This is the editorial of our monthly Quant Value Investment Newsletter published on 2023-08-01. Sign up here to get it in your inbox the first Tuesday of every month.

More information about the newsletter can be found here: This is how we select ideas for the Quant Value investment newsletter

This month you can read all about the newsletter’s recent performance and since it started over 13 years ago.

But first the portfolio updates.

Portfolio Changes

Europe – Buy Three – Hold One

Three new recommendations this month as the index is above its 200-day simple moving average.

The first one is a dirt cheap, fast-growing Poland-based information technology (IT) company trading at 13.1 times Earnings, Price to Free Cash Flow of 4.3, EV to EBIT of 4.5, EV to Free Cash Flow of 4.7, Price to Book of 1.0 and pays a dividend yield of 4.5%.

The second is a UK-based specialist retailer of greeting cards and gifts trading at ONLY 7.1 times Earnings, Price to Free Cash Flow of 3.4, EV to EBIT of 7.4, EV to Free Cash Flow of 5.2 and Price to Book of 1.2.

The third is a Polish mobile games developer trading at 10.5 times Earnings, Price to Free Cash Flow of 7.2, EV to EBIT of 3.2, EV to Free Cash Flow of 3.8 and Price to Book of 1.8. No dividends but it is buying back shares, a good deal at this dirt-cheap price!

Hold - One

Continue to hold Carlo Gavazzi Holding AG (recommended August 2021), already at a profit of +43.8%, as it still meets this portfolio’s selection criteria.

North America – Nothing to do

Despite the S&P 500 trading above its 200-day simple moving average, no new recommendations this month as we found a lot cheaper and higher quality companies in Europe and Asia. See the Polish IT company mentioned above!

Asia – Buy Two – Sell One – Hold One

Two new recommendations this month as the index is above its 200-day simple moving average.

The first is a Japanese food wholesaler trading at Price to Earnings ratio of 9.5, Price to Free Cash Flow of 8.9, EV to EBIT of 7.1, EV to Free Cash Flow of 9.2, Price to Book of 0.9 and pays a dividend yield of 2.9%. It has also started buying back shares.

The second is a Japanese manufacturer of automotive parts and construction machinery trading at Price to Earnings ratio of 9.5, Price to Free Cash Flow of 6.7, EV to EBIT of 3.9, EV to Free Cash Flow of 5.3, Price to Book of 0.7. It is also buying back shares and pays a dividend of 3.3%.

Sell – One

Sell Bando Chemical Industries, Ltd. (+68.3%) as it no longer meets the newsletter’s selection criteria.

Hold - One

Continue to hold Ebara Foods Industry, Inc. (-3.1%), recommended in August 2022, as it still meets this portfolio’s selection criteria.

Crash Portfolio – Sell One

No new Crash Portfolio ideas as most markets have recovered.

To date the 15 Crash Portfolio ideas, recommended since August 2022, are up an average of 17.8%!

Sell - One

Sell Nippon Pillar Packing Co., Ltd. (+68.6%) as it no longer meets the newsletter’s selection criteria.

Newsletter’s Performance

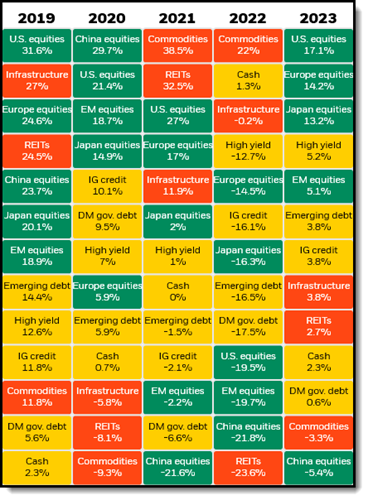

2023 has been a surprisingly good investment year so far if you think of the impact of rising interest rates, bank failures and higher borrowing costs.

Here is a great chart showing you what happened up till the end of June 2023:

![]()

Source: BlackRock Asset Return Map

Current ideas

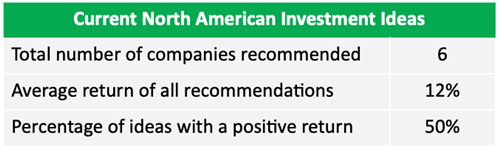

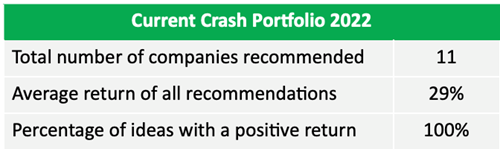

Let’s start with the performance of the ideas currently in the portfolios up till the end of June 2023.

