Estimated Reading Time: 7 minutes

Want to find undervalued negative enterprise value companies? This article shows you how to identify and benefit from negative enterprise value companies, which are often overlooked but can offer high returns.

You will learn why these companies are attractive, how to find them using our stock screener, and how to refine your search for the best results. By the end, you'll know how to incorporate this strategy into your portfolio and increase your returns.

How can I find negative enterprise value investment ideas is a question we get a lot from deep value investors. This article shows you exactly how to implement a negative enterprise value investment strategy in your portfolio.

Why negative enterprise value companies?

Why look for negative enterprise value companies?

A negative enterprise value company is usually very undervalued with a lot of cash on its balance sheet, thus interesting to deep value investors.

More cash than market value and debt

For a company to have a negative enterprise value it has to have more cash on its balance sheet than its market value and debt (exact formulas are shown below).

This means there is a high probability that the company is very undervalued.

Does a negative enterprise value strategy work? - Yes! +50.4% per year over 40 years

Before I show you exactly how to find negative enterprise value companies I am sure you first want to know if it works.

The best study I could find

The best study I found was; Returns On Negative Enterprise Value Stocks: Money For Nothing? by Alon Bochman and published in July 2013.

What he tested?

The performance of all negative enterprise value companies trading in the United States

Over the 40 year period from 30 March 1972 to 28 September 2012.

The selection process ensured that all fundamental data was published at least five days before they were used in enterprise value calculations so as to reduce look-ahead bias.

What he found:

- He found 2,613 stocks that traded at a negative enterprise value between 1972 and 2012.

- Portfolios were formed each month.

- Each month was a different investment opportunity with its own forward 12-month return.

- The average company spent 10.17 months (not necessarily consecutive) in negative enterprise value territory. Thus, the list shows a total of 26,569 (2,613 x 10.17) opportunities to invest in negative enterprise value companies.

Average return +50.4%

- The average yearly return across all 26,569 companies was 50.4%.

- This return does not including trading costs and taxes.

I am sure you will agree it’s an excellent return!

Ideal strategy for you and me

The backtest also found that a negative enterprise value investment strategy is a great strategy for small investors like us.

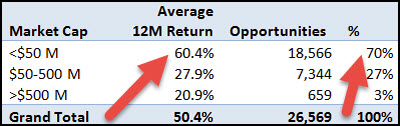

This is because Alon found that 70% of the negative enterprise value companies were companies with a market value of less than $50 million, far too small for the strategy to be of any interest to hedge funds or even normal investment funds.

This is good news.

The group of small companies also would have given you the best returns as you can see in the table below:

Source: Returns On Negative Enterprise Value Stocks: Money For Nothing?

Click here to start finding negative enterprise value companies now!

How you can find negative enterprise value companies?

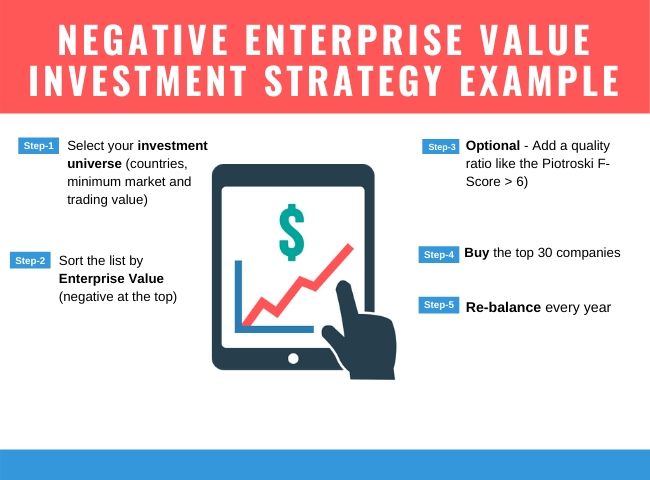

Here is a negative enterprise value investment strategy example:

We already saved a stock screen for you

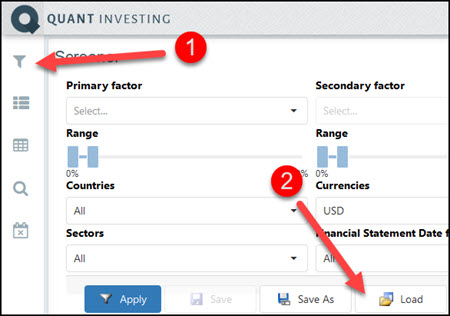

The Quant Investing stock screener makes it very easy to find negative enterprise value companies as we have already saved a screen you can load with only a few mouse clicks.

Once you have logged in and opened the screener Click on funnel screener icon then on Load button.

