Joel Greenblatt proved that his Magic Formula, as described in his excellent book The Little Book that Still Beats the Market, works in the US markets but does it also work when applied to Europe?

The Magic Formula also works in the Benelux

It definitely works if you apply it to companies in Belgium, Luxembourg and the Netherlands as proved by Pim Postma in his 2015 Bachelor thesis Magic Formula Investing in the Benelux.

Here is the abstract of Pim’s thesis:

“Joel Greenblatt’s Magic Formula trading strategy was able to generate market beating returns without taking additional risk in the United States stock market during the period of 1988 until 2004, and therefore clearly violates the Efficient Market Hypothesis.

This strategy is a simple stock selection method where Return on Invested Capital and Earnings Yield are the key metrics for determining the best common stock investments.

This paper takes this specific Magic Formula trading strategy to the Benelux stock market and performs a back test to see whether this strategy also shows market outperformance in the Benelux stock market.

The answer to this question is clearly a yes.

The Magic Formula trading strategy was able to realize an average 7,70% annual market premium in the Benelux stock market without taking additional risk during 1995 until 2014. This signalizes a market anomaly and also violates the Efficient Market Hypothesis.”

Yes the Magic Formula works

The abstract is just a fancy academic way of saying that from 1995 to 2014 the Magic Formula definitely worked in Belgium, Luxembourg and the Netherlands as it would have given you an average yearly return of 7.7% better than the market over the 20 year test period.

That is an impressive market beating return!

This is how he tested

Pim tested the Magic Formula investment strategy on companies in the Benelux stock market (Belgium, Luxembourg and the Netherlands), from 1994 until 2014 (20 years) using historical financial information from the Thompson Reuters DataStream database.

After excluding Financials and Utilities (because they tend to have very high leverage and/or some form of state intervention which could make the calculation of their EY and ROIC unreliable) and companies with a market capitalization below €10 million a list of 136 companies were left for testing the strategy.

He used the Benelux-DataStream Market index as a benchmark for the back test as it included all the companies in the back test universe.

Invested in 10 companies each year

Because the Benelux company universe was so much smaller than the US universe Joel Greenblatt tested in his book a portfolio of only 10 equal weight positions were formed.

Thus year on 31 March a portfolio of the top 10 Magic Formula companies were formed.

This portfolio of 10 companies were rebalanced on 31 March each year because most European companies have 31 December year ends and as of 31 March most of the year-end financial statements will already have been published and he could calculate Magic Formula components for each company.

These were the steps he followed:

Step 1: Eliminate Utilities and Financial companies. Also eliminate companies with a market cap below €10 million and companies of which no data was available.

Step 2: Screen the stock universe based on the ROIC and rank stocks from high to low.

Step 3: Screen the stock universe based on the EY and rank stocks from high to low.

Step 4: Combine these rankings into one compounded ranking.

Step 5: Buy the top 10 stocks out of the compounded ranking each year on 31th of March.

Step 6: Sell each stock after holding it an entire year on the 31th of March. When a top 10 stock of the former year is still in the top 10 stocks of the following particular year, you simply keep the stock in portfolio without selling and rebuying it (to reduce transaction costs).

Step 7: Continue to do this from 1995 until 2014.

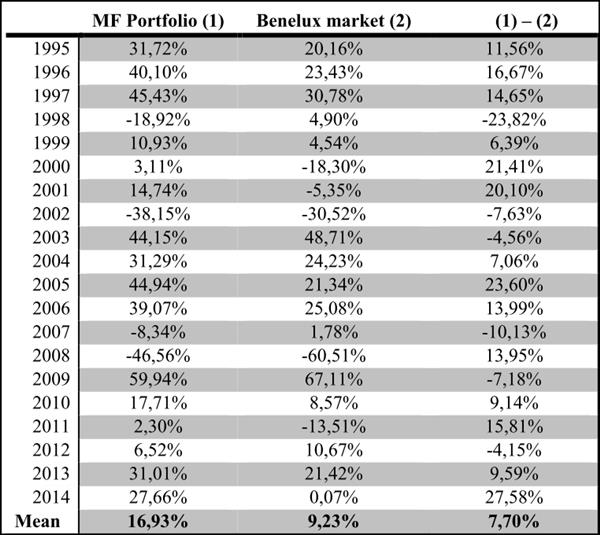

Returns of the Magic Formula

Now for the most important part, just how well did the Magic Formula perform?

Click to enlarge image

As you can see the Magic Formula performed very well.

If over the 20 year period from 1995 to 2014 you bought the 10 best Magic Formula companies each year you would have outperformed the market by 7.7% per year.

Performance better than most fund managers

And over the 20 years you would have done better than the market 70% of the time.

