This the editorial of our monthly Shareholder Yield Letter published on 2023-12-12. Sign up here to get it in your inbox the first Tuesday of every month.

More information about the newsletter can be found here: The best large cap investment strategy ever

This month I answer to the most likely question you have after you start investing world-wide – “What do I do about currency risk?”

But first the portfolio changes.

Portfolio Changes

Buy Four

Four new recommendations this month as the MSCI World index is above its 200-day simple moving average.

The first is a Swiss building materials company with a shareholder yield of 8.6%, share buybacks of 4.8%, and it pays a dividend of 3.8%.

The second is a VERY well-known Germany car manufacturer with a shareholder yield of 9.4%, share buybacks of 1.1%, and an attractive dividend yield of 8.3%.

The third is a Norwegian aluminium company with a shareholder yield of 10.0%, share buybacks of 0.9%, and a dividend yield of 9.1%.

The fourth and last recommendation is a United Kingdom-based bank with a shareholder yield of 8.0%, share buybacks of 5.8%, and a dividend yield of 2.2%.

What should you do about currency risk?

“What should I do about currency risk?" is a good question I get quite often.

This question of course fits with home bias that I urged you to overcome in last month’s newsletter. The thing is if you invest outside your home currency you take currency risk.

How does hedging work?

Before I show you the research on currency hedging first some information on how to hedge currency risk.

To hedge currency risk, you must borrow the foreign currency and invest the borrowed money in that market.

For example, if the currency where you live is Euro and you want to invest in Japan. You do not want to sell Euros and buy Japanese Yen because you are worried that the Yen will fall in value against the Euro and lower your returns.

To not have any Yen risk you borrow Yen and buy the shares in Japan with the borrowed money. When you sell you repay the Yen you have borrowed and only the profit or loss will have to be converted to Euro.

But when you borrow you must pay interest on the Yen loan. Some brokers let you to do this easily, but they charge quite a lot. And you must pledge your portfolio as security for the loan. Remember the broker needs security should you not repay the loan.

Yen interest rates are very low but even if your broker charges only 2% per year if you hold the investment for 3 years this cost will be 6%.

So, it’s expensive.

What does the research say?

I looked for independent research on currency hedging and found two interesting reports.

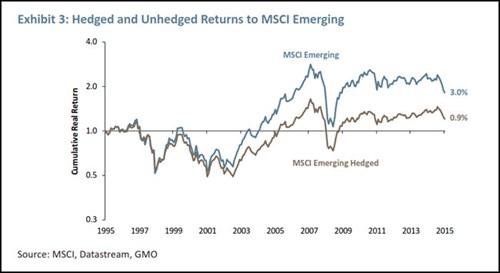

In the third quarter of 2015 GMO (www.gmo.com) published an interesting quarterly report called: Just How Bad Is Emerging, and How Good Is the U.S.? and Give Me Only Good News!

In the report they looked at the 20 year returns of emerging markets which had not been good at all.

Here is an extract from the report (bold text is mine):

Is it just a currency thing?

Falling currencies have indeed been a significant driver of losses in emerging equities over the past few years. In the 12 months ending September 30, for example, the local return to emerging stocks was -7.1% while the loss from the currency movements cost 13.1%. This might tempt one to think about currency hedging their holdings in emerging markets, but this turns out to be a bad idea historically.

In fact, it seems to be a spectacularly bad idea, as we can see in Exhibit 3.

This is a truly striking chart. Since 1995, the rather anaemic returns of +3.0% real in U.S. dollars for emerging equities turn into a truly depressing +0.9% real. So much for the idea of currency hedging!

Source: www.gmo.com Just How Bad Is Emerging, and How Good Is the U.S.? and Give Me Only Good News!

Hedging emerging markets was a bad idea

If you invested in emerging markets over the 20-year period hedging currency risk is a bad idea. The newsletter does not recommend emerging market companies which mean this research report is not that relevant, but the principles remain the same.

More currency hedging research

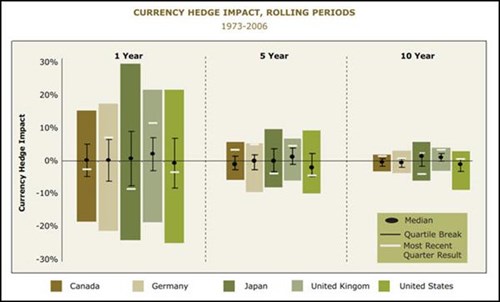

In 2007 The Brandes Institute, part of the great value fund manager Brandes Investment Partners published a research document called: Currency Hedging Programs: The Long-Term Perspective.

In the paper they looked at 34 years of data to find out if currency hedging is worth it.

The result of the paper can be summarised in the following chart which shows the benefit or loss in your portfolio if you hedged currency risk:

Source: Brandes Institute - Currency Hedging Programs: The Long-Term Perspective

What does the chart show you

What can we learn from this complicated looking chart?

#1 The most recent movement is a bad predictor of future movements.

This is especially true in times of wild currency movements. You can see this if you look at the small white line (Most recent Quarter Result) in the above chart. In nearly every period it is at an extreme level compared to the median value (black dot) in each bar.

This means if you only look at the most recent currency movement (last quarter in this example) to decide to hedge or not you may be making a big mistake as the next currency movement may be in the other direction.

#2 Currency movements are big over one-year periods (high bars under 1 Year) but are a lot lower over five and even 10 years (bars are not nearly as high).

This means you must be prepared for extended periods of hedging losses or gains, or if you do not hedge, big currency movements.

#3 Your base currency matters as some currencies are more volatile than others. Look how high the bars of the different currencies are.

#4 Hedging can make difference if you plan to invest for less than five years. After that hedging gains and losses get smaller (10 Year bars as not as high) but they do not disappear.

For example, a US based investor that hedged currency risk over the 34-year period would have had an average annualised loss of 1.8%. That is a huge drag on performance, but it could just as well have been a profit.

The thing is you just do not know. No one knows.

In summary

What can we learn from the above two research papers?

- Hedging emerging market currency risk was a bad idea

- Hedging currency risk of developed countries can give you a slight positive or negative return over 10 years, a lot larger gains or losses over 5 years and even more so over one year.

- Both studies mentioned there is a huge behavioural risk that comes with currency movements. It is the risk that you want to predict future currency movements based on the most recent past, think 1 to 3 years, especially if you have had large currency losses. The risk is that you hedge your currency risk just as the currency turns around, resulting in large currency losses.

How I manage currency risk

Because of:

- The costs involved,

- the part of my portfolio invested in different currencies being relatively small and

- over long periods of time currency movements net out to close to zero

I do not hedge currency risk.

Keep it simple

Another reason I do not hedge is I try to make investing as simple and systematic as possible.

Hedging currency risk is not something I want to do if over time it is most likely to only increase or decrease my investment returns by a small percentage.

If you want to hedge – do this

You may have a different view and that is fine. There is not right or wrong here, no-one knows what currencies will do.

If you want to hedge you must decide and then stick to it – always hedge. If not, you will most likely start hedging after a large currency loss, just as the currency turns around.

Your Shareholder Yield analyst wishing you profitable investing!