The do the following:

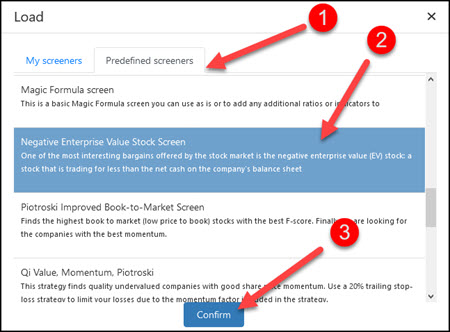

- Click on Predefined screeners tab,

- Scroll down the list to the Negative Enterprise Value stock screen and click on it

- Click on the Confirm button to load the negative enterprise value screen.

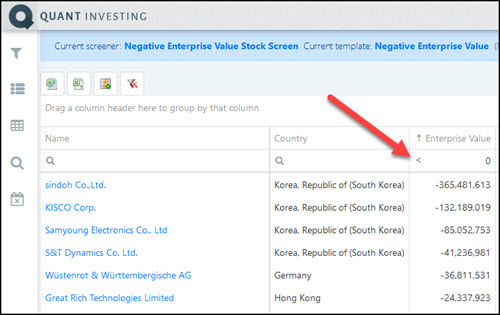

After the screen has loaded enter 0 in the field below the Enterprise Value column heading. Then click on the magnifying glass icon and select Less Than from the list.

When you are done it will look like this:

Your negative enterprise value screen

There you have it, your list of negative enterprise value companies after just six mouse clicks.

Click here to start finding negative enterprise value companies NOW!

Refine your settings

You can further refine the results with the following settings:

- Select only the countries where you invest

- Increase the quality of the companies with the Piotroski F-Score (> 6 for example)

- Include only liquid companies by specifying Daily Trading Volume or Market Value minimum.

How is Enterprise Value calculated?

In the stock screener Enterprise value is calculated as = the current market value of the company (market capitalisation) + Long-Term Debt + Minority Interest + Preferred capital - Excess Cash.

Excess cash is the amount of cash in excess of what the company needs to run its business, in other words cash that can be paid out to investors without harming the business.

Excess cash is calculated as follows:

If Total Current Assets are greater than (2 x Total Current Liabilities), then Excess Cash is the lower of:

- Cash and Short Term Investments or

- Total Current Assets - (2 * Total Current Liabilities).

If Current Assets are not greater than (2 x Total Current Liabilities) then Excess cash is 0.

Excess Cash example

Let us assume a company’s Current Assets minus two times its Current Liabilities are €1000 and its Cash and Short Term investments equal €500.

You can see it has excess cash because Current assets are larger than two times current liabilities.

Excess cash is thus €500, the lower of €1000 and €500.

Where does this excess cash formula come from?

Joel Greenblatt on his Magic Formula Investing website said only excess must be deducted in the Enterprise Value formula.

This makes sense as I am sure you will agree that a business cannot pay out all the cash on its balance sheet but only the amount more than it needs to run its business.

Unfortunately Joel does not mention how he calculates excess cash.

We went back to Benjamin Graham

We thus decided to use one of Benjamin Graham’s margin of safety rule he wrote about in his book The Intelligent Investor which says:

“Invest only in companies where the current ratio (Current assets / Current Liabilities) is more than 1.5.”

We increased this ratio to two before assuming a company has excess cash on its balance sheet. So as you can see a very conservative calculation.

Frequently Asked Questions

1. What is deep value investing?

Deep value investing is about finding stocks that are extremely undervalued. You buy them when they're cheap, betting they'll rise in value.

2. What is a negative enterprise value (EV)?

A negative EV means a company is valued less than the cash it holds after paying off its debts. It’s like buying a dollar for fifty cents.

3. Why would a company have a negative EV?

It could be because the market doesn’t trust the company or sees problems ahead. Sometimes, the market overreacts, creating an opportunity.

4. Is investing in negative EV companies risky?

Yes, it’s risky. These companies often have problems, but if you pick wisely and invest in a basket of stocks, the rewards can be big.

5. How can I find negative EV companies?

You can use financial websites or stock screeners. Look for companies where EV is less than zero.

6. What should I look for in a negative EV company?

Check the company’s cash flow, assets, and any debts. Also, understand why the market undervalued it.

7. Can negative EV companies recover?

Yes, if the market realises it undervalued the company, the stock price can go up fast.

8. What’s the biggest challenge with deep value investing?

Patience. These stocks can stay cheap for a long time before the market corrects itself.

9. How much of my portfolio should be in deep value stocks?

It’s best to only invest a small portion, as these are high-risk. Diversifying your investments helps manage risk.

10. Can deep value investing fit into my overall strategy?

Yes, it can be a part of a balanced strategy, especially if you’re looking for high potential returns and are okay with some risk.

PS To find negative enterprise value companies for your portfolio sign up here: Negative enterprise value screener.

PPS Why do you not sign up right now before you forget or get distracted?

If you are a deep value investor these articles may also be of interest:

Why and how to implement a falling knife investment strategy in your portfolio

Why and how to implement a net-net investment strategy world-wide

Click here to start finding negative enterprise value companies NOW!