because it makes it unlikely that any one company impacted the return of any quintile .

If the ratio or indicator could not be calculated when the portfolios were formed the company was excluded ONLY for that specific strategy that year.

Markets worldwide then regions

The following stock markets (and regions) were included:

North American Markets

- USA

- Canada

European Markets

- All the Eurozone countries

- United Kingdom

- Switzerland

- Norway

- Denmark

- Sweden

Japanese Market

- Only Japan

Other Asian and Oceanic Markets

- Australia

- New Zealand

- Hong Kong

- Singapore

All companies in five groups – Quintile 1 the best

To test the strategies, we used point in time data (so no look ahead bias), on 1 January 2022 we divided all the companies in the universe into five 20% groups or quintiles.

Quintile 1 shows the companies that scored best in for all the strategies we tested - Quintile 5 the worst. For example, Quintile 1 shows the return of the 20% of companies with the highest book to market ratio (lowest price to book – cheap companies) at the start of the year.

And Quintile 5 shows the return of companies with the lowest book to market ratio (highest price to book ratio – expensive companies).

For Price Index 6m quintile 1 show companies with the best momentum (biggest share price increase over 6 months) and quintile 5 companies with the biggest price fall in the previous 6 months.

For the Piotroski F Score quintile 1 shows the return of companies with the best Piotroski F-Score (9 or 8) and quintile 5 those with the worse F-Score.

For the Size strategy quintile 1 shows the return of the 20% of companies with the biggest market value and quintile 5 the 20% smallest companies.

Return calculation

Returns for each quintile is calculated as the average percentage change from the stock price over the period, dividends included.

No adjustments were made for currency movements.

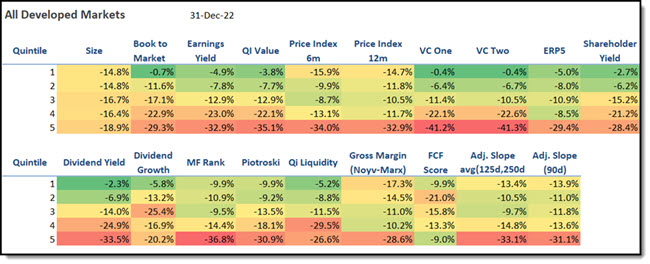

The best investment strategy world-wide in 2022

The following table summarises how all 19 investment strategies performed world-wide:

For reference the MSCI World Index lost -19.7%.

Click image to enlarge

Best performing strategies world-wide

How all the best rated companies (Quintile 1) perform?

- Average return Quintile 1 of all strategies: -7.9%

- Maximum return of Quintile 1 strategies: -0.4%

- Minimum return of Quintile 1 strategies: -17.3%

What worked?

Here are the two best performing Quintile 1 strategies:

- Undervalued Value Composite One and Two (VC One and VC Two) ranked companies lost the least, both at -0.4%

- Buying companies with a low price to book value lost -0.7%. Most likely because you would avoided technology companies.

What did not work?

These were the worse Quintile 1 strategies:

- The worse strategy was investing in good quality companies as defined by Gross Margin (Noyv-Marx) -17.3%

- Momentum also performed badly. If you bought companies with the best price increase over 6 months (Price Index 6m), you would have lost 15.9%.

Click Here – To get all the tools you need to implement all 19 strategies NOW!

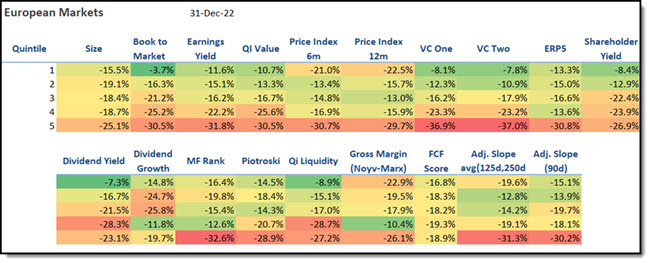

The best investment strategy in Europe in 2022

Below is the performance of all 19 strategies in Europe:

For reference the European STOXX 600 Index lost -12.9%.

Click image to enlarge

Best performing strategies in Europe

How all the best rated companies (Quintile 1) perform?

- Average return Quintile 1 of all strategies: -13.6%

- Maximum return of Quintile 1 strategies: -3.7%

- Minimum return of Quintile 1 strategies: -22.9%

What worked?

These were the best two Quintile 1 strategies:

- Also here, buying companies with a low price to book (value) lost the least -3.7%

- High Dividend Yield (value) companies also did relatively well and lost only -7.3%

What did not work?

The two worse performing Quintile 1 strategies were:

- Quality companies with the best Gross Margin (Novy-Marx) was the worst performing strategy and lost -22.9%.

- If you invested in companies with the best 12 months momentum – Price Index 12m - it would have also performed badly losing -22.5%.

Click Here – To get all the tools you need to implement all 19 strategies NOW!

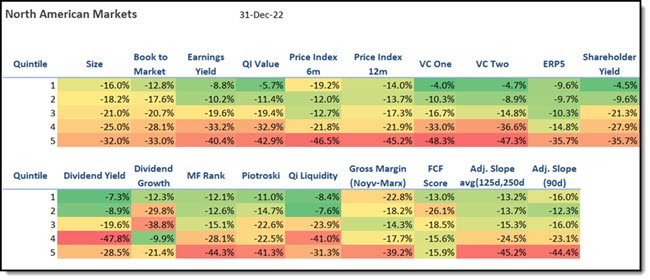

The best investment strategy in North America in 2022

Below is the performance of all 19 strategies in North America:

For reference the S&P 500 Index lost -19.4%

Click image to enlarge

Best performing strategies in North America

How all the best rated companies (Quintile 1) perform?

