Quite a few Quant Value newsletter subscribers have mentioned that getting their orders executed in Japan and Hong Kong is not as easy as they thought.

Here are our best ideas on how you can get it done.

How to buy and sell outside your home market

First a few general thoughts.

Investing in another country may feel uncomfortable. It has been for me but after a few transactions the feeling goes away. I have done it so many times I hardly get the feeling any more.

But as with anything you are not used to it takes a bit of courage and a bit more trouble than buying a stock in your home market.

Start small

If you are unsure, start with smaller investments. That is how I started.

After a few small successful trades (and an idea of the dealing costs) you will soon feel comfortable investing larger amounts.

Find a broker

This first thing you need to do is find a broker that can buy and sell in all the countries you feel comfortable investing in and do so at a fair price.

As my main broker only offers dealing in a limited number of countries, I had to open an account with a second broker. They are not cheap, 0.25% plus €29 brokerage fee, but can buy and sell nearly anywhere in the world.

For broker ideas take a look at the September 2021 Quant Value newsletter or look around in your country to see if you there is a similar second bank or broker you can use that offers trading in more countries.

Click here to get the Quant Value newsletter's ideas NOW!

Buying and selling in Japan

As you have seen, the Quant Value newsletter recommends a lot of really undervalued companies in Japan.

The first thing to buy or sell is to find the current stock price of the company, so you know where to set your price limit. To do this we recommend that you always go directly to the web page of the stock market where you want to buy or sell.

For Japan this means the Tokyo stock exchange.

To find it, simply search “tokyo stock exchange”, which will give you the following result: Tokyo Stock Exchange.

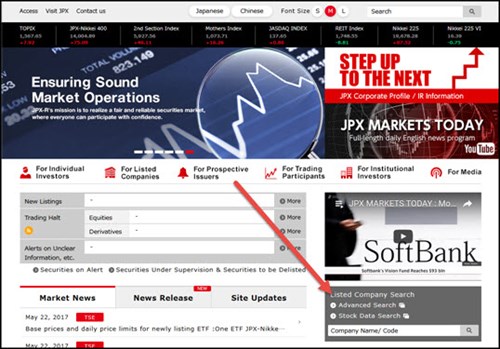

The website looks like this:

Where to find the company search box

The red arrow shows you the company search box.

To find a company:

- Type the name of the company

- Click on the magnifying glass icon

Type the company name and click the magnifying glass icon

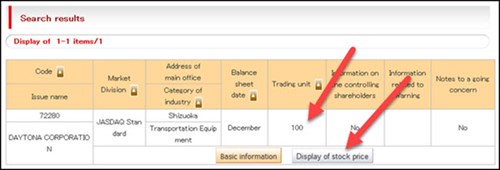

The search result looks like this:

Result when searching for a company

Important: Make a note of the Trading unit

In the search result it is important that you note the number below Trading unit, 100 in this case.

This is important because in Japan the number of shares you can buy, and sell must always be equal to the Trading unit. If you order fewer shares than the Trading unit, 80 for example, your order will not be accepted.

This also means that if you want to buy or sell more shares you can only buy multiples of Trading Units. For example, 100, 200, 1100 or 3300.

To find information on the current stock price click the Display of stock price button.

This will open the following page:

Japanese Stock Exchange price information

This page gives you all the information you need to enter your order.

This is what you need to look for:

- Trade Time - This is the time in Tokyo when the last trade took place.

- Recent Price - Last price the shares traded at, 3,350 Japanese Yen (JPY).

- Ask - This is the price where a seller is offering to sell shares, 3,390.

- Bid - This is the price where a buyer is prepared to buy, 3,335.

- Volume - Is the number of shares that have traded so far on the day, 6,700.

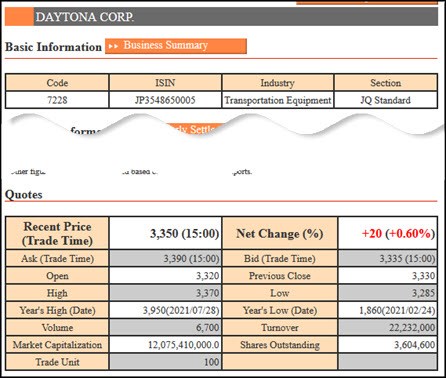

Market depth is helpful – when available

This page unfortunately does not show you how many shares the current buyer and seller wants to buy or sell – called market depth. This information is very helpful when you set your limit price. Because you can set your limit price at a level where you can be quite sure that your whole order will be executed.

Here is an example of the market depth shown on the Tallinn Stock Exchange:

Market depth example on the Tallinn Stock Exchange

For example, if you want to buy 3,000 shares you will have to offer at least €1.807. If the sellers are still there when your broker sends the order to the exchange (remember the information you see is 15 minutes or older)

Your order 3,000 share order will be executed as follows:

- Buy 178 at €1.803

- Buy 468 at €1.804

- Buy 264 at €1.805

- Buy 500 at €1.806

- Buy 1,590 at €1.807

Now back to the Japanese order.

How many shares to buy or sell?

Now you have to calculate how many shares to buy.

If your normal investment per company is €4,000, and you decide to set your buy limit at 3,395 (0.15% above the current, Ask price of 3,390) this is how you calculate the number of shares to buy.