As you can see performance has been great with the crash portfolio performing especially well.

Let’s now look at the long-term performance as that is the data that is important for you to see if the newsletters’ investment strategy works.

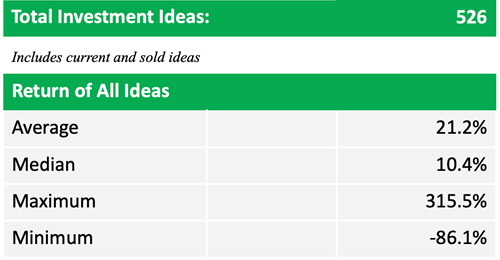

Performance Since July 2010 – 13 years ago

- Loss of 86.1% occurred before we started the Stop Loss system

- Returns are calculated as price change plus dividends in the currency of the company's main listing.

- Includes returns of Crash portfolios

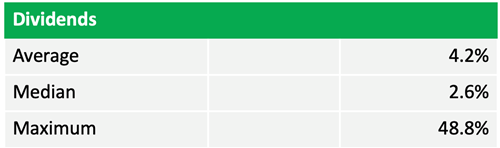

Dividend income

Even though we do not look at dividends when choosing ideas, an attractive dividend is a nice bonus as you get paid to wait as stock prices increase.

Average divided return of all ideas

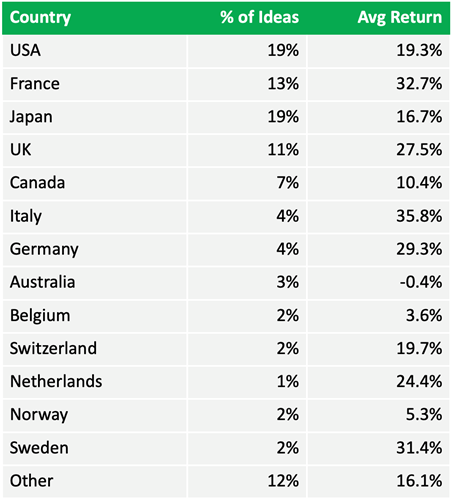

Country performance

This is where companies were recommended and how they performed:

Where ideas were recommended and average return

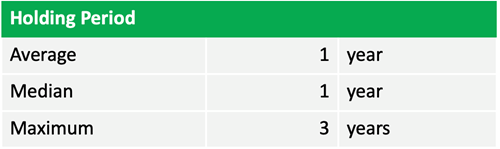

How long are ideas in the portfolio?

All ideas are analysed again after a one-year holding period, to see if they still meet the newsletter’s Quality, Value and Momentum, investment criteria. This is how long companies stay in the portfolio:

How long are ideas in the portfolio

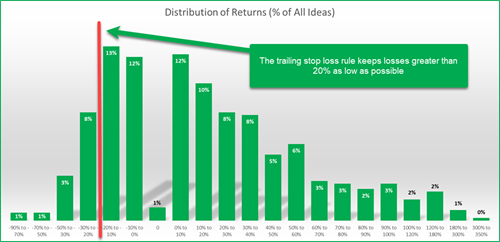

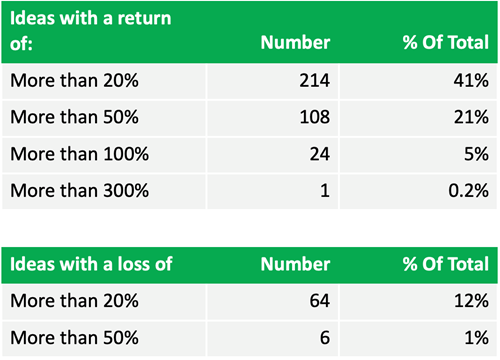

Distribution of returns

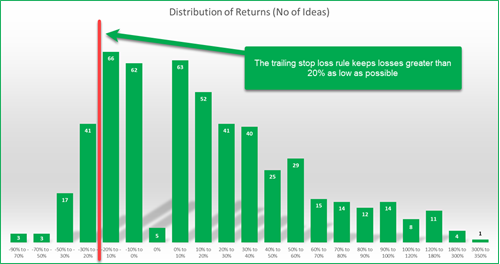

You know investing works best when you cut your losses fast and let your winners run. To do this the newsletter follows a STRICT 20% trailing stop loss system.

