Have you ever seen a book on when or how to sell stocks?

Neither have I…

Only when I set out looking for one did I find one or two. But it was a bit like looking for a needle in a haystack between the hundreds of books on how and when to buy.

Can you answer this simple question?

Before I go on let me ask you.

Have you ever given any thought to when and how to sell investments, or better still, do you have a selling strategy?

I never had a selling strategy until a few years ago when I looked at my buy and sell decisions over a number of years and realised that I make the classic mistake of:

- Selling winners too early and

- Hanging onto losers with the hope that they will recover.

Is this something you also do?

A hard habit to break

Try as I may, I found it hard to break these two habits.

After a lot of research I developed a strict selling strategy which has really improved my returns. And I think it will help you too.

It has helped me to hold winners and sell losing investments quickly and easily.

How to break the habit

This is what I did:

- I developed a selling strategy

- I wrote it down

- I review it regularly

- I force myself to follow it

Do this or it will not work

The above points may seem simple or unnecessary but believe me they are not. If you don't do this you will not follow your own strategy for reasons explained below.

I can tell you honestly I tried the “don't worry I will follow the strategy” approach, it does not work.

You have to brainwash yourself

Once you have formulated your strategy you have to brainwash yourself or you will not follow it - because it goes against our human nature.

Before I give you steps on how to develop your selling strategy first some information on why selling is important.

Why is it important to limit losses?

Limiting a loss is very important as the price increase to recover from the loss grows exponentially as the loss gets bigger.

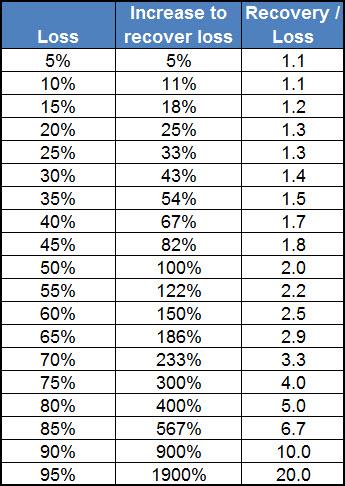

This is best shown with the following table:

The table shows the return you have to generate (column "Increase to recover loss") to recover from the "Loss" in column 1.

A 5% loss is still easy to recover from. But if you suffer a 20% loss you need a return 1.3 times (column 3) the loss to recover your investment.

It only gets a LOT worse

Should you suffer a 60% loss you need a return 150% or 2.5 times the loss to recover your capital.

And if you lose 90% and the stock goes up 100% from there your loss is still 80%.

Whatever you think about selling, this is the most important thing to keep in mind!

Click here to find ideas that EXACTLY fit your investment strategy

Behavioural aspect of selling

I am sure you also know that pain, fear and regret play a big role when we fail to sell a stock that has declined.

Sometimes when a stock price falls, it’s a big opportunity to invest more at an attractive price.

But in cases where you have made a mistake, and really should sell immediately, behavioural research shows that you will often hang on, suffering an even greater loss.

Why you hold on to a losing investment

If you sell you have permanently locked in the loss, and you then have the pain and regret of having made a bad investment, including the potential embarrassment of telling others.

When you own something humans make this BIG mistake.

Also we think that when we own something it increases its value. For example, just after placing bets, punters at the racetrack become much more confident about their horse’s chance of winning.

Similarly, lottery ticket buyers tend to buy more frequently if they are allowed to choose their own numbers.

And the same thing happens to investors when they buy a stock.

It is thus important that you do not overvalue your current investments. Pretend that you don’t own them, and ask, “If I didn’t own this company today, would I buy it?” If the answer is no, you should sell.

How to avoid this expensive error

So what can you avoid this costly mistake?

Here are a few suggestions:

- Approach investment decisions from as neutral a position as possible.

- Ignore the price you paid when reviewing your investments. Think: “will I buy this company now at this price?” If not then sell. If you find this difficult ask a friend you trust to also look at the investment and give you his opinion.

- Accept that you will make mistakes with some of your investments. All investors make mistakes. Sell and move on.