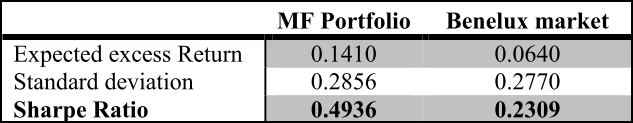

Better risk adjusted return

Not only did you outperform the market, the higher returns you generated would have more than compensated you for the higher volatility of the Magic Formula portfolio which only had 10 investments compared to the market portfolio which had more than 200 companies.

As you can see the table below the Magic Formula portfolio had a substantially higher risk adjusted return or Sharpe Ratio (higher is better) which means you were very well compensated for the higher ups and downs (volatility) of the Magic Formula strategy.

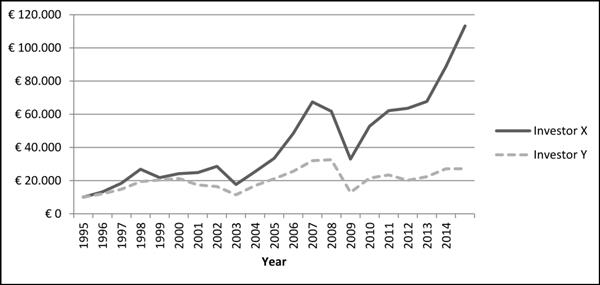

Just how much better did the Magic Formula perform?

How much better would you have done if you used the Magic Formula?

The following chart shows this very clearly.

Click to enlarge image

Magic Formula gave you 11.3 times your capital

Investor X invested €10,000 in March 1995 using the Magic Formula and at the end of the 20 year period had €113,238 in his investment account. This is 11.3 times the amount he or she started with.

Market portfolio only gave you 2.7 times your capital

Investor Y also started with an initial investment of €10,000 but invested in the Benelux market index and at the end of 20 years had only €27,182 in his investment account, only 2.7 times his or her starting amount.

Conclusion

This research study clearly shows that the Magic Formula investment strategy also works outside the USA as it substantially outperformed the Benelux (Belgium, Luxembourg and the Netherlands) stock markets.

How you can use the Magic formula in your portfolio

The Quant Investing stock screener already has everything you need to get the Magic Formula working in your portfolio.

How to select to best Magic Formula ranked companies

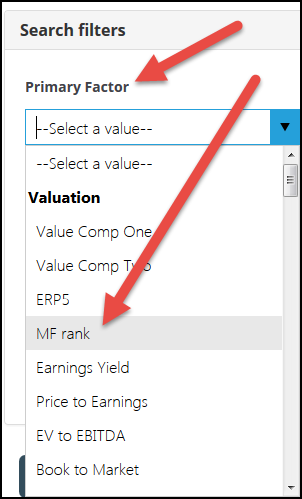

To get started simply select MF rank (Magic Formula ranking) as your primary screening factor.

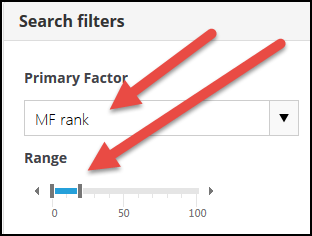

You can combine this with any of the more than 110 other ratios and indicators the screener gives you. We have for example found that the Magic Formula can be very successfully combined with six month share price momentum.

Then, using the slider, select the range of companies you want to select. In the image below the 20% of companies with the best Magic Formula ranking will be selected.

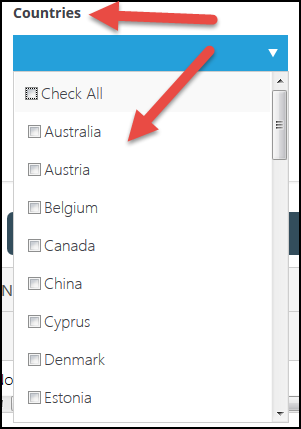

Select the countries you invest in

Your next step is to select the countries where you would like to invest.

Select traded volume and company size

The last thing for you to do is select the minimum traded value and company size you want the stock screener to look for.

Get your list of Magic Formula companies

If you then click the Filter button the screener will give you a list of the best Magic Formula companies that meet all the above criteria you have selected.

PS To find Magic Formula investment ideas in the countries you invest in (for less than an inexpensive lunch for two) click here: Join today

These Magic Formula articles may also interest you:

Does the Magic Formula also work in Finland?

A better alternative to the Magic Formula?

Investment strategy tested: Magic Formula investing & 6 month Price Index

How to get the best returns with Magic Formula investing

Please note: This website is not associated with Joel Greenblatt and MagicFormulaInvesting.com in any way. Neither Mr Greenblatt nor MagicFormulaInvesting.com has endorsed this website's investment advice, strategy, or products. Investments recommendations on this website are not chosen by Mr. Greenblatt, nor are they based on Mr Greenblatt's proprietary investment model, and are not chosen by MagicFormulaInvesting.com. Magic Formula® is a registered trademark of MagicFormulaInvesting.com, which has no connection to this website.