I've been investing in undervalued small cap Japanese companies for a few years now. As you have also seen there are a lot of cheap companies, but what frustrated me was that a lot of the ideas were dead money.

A lot of investments were dead money

With dead money I mean you buy an undervalued company, the company's performance is okay – sales growth below 5% and profits growing slightly more - but the stock price goes nowhere for years.

I finally found a way to overcome this problem and that is what this post is all about.

But before I get to that first a bit of background information.

Why Japan?

Why invest in Japan you may be thinking.

Well even before the most recent market correction in 2022 the market was already dirt cheap.

Because of this the market has not nearly fallen as much as in the rest of the world. And there was no tech bubble in Japan.

The tech bubble and the huge outperformance of the US stock markets resulted in the Japanese market getting completely neglected. Low growth and high returns elsewhere led to nobody wanting to invest in Japan.

The Yen is at a 20-year low

Another huge plus is the Japanese Yen is at a 20 year low compared to most other currencies worldwide.

Just look at the following two charts of the Yen compared to the US dollar and the Euro.

Source: Google Finance 2022-07-06

The Yen fell because Japan is clinging to its ultra-low interest rate policy compared to the US and to a lesser extent Europe, where interest rates are rising.

Weak Yen is a great opportunity

The low Yen creates a great opportunity because if you by Japanese companies now you get the double benefit of the company stock price going up as well as the currency appreciating.

But weren’t Japanese companies’ dead money

Getting back to what I said about dead money.

Japanese companies have been dead money for so long mainly because of the following:

- High amount of cash - sometimes more than the market value of the company

- Low returns. Mainly because of all the cash that increases assets but earns nothing

- Low growth in sales as well as profitability

- No shareholder return focus.

But a lot of these things are changing. For example, a new corporate governance code which has led to a lot of improvements.

You can read more about all the improvements in Japan in this great article by GMO: Japan Equities: Entrenched Perceptions Ignore Improving Reality

The activists are coming

Activists have become increasingly active in Japan and with good results. There's only been a few examples, but this is a trend that will encourage other activists to also get involved in Japan.

Companies have taken note and started taking returns to shareholders seriously.

This is led to a lot of more companies paying higher dividends as well as starting to buy back stock and this is exactly where the opportunity lies.

We just have to find the right investment strategy to ride this trend.

Finding the right companies to ride this trend

To take advantage of the above changes we have to find the right strategy to avoid dead money and buy those that are increasing returns to shareholders.

How do we do this.

I've thought about this a lot as I invested in a few of these dead many Japanese companies and it dawned on me that there's a very simple ratio we can use to find the exact companies we are looking for in Japan.

It is called shareholder yield.

Enter shareholder yield

If you've been following us for a while, you know we really like shareholder yield. It is the sum of all cash returned to investors in the form of dividends plus share buybacks.

In this article How and why to implement a shareholder yield investment strategy , you can see all the back tests of the shareholder yield investment strategy we could find.

It also gives you exact description ofwhat shareholder yield is all about and what makes it a great investment strategy.

Click here to use Shareholder Yield to find ideas in Japan NOW!

How to implement shareholder yield in Japan

The rest of this post shows you exactly how to implement a high shareholder yield investment strategy in Japan.

The Quant Investing stock screener makes it very easy to find high Shareholder Yield companies.

We have saved everything for you

To make it easy we have already saved a screen, with all the ideas mentioned above for you.

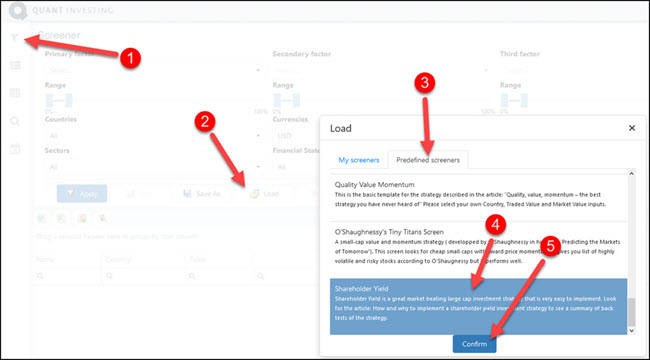

All you have to do is load the screen with a few mouse clicks. This is how you do it:

- Log into the screener

- Click on the screener icon (small funnel) at the top left of the page

- Click the Load button

- Click the Predefined screeners tab

- Scroll down until you find the Shareholder Yield screen, click on it

- Click the Confirm button to load the screen

How to load the Shareholder yield investment strategy

Click image to enlarge

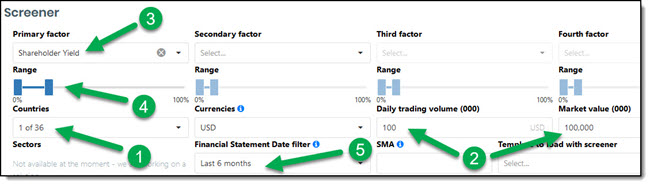

Change it to exactly meet your needs

To only find companies in Japan we have to change the screen but that is easy to do.

Just do the following:

1. Select Japan from the Countries list.

2. Add the Daily trading volume and minimum market value you prefer. I selected $100,000 and $100m

3. Add shareholder yield as a primary ratio

4. Select the highest Shareholder Yield companies by setting the sliders from 0% to 20%

5. Select Financial statements updated in the past 6 months

Shareholder Yield screen for Japan

Click image to enlarge

Remember to save your screen after making all the changes. Use the Save As button.

Get the exact definition

To see exactly how all the ratios and indicators are calculated and how to use them click the following link glossary .

The results of the screen

Here are the results of the screen:

Highest Shareholder Yield companies in Japan

Click image to enlarge

Some really high buyback numbers

I added dividend yield as a column so you can see how high buybacks have been, for example, Sanshin bought back over 36% of its shares (42.02% - 5.53%)

Your research required

As you know a screen is just a list of interesting ideas you need to take a closer look at.

In this case you may want to research the following:

- Is it a once off buyback?

- Is it a once off dividend?

- Does the company have enough cash to continue doing this?

- Is it due to a policy change? If so it is good news!

The best investment ideas in Japan

That is all you have to do to find the best investment ideas in Japan.

Wishing you profitable investing!

PS To start finding the best value investing ideas in Japan now – Click here to sign up.

PPS It costs just more than €1 per day and if you do not like it you get all your money back – it is as simple as that.

PPPS It is so easy to put things off and forget, why not sign up right now?

Click here to start using the Shareholder Yield strategy in Japan NOW!