This is the editorial of our monthly Quant Value Investment Newsletter published on 2024-01-09. Sign up here to get it in your inbox the first Tuesday of every month.

More information about the newsletter can be found here: This is how we select ideas for the Quant Value investment newsletter

This month you can read all about the newsletter’s recent performance and since it started over 13 years ago.

But first the portfolio updates.

Portfolio Changes

Europe – Buy Two

Two new recommendations this month as the index is above its 200-day simple moving average.

The first company is a Norwegian shipping company trading at Price to Earnings ratio of 7.3, Price to Free Cash Flow of 4.7, EV to EBIT of 8.0, EV to Free Cash Flow of 6.3, and Price to Book of 1.6. It pays a very attractive dividend of 12.1%.

The second is a German-based supplier of commercial vehicles trading at Price to Earnings ratio of 8.8, Price to Free Cash Flow of 4.0, EV to EBIT of 7.1, EV to Free Cash Flow of 6.9, Price to Book of 1.4 and it currently pays a dividend of 4.1%.

North America – Buy One – Sell One

One new recommendation this month as the index is above its 200-day simple moving average.

The company is a US-based shoe manufacturer trading at Price to Earnings ratio of 9.0, Price to Free Cash Flow of 4.0, EV to EBIT of 6.1, EV to Free Cash Flow of 3.7, Price to Book of 1.2 and pays a dividend of 3.3%.

Stop Loss – Sell

Sell Resources Connection, Inc. at a loss of 17.1%

Asia – Buy Three – Sell One

Three Japanese recommendations this month as the index is well above its 200-day simple moving average.

The first is a Japan-based owner and operator of 24-hour fitness clubs trading at Price to Earnings ratio of 9.0, Price to Free Cash Flow of 6.0, EV to EBIT of 3.7, EV to Free Cash Flow of 4.1, Price to Book of 1.6 and it pays a dividend of 2.3%.

The second is a Japanese manufacturer of textiles and chemicals trading at Price to Earnings ratio of 11.6, Price to Free Cash Flow of 9.3, EV to EBIT of 6.3, EV to Free Cash Flow of 9.7, Price to Book of 0.5 with a dividend yield of 2.4%.

The last idea is a Japanese designer and manufacturer of sensors. It is trading at a Price to Earnings ratio of 9.3, Price to Free Cash Flow of 8.1, EV to EBIT of 4.0, EV to Free Cash Flow of 5.6, Price to Book of 1.0 and pays a dividend of 1.1%.

Sell One

Sell Shinwa Co., Ltd. at a profit of +2.5% as it no longer meets the portfolio’s selection criteria.

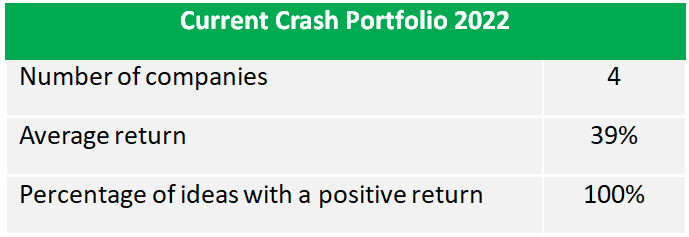

Crash Portfolio – Hold One

No new Crash Portfolio ideas as most markets have recovered.

To date the 15 Crash Portfolio ideas, recommended between August 2022 and May 2023, are up an average of 28.8%!

Hold One

Continue to hold Fukuda Denshi Co., Ltd. +85.8% (recommended January 2023) as it still meets the portfolio’s selection criteria.

Newsletter’s Performance

Despite all the negatives 2023 was a surprisingly good investment year if you think of the impact of wars, rising interest rates, bank failures and higher borrowing costs.

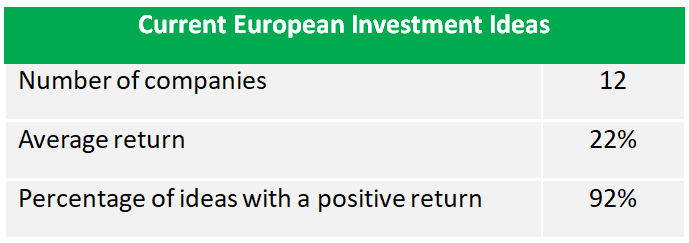

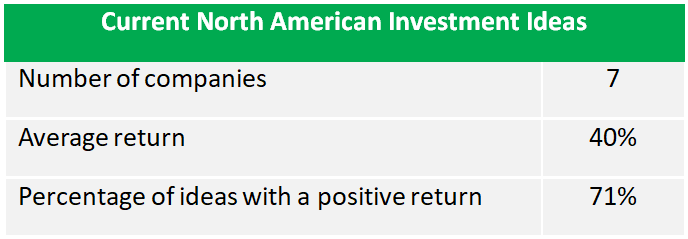

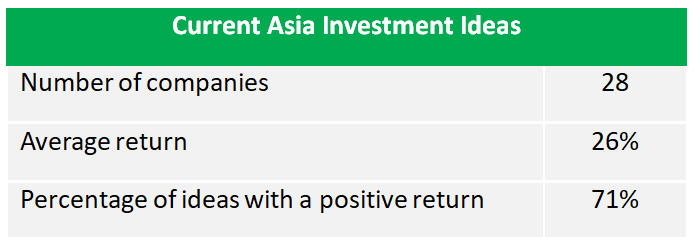

Current ideas

Let’s start with the performance of the ideas currently in the portfolios at the end of 2023.

As you can see performance has been great with North America and the Crash Portfolio performing especially well, up 40%!