The following two charts show you how successful the newsletter has been at doing this.

Over 13 years 63%, just under two third of all ideas, would have given you a positive return, with the highest return of 315.5% (the second highest was +269.2%).

Chart showing number of companies:

Distribution of newsletter returns – Showing number of companies

Chart Showing percent of all recommended companies:

Over 3 to 1 more winners than losers

3.3 times more winners over 20% than losers

As you can see the positive returns FAR outnumber negative returns.

For example, returns of more than 20% is 3.3 (214/64) times higher than losses of more than 20%.

This is because of three things:

- A great time-tested investment strategy

- The strict stop loss system

- Stop buying when markets fall

The stop-loss system works!

You already saw how well the stop loss system works.

It works so well that since March 2015, when we implemented it, only 11 of the 526 (2.1%) ideas lost more than 40%.

This happened because of large sudden price drops, (before the stop-loss system can sell) for example, after a profit warning, legal action, stock suspension or fraud announcement.

The stop loss system lets you avoid the left-hand side of returns (losses in the chart above).

This is important because:

- Firstly, you feel more comfortable investing, even in companies you may not know. It is easier to get in if you know you can get out.

- Secondly, you avoid the emotional pain of a large losses. This helps you stick to the investment strategy.

Reading Recommendations

How government spending is causing inflation

In her July 2023 "Fiscal Dominance" Lyn Alden talks about how government's spending and policies can cause inflation.

She has been saying since 2020 that the government's spending could lead to inflation, and traditional ways of dealing with inflation, like changing interest rates, might not work this time. But it's not easy to predict exactly how things will go in this unique economic situation.

Through the Looking Glass

When Alice went through the mirror in the famous book Through the Looking Glass, everything was flipped and different.

That’s a useful analogy for describing the relationship between fiscal dominance and interest rates.

- When sovereign debt is low and most money creation comes from bank lending, higher interest rates do exactly what we expect them to do: slow down loan creation and inflation. Alice is in the real world.

- When sovereign debt is high and as much money creation comes from fiscal deficits as it does from bank lending, then it becomes a tug-of-war. Higher interest rates have mixed effects, as they do suppress the private sector lending but also increase the deficit by a similar degree. Alice is on the precipice of the mirror, but not yet through it.

- When sovereign debt is extraordinarily high and far more money creation comes from fiscal deficits than from bank lending, higher interest rates can become outright positively correlated with inflation. Alice has gone through the looking glass, and everything is flipped.

The United States is approximately in the second category.

…

Japan is the main example of a country that is already through the looking glass, where everything is flipped.

Why you must lower your return expectations

Niels Clemen Jensen is negative again! In his July newsletter “Three Reasons to Moderate Your Optimism” he mentions:

Some investment challenges are virtually set in stone. Take for example the demographic outlook. Whether we like it or not, the populace at large is ageing quite fast, and there is little we can do about it. In this Absolute Return Letter, I will focus on a few such issues and what the implications are, namely:

-

- The (excessively) high returns of recent years, and why that will result in lower returns going forward.

- The new world order which is forming in the wake of Russia’s invasion of Ukraine and the rise of China, and what that implies for investors.

- The ageing of the populace at large, and why future equity returns will be lower as a result.

Final few words

Vanguard states on its website that “our research shows that the average Vanguard investor’s portfolio holds 63% stocks, 16% bonds, and 21% cash.

We also found an interesting difference in the way investors approach their asset mix based on their age. If you’re under age 39, your portfolio is more likely to be heavily weighted towards stocks. In fact, this age group allocates nearly 90% of their portfolio to them. By comparison, people over age 55 only hold about 66% of their assets in stocks.”

This is broadly in line with the findings of T. Row Price and supports my thinking. In fact, for at least a year or two, the impact could be even more dramatic than you would have thought. Because of the extraordinarily low interest rates of recent years, there is a fair amount of catching up to do, as many investors are ‘behind plan’ in terms of switching from equities to bonds. Precisely how big the impact from the catch-up will be is next to impossible to say, but I would recommend a cautious approach, given how out-of-sync wealth-to-GDP is.

Wishing you profitable investing

PS Not a newsletter subscriber yet? Sign up now while the ideas are still fresh, it costs less than a cheap lunch for two, click here to: Get your Quant Value newsletter now

PPS It is so easy to put things off and forget, why not sign up right now!

Not a subscriber? Click here to get ideas from the BEST strategies we have tested NOW!