This article shows you exactly how we find the investment ideas recommended in the Shareholder Yield Letter.

Only buy when markets are moving up

Before we even start looking for ideas, we make sure the markets are not falling.

You know when markets fall, they all fall together – in more technical terms – they become correlated.

This means, when markets are falling, and you keep on buying, ideas will soon be sold because of the strict trailing stop loss system (more on that later) the newsletter follows.

This is definitely not what you want!

To solve this problem we follow a simple rule (based on a LOT of solid research ) - No new ideas are recommended when markets are falling. This means we will only recommend new ideas if the MSCI World Index is above its 200-day simple moving average (SMA).

The best universe and investment strategy

The Shareholder Yield Letter finds investment ideas based on TWO powerful easy to understand principles.

Principle #1 – Fish in the right Pond

The first is principle is to fish in the right pond. This means use the best group of companies (investment universe) to look for ideas.

For this we use the Market Leaders investment universe as defined in the terrific book What Works on Wall Street by James O'Shaughnessy. In the book James tested an investment strategy of only investing in market leading companies which beat the market.

Market Leaders are non-utility companies with larger than average:

- Market value

- Number of shares outstanding

- Free Cash flow and

- Sales above 1.5 times the average of the universe

Outstanding performance +889.3%

In back tests we have done it performed great!

If you, in the 14-year period from 2001 to 2015 bought the 20 most undervalued Market Leading companies worldwide you would have earned a compound yearly return of 18.5% or 889.3% over 14 years .

If you invested in the MSCI World index you would have only earned 8.3% per year or 105.3% over 14 years.

Principle #2 – Find companies that pays shareholders the most

Market Leaders is a large cap investment universe so we wanted to find the best large cap investment strategy we could find.

We looked and tested a lot of strategies over a LONG time to finally decide on the Shareholder Yield investment strategy.

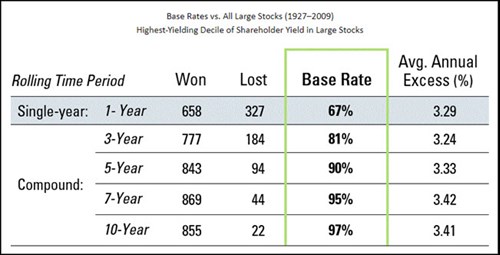

We chose Shareholder Yield not just because of its market beating performance but because it does so consistently! Measured over ANY 10-year period in an 80 year back test period it beat the market 97% of the time (90% over any 5-year period).

Here are the results of the back test:

Source: 7 Traits for Investing Greatness by Jim O'Shaughnessy (80-year (1927–2009) back test of the shareholder yield investment strategy)

What is a shareholder yield investment strategy?

A Shareholder Yield investment strategy values a company based on two ways it returns cash to shareholders:

- Dividends and

- Stock buy backs

A company’s Shareholder Yield is the sum of Dividend yield + Percentage of Shares Bought Back.

The higher the shareholder yield the more attractive the company is.

Not A Shareholder Yield Letter subscriber? - Click here Sign Up right NOW!

What the stock screen looks like

These are the steps we take to find the ideas

Get a list of companies with the highest shareholder yield

The first step is to get a list of Market Leading companies with the highest shareholder yield.

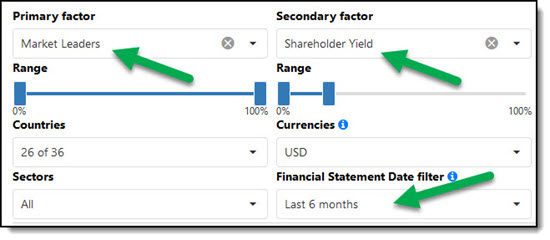

We use the Quant Investing stock screener to get investment ideas, using the following ratios and indicators:

- Market Leaders investment universe

- All developed stock markets worldwide

- Shareholder Yield select the best 20%

- Financial results updated in the past 6 months

- Results sorted by Shareholder Yield from high to low

The screen looks like this:

Click image to enlarge

Analyse 5-years of results

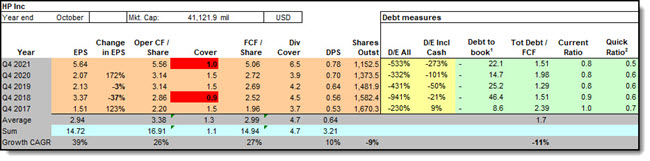

Once we have a list of companies, we build an analysis spreadsheet with five years of results for each company.

Is the company is correctly included?

We use the spreadsheet to make sure a company is correctly included in the screen, and not because of data errors or unusual numbers, a large once-off profit for example.

This is what the spreadsheet looks like:

Click image to enlarge

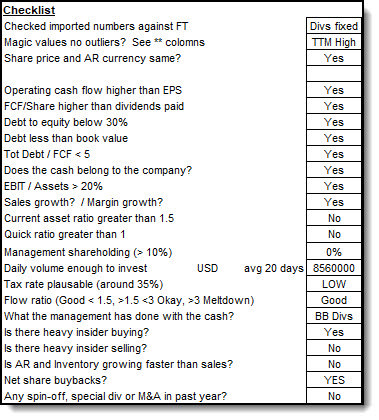

We then work through this 23-point checklist

To make sure the company fits with the stock screen we also work through a 23-point checklist that looks like this:

If anything in the checklist brings up a red flag, we do more research or move on to the next company. A company does not have to pass a certain number of checklist items before it is recommended. The checklist reminds us of all the important items that we need to look at.

Check the latest news

If a company has made it through the above process, we look at the latest company news on the investor relations website.

We look at the latest financial results (half yearly or quarterly), as well as all the financial press releases to make sure the company has not done anything that may have changed its financial situation or its business.

