In spite of US markets nearly hitting new highs I thought you would be interested to see where in the world deep value investment ideas can be found.

Use this best value ratio

I used Earnings yield (EBIT / Enterprise value) the best valuation ratio you can use to find deep value ideas.

This is because it uses earnings before interest and taxes (EBIT) which is comparable across countries with different tax rates, and enterprise value calculated as (market value + debt – cash) which takes the capital structure of the company into consideration.

It is also the valuation ratio Joel Greenblatt used in his Magic Formula investment strategy (see The Little Book that Still Beats the Market)

What to screen for

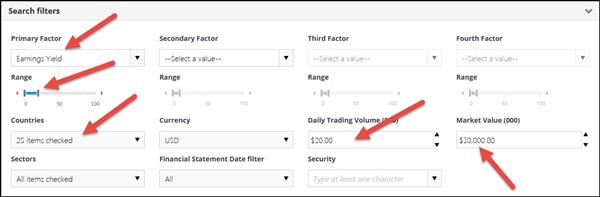

This is what the screen looks like:

- All developed markets (countries)

- 20% of companies with highest earnings yield (EBIT/Enterprise value)

- Minimum trading value $20,000 per day. I kept this small as a lot of deep value ideas are small companies and the ideas are for your personal account.

- Minimum market value $10 million. Also low to catch small deep value ideas

- Sorted the output by earning yield

The screen looks like this

This is what the screen looks like:

Click image to enlarge

Click here to start getting Deep Value ideas NOW!

An earnings yield of what?

As with any screen like this you will always find outliers as shown in the image below.

[Image of screen has been removed as it is out of date - Please go to our blog page for more recent investment ideas]

These values are most likely due to an extreme event (special profit) or other factor, for example a lot of cash which reduces the enterprise value of the company substantially.

It’s interesting to note that there are mainly Japanese, South Korean and Hong Kong companies on the screen.

Better deep value investment ideas

In order to start getting earnings yield values that look half way plausible you have to scroll down the list of companies quite a bit.

Here the earnings yield is still high but starts getting believable:

[Image of screen has been removed as it is out of date - Please go to our blog page for more recent investment ideas]

Still a lot of Japanese companies in the screen and companies in struggling industries (oil and gas for example), which is exactly what you expect from this type of screen.

Click here to start getting Deep Value ideas NOW!

Adding quality to deep value

As you can imagine a lot of these deep value ideas are junk companies that you have to look at in more detail to see if the extremely high earnings yield is correct and why it is so high.

There is however a way to quickly and easily increase the quality of the investment ideas the screener comes up with.

Add Piotroski F-Score

Simply screen for companies with a Piotroski F-Score higher than 5 (best score is 9).

You can read more about the Piotroski F-Score here: This academic can help you make better investment decisions – Piotroski F-Score

You also do not have to use the Piotroski F-Score as the screener also has 22 other quality measures you can use, for example:

- Gross Margin - Novy Marx

- James Montier cooking the books score

- Return on invested capital (ROIC)

You can see the definition of all the ratios and indicators in the screener glossary.

Piotroski F-Score better than 6

If you only select companies with a Piotroski F-Score higher than six this is what the screener comes up with:

[Image of screen has been removed as it is out of date - Please go to our blog page for more recent investment ideas]

As you can see here the ideas start getting interesting and there is a nice mix of ideas throughout the world.

16 more deep value ideas

Below is the second page of the screen with 16 more ideas for you:

[Image of screen has been removed as it is out of date - Please go to our blog page for more recent investment ideas]

You can see the earnings yield is not nearly as high as the previous screen but the quality of the ideas you get are a lot better.

Click here to start getting Deep Value ideas NOW!

Please always do your own fact checking

As with all screens this is just a list of companies. Please do your own analysis and fact checking to make sure the company is correctly included in the list.

PS To get all the tools to implement this strategy in your portfolio click here

PPS It's so easy to put things off why not sign up right now