This the editorial of our monthly Quant Value Investment Newsletter published on 2022.11.01. Sign up here to get it in your inbox the first Tuesday of every month.

More information about the newsletter can be found here: This is how we select ideas for the Quant Value investment newsletter

This month you can read about how the newsletter’s investment strategy has developed over the past 12 years.

But first the portfolio updates.

Portfolio Changes

Europe – Sell Two

No new recommendations this month as the index is below its 200-day simple moving average.

Sell Pendragon PLC (+48.2%) as it no longer meets the newsletter’ selection criteria.

Stop loss - Sell

Miquel y Costas & Miquel, S.A. - 0.6%

North America – Nothing to do

No new recommendations this month as the index is below its 200-day simple moving average.

Asia – Buy Two – Sell Two

Two new recommendation this month as the Japanese index is above its 200-day simple moving average.

The first is a VERY undervalued Japanese wholesaler of lifestyle related products trading at Price to Earnings ratio of 10.3, Price to Free Cash Flow of 9.1, EV to EBIT of 1.9, EV Free Cash Flow of 2.3, Price to Book of 0.7. It also has an attractive Dividend Yield of 4.1%.

The second is also a Japanese company that manufactures water and sewage treatment equipment. It is attractively priced at a Price to Earnings ratio of under 5, 5.9 times Price to Free Cash Flow of 5.9, only 1.3 times EV to EBIT. It is also trading half of book value and pays a dividend of 4.0%.

Stop loss - Sell

The Hour Glass Limited +31.2%

IDEA Consultants, Inc. -25.7%

Crash Portfolio – Buy Two, Sell One

Two new ideas for the Crash Portfolio this month.

The first is a Belgium-based provider of live outside broadcast digital video production systems. It is also cheap trading at a Price to Earnings ratio of 8, Price to Free Cash Flow of 8.5, EV to EBIT of 6.3, EV Free Cash Flow of 7.2. Its Dividend Yield at 4.8% is also attractive.

The second is a Greece-based retailer of toys, baby apparel, and stationery, attractively priced at Price to Earnings ratio of 8.3, Price to Free Cash Flow of 10.5, EV to EBIT of 6.1, EV Free Cash Flow of 9.6. It is currently trading at a Dividend Yield (incl. a special dividend) of over 11%.

Stop loss - Sell

MPC Container Ships ASA -21.8%

The newsletter turned 12 and no one noticed

When completing the half year report earlier this year I noticed that we have been publishing the newsletter for more than 12 years.

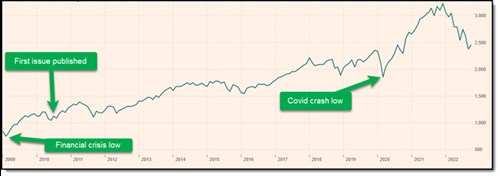

The first newsletter was sent out on 19 July 2010, about one and a half years after the March 2009 low after the financial crisis.

Great timing?

Great timing you may be thinking?

We didn't time it that way of course we had no way of knowing that the market turned around in March 2009 but in hindsight it was good. The thing is no one knew that at the time.

You can clearly see how uncertain thing were at the time as this is what we wrote about the first two companies we recommended:

In spite of these very acceptable financial results the share prices have not moved up much from the lows reached in March 2009, giving you the ideal opportunity to invest.

I have already bought both companies for my own portfolio as I found them so attractively priced.

Quite frankly, I would understand if you are hesitant to invest, especially in companies based in Europe which is currently in the grip of a recession and a sovereign debt crisis.

But it is exactly in tough times like these when you inevitably find the biggest bargains, as companies are avoided and overlooked by investors.

My experience has been that as long as a company is on a sound financial footing and attractively priced it is a mistake not to invest.

What the journey looked like so far

This is what the journey looked like so far.

Source: MSCI World Price Index USD

As you can see it has not been plain sailing, lots of ups and downs to get where we are at the moment.

Continues improvement

We knew that we would be facing tough times. That is why we continued to test the newsletter’s as well as other investment strategies. To improve all the time.

We also improved risk management. In March 2015 we implemented a strict 20% trailing stop loss strategy.

This was to sell losing investments fast and let winners run.

Stop buying when markets are falling

After a lot of thinking and research we realised we had to find a way to lower losses when markets start falling. You know when markets fall, they start falling together – in more technical terms – they become correlated.

This means, when markets are falling, and you keep on buying, the companies will soon be sold because the trailing stop loss will be triggered.

So, in spite of you buying companies that meet your investments strategy you will be selling just because the market overall is falling.

This is definitely not what we want!

So, we implemented a rule that says - No new investments when markets are falling. In practical terms this means no new companies are recommended if a market is trading below its 200-day simple moving average.

Make the most of market crashes

When the markets crashed as the Corona pandemic hit, we were worried, but we also realised that it was a great investment opportunity as investors were selling everything all at once just to get out.

We did not want to bet the house (invest heavily), but we wanted to selectively recommend very high-quality companies that had a good chance to survive and do well when things returned to normal.

This is how the Market Crash portfolio was born.

You can read more about the exact criteria of the strategy here: Quant Value Crash portfolio started

Basically, the difference between the "normal" recommendations and Market Crash portfolio is that the Crash Portfolio recommends ideas in spite of falling markets (being below their 200-day simple moving average).

And the crash portfolio uses a LOT stricter quality ratios and does not look at momentum (remember markets are falling so momentum is bad everywhere) when looking for ideas.

PS Not a newsletter subscriber yet? Sign up while the ideas are still fresh, it costs less than an lunch for two, click here to: Get the Quant Value newsletter now

PPS It is so easy to put things off, why not sign up right now before you forget