Let’s now look at the long-term performance as that is the data that is important for you to see if the newsletters’ investment strategy works.

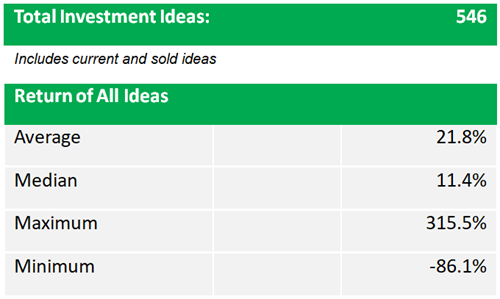

Performance Since July 2010 – 13.5 years ago

- Loss of 86.1% occurred before we started the Stop Loss system

- Returns are calculated as price change plus dividends in the currency

of the company's main listing.

- Includes returns of Crash portfolios

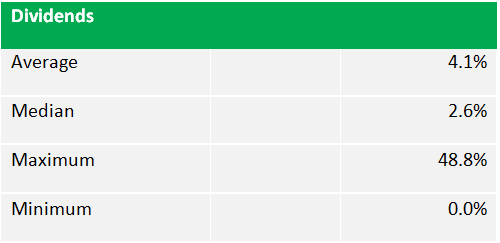

Dividend income

Even though we do not look at dividends when choosing ideas, an attractive dividend is a nice bonus as you get paid to wait as stock prices increase.

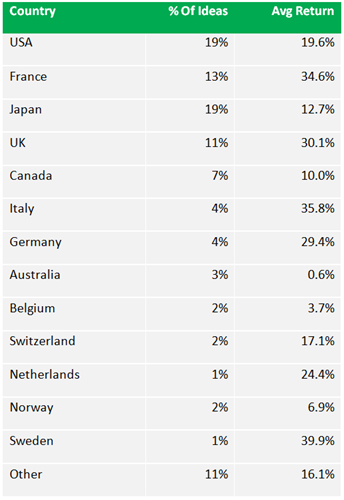

Country performance

This is where companies were recommended and how they performed:

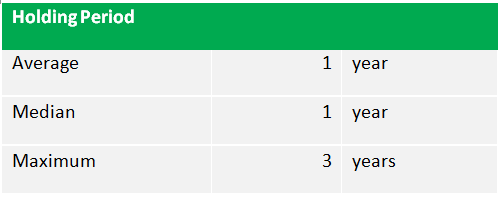

How long are idea in the portfolio?

All ideas are analysed again after a one year holding period, to see if they still meet the newsletter’s Quality, Value and Momentum, investment criteria. Companies mostly stay in the portfolio for a year.

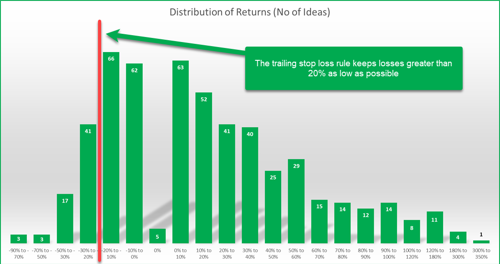

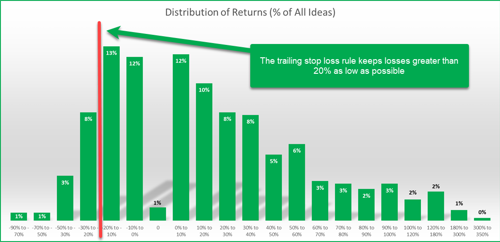

Distribution of returns

This is the most important chart!

You know investing works best when you cut your losses fast and let your winners run. To do this the newsletter follows a STRICT 20% trailing stop loss system.

The following two charts show you how successful the newsletter has been at doing this.

Over 13 years 63% (just under two third of all ideas) would have given you a positive return, with the highest return of 315.5% (the second highest was +269.2%).

Chart showing number of companies:

Chart Showing percent of all recommended companies:

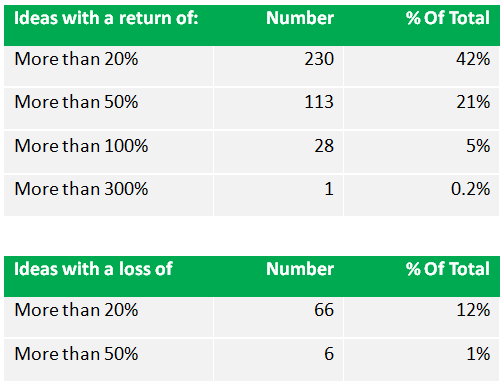

Over 3.5 to 1 more winners than losers

As you can see the positive returns FAR outnumber negative returns.

For example, returns of more than 20% is 3.5 (230/66) times higher than losses of more than 20%.

This is because of three things:

- A great time-tested investment strategy

- The strict stop loss system

- Stop buying when markets fall

The stop-loss system works!

You already saw how well the stop loss system works.

It works so well that since March 2015, when we implemented it, only 11 of the 546 (2.1%) ideas lost more than 40%.

This happened because of large sudden price drops, (before the stop-loss system can sell) for example, after a profit warning, legal action, stock suspension or fraud announcement.

The stop loss system lets you avoid the left-hand side of returns (losses in the chart above).

This is important because:

- You feel more comfortable investing, even in companies you may not know. It is easier to get in if you know you can get out.

- You avoid the emotional pain of a large losses. This helps you stick to the investment strategy.

Not a subscriber? Click here to get ideas from the BEST strategies we have tested NOW!