Find the exchange rate

In this example I assume your home currency is Euro, but you can use the same steps for US Dollar for example.

To find the current Euro Yen exchange rate, go to Google Search and type in 1EUR JPY (EUR for Euro and JPY for Yen) and click on the search button.

(You can find all the currency codes you need here: Wikipedia Currency Codes)

Your search result looks like this:

Euro Yen exchange rate

This means one Euro is worth 128.98 Japanese Yen.

What your order looks like

Now you have all the information you need to enter your order on the website of your broker.

The number of shares you want to buy is 152 (Euro 4000 / (3395/128.98).

But remember the Trading Unit for the company is 100 so you will have to change your number of shares to either 100 or 200.

Euro 4,000 is your maximum investment per company

3,395 Yen is your buy limit price

100 shares are how many you want to buy

128.98 Yen is the Euro Yen exchange rate.

Where to set your buy and sell price limits

What price to use for your buy and sell limit orders is a good question.

I do not want to spend a lot of time watching small share price movements which means I set buy and sell prices up to 0.5% better than the current buy and sell prices to make sure my orders get executed quickly.

Using the above information of as an example:

- I would set my buy limit at 3398 (0.25% above the current seller at 3390)

- And my sell limit at 3346 (0.25% below the current buyer at 3355)

Always monitor your orders – avoid expensive execution

Remember to always monitor your orders to make sure they get executed.

In most cases the buy and sell prices you see are 15 minutes old (sometimes even older) this means the market price may have moved. You may have to change your limit order so that your transaction gets executed.

I check about an hour after entering an order to see if it is executed, if not I adjust the limit.

Make sure your full order is executed the same day

If your order is only partly executed, change your limit price (or cancel the order) to make sure your order is completely executed on the day you entered it. If not, you may be charged the minimum brokerage fee and stock exchange fee the following day – this is expensive!

Click here to get the Quant Value newsletter's ideas NOW!

What about different time zones?

Time zones can make buying and selling more trouble, but it is usually not much of a problem.

For example, the time in Sydney (Australian stock Exchange) is eight hours ahead of my time here in Germany. This means I have to place my orders early in the morning when the market there is close to closing. I thus do not have much time to see that my order is completely executed.

Because of this I set a wider limit price to make sure the order is executed.

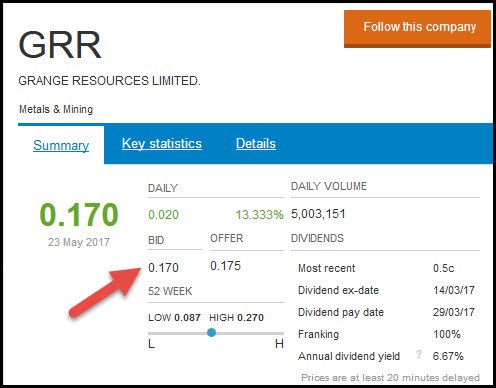

For example, this was the price summary for the Australian company Grange Resources:

Australian stock market price page example

If I wanted to buy, I would set my limit price at AUD 0.18 (2.86% higher than the current seller)

If I wanted to sell, I would set my limit at AUD 0.165 (2.94% below where there is a current buyer)

I may also try AUD 0.1775 to buy and 0.1675 to sell but be careful as the exchange may not accept these (less than a cent) prices - which means your order will not be executed.

Why I hate penny (low price) stocks!

The above example shows you why I hate low share prices because a small change in price, for example AUD 0.05 is equal to nearly 3% which makes trading these shares very expensive.

But if we want to buy them, we just have to live with it.

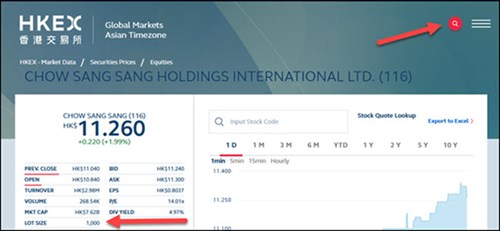

How to buy or sell stocks in Hong Kong

The Hong Kong stock market is similar to the Japanese market in that you can only buy or sell stocks in multiples of its Lot Size (called trading Unit in Japan).

To find a company’s Lot Size:

- Go to the Hong Kong stock market website.

- Search for the company you want to trade (click on the top right red magnifying glass icon)

- Note the number next to Lot Size

This is what the company search looks like:

Company page on Hong Kong stock exchange

This means if you want to trade CHOW SANG SANG (116) you can only buy or sell a minimum of 1000 shares or multiples of it.

So, an order for 1500 shares will not be executed, you have to change your order to 1000 or 2000 shares.

Find the currency value

The same as the Japanese example above, you have to find the exchange rate. Do this by searching “1EUR HKD”. HKD is the abbreviation for Hong Kong Dollar.

Value of EUR 1 in HKD

What your order looks like

Now you have all the information you need to enter your order on the website of your broker.

The number of shares you want to buy is 3,232 (Euro 4000 / (11.3/9.13).

But remember the Lot Size for the company is 1000, so you will have to change your number of shares to either 3000 or 4000.

Euro 4,000 is your maximum investment per company

11.3 HKD is your buy limit price

3000 shares are how many you want to buy

9.13 is the Euro Hong Kong Dollar (HKD) exchange rate.

We hope you have found these ideas helpful.