- Average return Quintile 1 of all strategies: -11.3%

- Maximum return of Quintile 1 strategies: -4.0%

- Minimum return of Quintile 1 strategies: -22.8%

What worked?

The two best performing Quintile 1 strategies were:

- Buying cheap Value Composite One (VC One) companies would have given you the second lowest loss of -4.0%

- Buying cheap Shareholder Yield companies would have given you the second lowest loss of -4.7%.

What did not work?

The two worse performing Quintile 1 strategies were:

- Buying quality companies with the best Gross Margin (Novy-Marx) was the worst performing strategy that lost -22.8%.

- Buying the best 6 months momentum – Price Index 6m - companies would have given you the second lowest return of -19.2%.

Click Here – To get all the tools you need to implement all 19 strategies NOW!

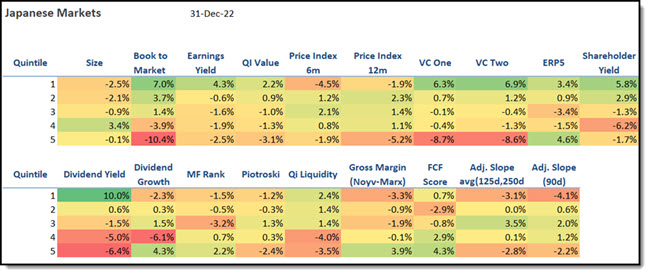

This was your best investment strategy in Japan in 2022

Below is the performance of all 19 strategies in Japan.

For reference the Japanese Topix 1st Stock Price Index lost -7.1%

Click image to enlarge

Best performing strategies in Japan

How all the best rated companies (Quintile 1) perform?

- Average return Quintile 1 of all strategies: +1.3%

- Maximum return of Quintile 1 strategies: +10.0%

- Minimum return of Quintile 1 strategies: -4.5%

What worked?

The two best performing Quintile 1 strategies in Japan were:

- Same as in North America, the best strategy was buying companies with the highest dividend yield which would have returned +10.0%.

- Buying companies with a high Book to Market (Low price to Book) ratio was the second-best strategy that returned +7.0%.

What did not work?

The two worse performing Quintile 1 strategies were:

- Buying companies with the best 6-month momentum was the worst strategy losing -4.5%.

- The second worse strategy was investing in the best Adjusted Slope Average (90d) momentum companies which lost -4.1%.

Click Here – To get all the tools you need to implement all 19 strategies NOW!

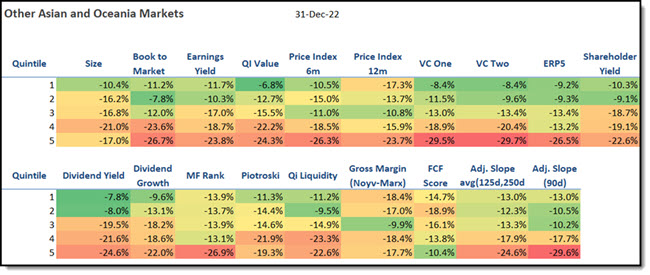

The best investment strategy in Asia and Oceania Markets in 2022

Australia, New Zealand, Hong Kong, and Singapore companies are included in this analysis.

For reference the iShares Core MSCI Pacific ex-Japan ETF (Australia, New Zealand, Hong Kong, and Singapore companies) lost -5.9%.

Click image to enlarge

Best performing strategies in Asia and Oceania

How all the best rated companies (Quintile 1) perform?

- Average return Quintile 1 of all strategies: -11.4%

- Maximum return of Quintile 1 strategies: -6.8%

- Minimum return of Quintile 1 strategies: -18.4%

What worked?

The two best performing Quintile 1 strategies were:

- Investing in companies with the best Qi Value was the best strategy lost -6.8%.

- Buying the 20% of companies with the highest Dividend Yield was the second-best investment strategy which lost only -7.8%.

What did not work?

The two worse performing Quintile 1 strategies were:

- If you invested in quality Gross Margin (Novy-Marx) companies, you would have had the lowest return of -18.4%.

- If you invested in companies with the best 12 months momentum – Price Index 12m – you would have also performed badly losing -17.3%.

Returns all over the place – This is normal

As you can see no one strategy worked everywhere – sometimes exactly the opposite worked – this just proves that over the short-term anything is possible.

A warning – investment strategy may stop working

Remember just because a strategy did great – or lost the least - in 2022 does not mean it will continue to work. As you can see the same strategy performed well in one region and bad in another.

Jumping on the best performing strategy is most likely a bad idea - possibly the worst idea for 2023.

Perhaps your best strategy this year was the worst strategy in 2022 as it may turn around as happens a lot to under-performing strategies.

Like you I have no idea as to what strategy will work best in the future and if someone says he does, he or she is lying – you can be sure of that.

The best investment wisdom applied here

The same investment advice that has always worked also applies here. If you use a time-tested good performing investment strategy, that suits your nature so you can stick with it through thick and thin, you will have great returns over the long term.

If you want to read more about the best strategies we have tested, click here: Best investment strategies we have tested at Quant Investing

Wishing you profitable investing in 2023!

PS To get this report on a weekly basis as well as the tools to implement all 19 strategies (for less than an inexpensive lunch for two) sign up here.

PPS It is so easy to put things off, why not sign up right now?

Click Here – To get all the tools you need to implement all 19 strategies NOW!