Estimated Reading Time: 7 minutes

By reading this post, you’ll discover how to supercharge your Magic Formula investment strategy by combining it with momentum investing. You'll learn how this powerful blend helps you pick stocks that are both undervalued and on an upward trend, leading to potentially higher returns. This article explains the steps to implement this enhanced strategy, backed by real back-tested results.

The Magic Formula, developed and tested by Joel Greenblatt, is a great investment strategy that guides you towards selecting high return and undervalued stocks.

Yet, in the vast world of investment, there's always room to push the envelope further.

Imagine improving on your returns by marrying the Magic Formula with other strategies like momentum investing. This addition promises a way to amplify your investment returns, supported by solid back-tested evidence.

The Essence of the Magic Formula

At its core, the Magic Formula simplifies stock selection to two key metrics: earnings yield and return on invested capital (ROIC). This ingenious approach simplifies investing by finding companies that are not only cheap but also efficiently turning their capital into profits.

It's a strategy that seeks out the best deals in the market, laying a foundation for strong investment returns.

The Power of Momentum Investing

Momentum investing takes a different tack. It's based on the premise that stocks on an upward trajectory tend to continue going up. By identifying these trends and riding the trend, momentum investors aim to capitalise on the market's current trends.

It's a strategy that thrives on upward movement, offering a dynamic complement to the steady, value-focused approach of the Magic Formula.

Combining Magic and Momentum

Integrating momentum investing into the Magic Formula framework creates an investment strategy that's greater than the sum of its parts. This approach leverages the value strength of the Magic Formula while tapping into the growth potential of by momentum trends.

It's a strategy designed to capture both long-term value and short-term gains, offering a balanced approach to stock selection.

Evidence from Back-Tested Results

The effectiveness of this strategy is not just theoretical. Back-tested results have shown significant performance boosts when the Magic Formula is paired with momentum investing.

A back test we did focusing on European markets from 1999 to 2011 revealed that adding a momentum filter to the Magic Formula selections could propel returns to new heights.

Click image to enlarge

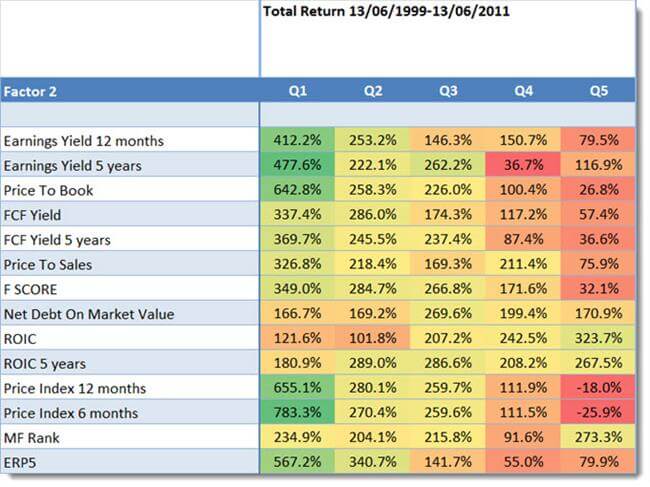

Magic Formula returns when combined with a third ratio in Europe from June 1999 to June 2011.

Source: Quantitative Value Investing in Europe: What works for achieving alpha

Look at column Q1

Look at the returns in column Q1, it shows the returns generated by first selecting the 20% best Magic Formula companies combined with the ratios in the column called Factor 2.

Best combination +783% was 6-Month Momentum (600.5% improvement)

This means you could have earned the highest return of 783.3% over the 12 year period if you invested in the best ranked Magic Formula companies that also had the highest 6 month price index (share price momentum).

This is a 600.5% improvement over the best return of 182.8% you could have earned if you used only the Magic Formula to get investment ideas.

2nd Best Combination +655% was 12-Month Momentum (472% improvement)

12-Month momentum also did well increasing the strategy’s return from 182.8% to 655.1%, a 472.3% improvement!

Click here to start finding your own Magic Formula ideas NOW!

Customise Your Strategy

Whether you're leaning more towards value in turbulent times or favouring momentum during bullish phases, the flexibility is in your hands.

You can align your Magic Formula strategy with your personal investment philosophy, risk tolerance, and market outlook.

Implementing the Enhanced Magic Formula

Putting this enhanced strategy into practice is just as easy as implementing the Magic Formula, all you must do is add one additional small step.

This article shows you exactly how and gives you practical implementation tips: How to implement the Magic Formula investment strategy - Your Step-by-Step Guide to Investment Success.

Risk Management and Portfolio Construction

You know effective risk management is always important, especially when applying sophisticated strategies.

Always keep diversification, regular portfolio rebalancing, and setting stop-loss limits in mind to protect your investments from undue volatility.

These activities may not be exciting, but they make sure your portfolio remains resilient through market ups and downs. And more importantly they let you stick to the strategy.

Conclusion

Enhancing the Magic Formula with momentum and other ratios and indicators opens new avenues for your investment success.

As you explore use this enhanced strategy, remember your goal is to build an investment portfolio that resonates with your investment nature, your aspirations.

Click here to start finding your own Magic Formula ideas NOW!

Frequently Asked Questions

1. What is the Magic Formula?

It's a strategy that picks stocks based on high returns and low prices.

2. Why combine Magic Formula with momentum investing?

Momentum can boost returns by selecting stocks that are already on an upward trend.

3. How does momentum improve the Magic Formula?

By adding momentum, you can significantly increase potential returns compared to using the Magic Formula alone.

4. What time frames should I use for momentum?

The article suggests using 6-month or 12-month momentum for the best results.

5. Can I adjust this strategy to fit my goals?

Yes, you can customize it based on your risk tolerance and market outlook.

6. Is Magic Formula with momentum strategy hard to implement?

No, it's simple. Just add a momentum filter to your Magic Formula picks.

7. What kind of returns can I expect?

Back-tested data shows potential returns of over 600% when using both strategies together.

8. What markets does this work best in?

The strategy has been tested successfully in European markets, but it can be adapted for other regions.

9. How do I manage risks with this strategy?

Diversification and regular rebalancing are key to managing risks.

10. Is this strategy right for beginners?

Yes, it's straightforward and can be a good fit for those who want to combine value with growth.

Please note: This website is not associated with Joel Greenblatt and MagicFormulaInvesting.com in any way. Neither Mr Greenblatt nor MagicFormulaInvesting.com has endorsed this website's investment advice, strategy, or products. Investments recommendations on this website are not chosen by Mr. Greenblatt, nor are they based on Mr Greenblatt's proprietary investment model and are not chosen by MagicFormulaInvesting.com. Magic Formula® is a registered trademark of MagicFormulaInvesting.com, which has no connection to this website.