If you are a low volatility investor here is indicator that can help you!

We have just added 36-month (3 year) volatility to the Quant Investing stock screener.

All the volatility indicators available in the screener now are:

- Volatility 3 m

- Volatility 6 m

- Volatility 12 m

- Volatility 36 m

What does it do?

The indicator is called Volatility 36 m and it shows you, in percent per year, how volatile a company’s stock price has been over the past 36-mionths

How is it calculated?

Volatility 36 m is calculated as – the standard deviation of the daily log normal returns of the share price over 36 months, annualized.

The output is a percentage number (%).

What it means and how to use 36m volatility

The lower the number the lower the volatility of a company’s stock price was over the past 36-months or three years.

To select companies with low volatility, select a low number.

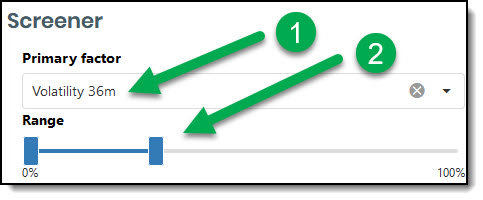

This means set the slider from 0% to 30% as shown in the image below:

What can it be used for?

It lets you select low volatility companies over the medium term – 36-months or three years.

You can also use it to implement The Conservative Formula: Quantitative Investing made Easy investment strategy developed and published in March 2018 by Pim van Vliet and David Blitz.

Here is the abstract from the research paper

We propose a conservative investment formula which selects 100 stocks based on three criteria:

Low return volatility,

High net payout yield, and

Strong price momentum.

We show that this simple formula gives investors full and efficient exposure to the most important factor premiums, and thus effectively summarizes half a century of empirical asset pricing research into one easy to implement investment strategy.

With a compounded annual return of 15.1 percent since 1929, the conservative formula outperforms the market by a wide margin. It reduces downside risk and shows a positive return over every decade.

The formula is also strong in European, Japanese and Emerging stock markets, and beats a wide range of other strategies based on size, value, quality, and momentum combinations.

The formula is designed to be a practically useful tool for a broad range of investors and addresses academic concerns about ‘p-hacking’ by using three simple criteria, which do not even require accounting data.

Source: SSRN - The Conservative Formula: Quantitative Investing Made Easy

You can read more about the investment strategy here: The Conservative Formula: Quantitative Investing made Easy by Pim van Vliet and David Blitz.