We look for actions that can or have changed the business or structure of the company.

Remember, the stock screener finds companies based on past results and you need to make sure the company has not changed since then.

What to look for:

- Spin-offs - After a spin-off, a company may look completely different from the company that was selected by the screener based on information before the spin-off.

- Special dividends – This increases its Shareholder Yield but only for the current year.

- Large acquisitions - May change the company’s business and or its financial situation, for example a lot of new debt.

No second guessing

During this full process we do not to second guess the ideas the investment model comes up with. For example, excluding companies because we do not like the business or the industry.

This is important because research has shown that second guessing a high performance, time tested, investment strategy only leads to lower returns .

Only if a company passes all the above tests is it recommended in the newsletter.

Not A Shareholder Yield Letter subscriber? - Click here Sign Up right NOW!

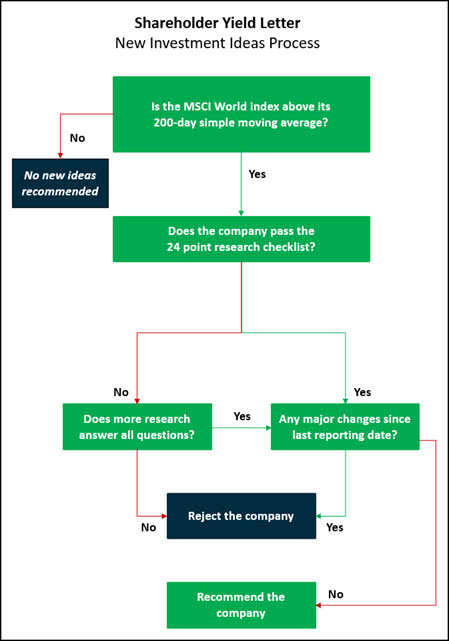

These flow charts show you the process

Here is the entire process in the form of a flow chart.

Click image to enlarge

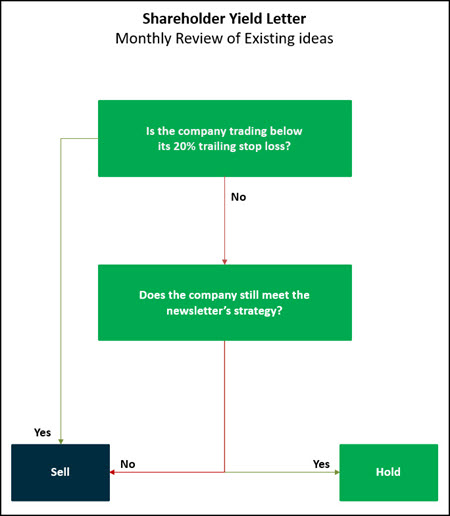

And this is what happens to all the existing ideas each month:

Click image to enlarge

As you can see, it is a solid process, with a lot of research and analysis.

Frequently Asked Questions (FAQs) about the Shareholder Yield Investment Strategy

Why does the Shareholder Yield Letter only recommend new ideas when markets are moving up?

The strategy follows a rule to only recommend new ideas if the MSCI World Index is above its 200-day simple moving average (SMA). This is because during falling markets, stocks tend to move together, increasing the likelihood of triggering stop-losses and incurring losses.

By waiting for markets to be in an uptrend, the strategy aims to provide better investment stability and avoid premature sell-offs.

What makes the Market Leaders investment universe so effective for the Shareholder Yield strategy?

The Market Leaders universe consists of non-utility companies with larger than average market value, number of shares outstanding, free cash flow, and sales. These criteria ensure that you are investing in financially strong companies.

Historical back tests have shown that investing in these market-leading companies can significantly outperform broader indices, providing robust long-term returns.

How does the Shareholder Yield strategy differ from other dividend-focused strategies?

The Shareholder Yield strategy considers both dividends and stock buybacks, providing a more comprehensive view of how a company returns cash to its shareholders. By combining these two components, the strategy identifies companies that not only pay dividends but also actively reduce their share count, which can lead to higher share prices and improved investor returns over time.

What steps are involved in screening and selecting companies for the Shareholder Yield Letter?

The process includes:

- Screening for Market Leading companies with the highest shareholder yield using the Quant Investing stock screener.

- Analysing five years of financial results to ensure data accuracy.

- Evaluating each company against a 23-point checklist.

- Reviewing the latest company news and financial updates.

- Ensuring no second guessing of the investment model to maintain the integrity of the strategy.

Why is it important to review the latest news and financial updates of the selected companies?

Reviewing the latest news ensures that the company's financial situation or business structure hasn't changed significantly since the screening process. Events like spin-offs, special dividends, or large acquisitions can alter a company's financial health and future prospects.

These additional check helps confirm that the company remains a good investment based on the most current information.

How reliable is the Shareholder Yield strategy based on historical performance?

The Shareholder Yield strategy has been extensively back-tested and shown to consistently outperform the market. In an 80-year back test, it beat the market 97% of the time over any 10-year period and 90% over any 5-year period.

This consistent performance makes it a reliable strategy for long-term investors seeking stable and superior returns.

What is the significance of not second-guessing the investment model during the selection process?

Second-guessing the investment model can lead to biases and suboptimal investment decisions. Research has shown that adhering strictly to a high-performance, time-tested investment strategy generally yields better results than making subjective adjustments.

By following the model rigorously, you maintain the integrity of the strategy and increase the likelihood of achieving higher returns.

PS To sign up for the newsletter, for less than an inexpensive lunch for two each month, click here: Sign me up!

PPS It is so easy to forget so why not sign up right now while it is still fresh in your mind. You can cancel at any time for a FULL refund if you are not happy.

Not A Shareholder Yield Letter subscriber? - Click here Sign Up right NOW!