- Realise that you will face a lot of pressure to rationalise your mistakes and not correct them.

- Know that you will invent new reasons to hold on to a losing investments.

- Know it will be especially difficult to sell when your original buy decision is known to people who are important to you. This is because it will hurt to admit your mistake to them, and to yourself.

Strategies to improve your selling decisions

Here are a few strategies you can use to improve your selling decision making.

Selling to realise a gain

Movement of the share in the ranking

If you invest based on a ranking system or use a strategy, for example buying low price to earnings ratio, low price to book ratio, or high dividend yield, you can use the movement of a company from cheap to expensive through the ranking to find the selling point.

For example if you buy the 10 highest ranked companies, should a company in your portfolio not be in the top 10 or 20 after a year, the investment is sold.

When your premise is fulfilled

This is what it is all about – you buy a company because of a well thought out investment story, and things work out exactly like you expected, or better.

When this happens you have every right to sell and take your deserved profits.

After a substantial rise in price

Another reason for selling is when you think the stock has become too expensive or overvalued.

If it has become overvalued in terms of your investment criteria (for example price to earnings ratio) sell the investment and re-invest in an undervalued company.

When it doubles

There is an old stock market rule that says you should sell half of your investment when an investment doubles. This is a purely emotional reason for selling. But it allows you to feel like you have received all of your money back and that the money you now have invested is pure profit.

The idea is of course only emotional as all the money, including the profit, is all yours.

My approach

To overcome my tendency to sell winning investments too soon I now follow a strict trailing stop loss system of 20%.

As soon as an investment falls 20% from its high it is sold. No questions asked.

This allows me to participate in further upward share price movements while at the same time getting out of the position as soon as it starts to decline.

If you have difficulty following this rule you may find it helpful to move overvalued investments to a separate part of your portfolio (for example a separate part of your portfolio spreadsheet).

If not you may think of the investment as part of your normal portfolio and want to ignore the trailing stop loss.

Here is an article, with STRONG evidence that will convince you that following a trailing stop loss is a great idea: Truths about stop-losses that nobody wants to believe

Click here to find ideas that EXACTLY fit your investment strategy

Selling to limit a loss

Your reason for making the investment

Once you have done your homework on a company, write down a short reason why you are buying.

If you were wrong about your reason for buying, sell the investment with no questions asked.

Important: Never invent new reasons to hold an investment!

Holding onto an investment to simply to recover your initial investment is a BAD idea; it is a recipe for an even larger loss.

When your cannot take it any more

Have you ever bought a company that has taken you on an emotional roller-coaster ride? Instead of increasing in value the price dips and bounces every day.

If holding an investment makes you so uncomfortable that you can’t sleep and you only worry about how much money you have lost or made in a single day you are being distracted. In this case it is better to sell and move on.

Percentage drop in price

This strategy is the simplest of all, but is much harder to implement than it looks.

Sell after a fixed percentage fall in price. This level can be set by looking at the table shown above, or can set according to your pain threshold.

My approach to limiting a loss

In the past I have had complex selling strategies based on different prices where I will buy more and if the investment falls more I sell completely. What I realised that the more complex my strategy was the more difficult it was to follow and the easier it was for me to think of ideas not to sell a losing investment.

I have since made my selling strategy as simple as possible and I urge you to do the same.

Now if an investment falls more that 20% from its highest price (trailing stop loss) I sell. I know this in controversial, especially with deep value investors, but it works for me.

You can find the research behind my decision here: Truths about stop-losses that nobody wants to believe

I implemented this strategy after analysing my portfolio positions over several years and I learned that my best investments tend to perform well right from the start.

The faster you can sell losing investments the sooner you can invest in other more attractive investments.

In summary

The most important points in this article are:

- Formulate a sell strategy that works for you.

- Have it written down.

- Look at it often.

- Make changes as you get new ideas or information.

- Stick to it – no exceptions!

PS To find investment ideas that EXACTLY match your investment strategy click here

PPS It is so easy to put things off why not sign up right now?

Click here to find ideas that EXACTLY fit your investment strategy