In our continuous efforts to help you increase your returns we added an Alert function to the screener.

For more information on exactly how to use the Alert function see this article: How to effectively use the screener’s company alert function

In this glossary entry you can learn how to use the Price alert Trailing Stop (top).

(Also see Trailing Stop (bottom))

Alerts allow you to set Price limits and as soon as they are triggered, you'll receive an email notification.

How to Set Your Trailing Stop Loss Alert

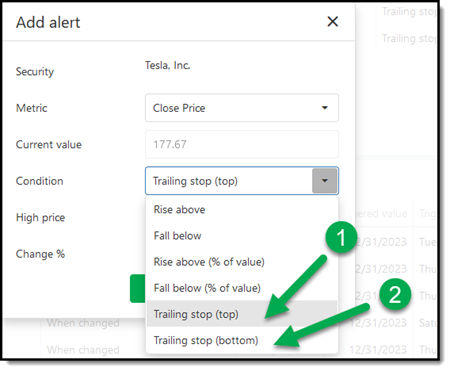

As you can see below there are two trailing stop losses you can use:

#1 Trailing stop (top)

How Trailing Stop (Top) Works

Trailing stop (top) is a trailing stop loss which is triggered when the current price FALLS more than the Change % from the Highest price the stock reached after you set the trailing stop.

This means the High price changes to the current Close Price if it’s higher than the previous High price. So, it can only go up.

If you set a Trailing stop, you can either use the current stock price or enter your own value (perhaps the highest price since you bought the stock).

Trailing Stop (Top) Example

For example, if you enter a High price of 20 and a Change % of 5% the alert will be triggered should the close price fall below 19 (20 - (20 x 5%)) = 19)

If the next day the Close Price increases to 22 then the alert trigger level becomes 20.9 (22 - (22 x 5%))

If the day after the Close price falls to 21 the trigger price stays at 20.9.

If the day after the Close price falls to 20 then the alert is triggered as its less than 20.9.

High Price Automatically Adjusted

Thus, a Trailing stop (top) alert is designed to automatically adjust to the new High price at each close date.

You don't have to manually adjust the "High price". The system tracks the highest price reached since you set the alert and automatically recalculates the trailing stop based on this new high.

Here is an example:

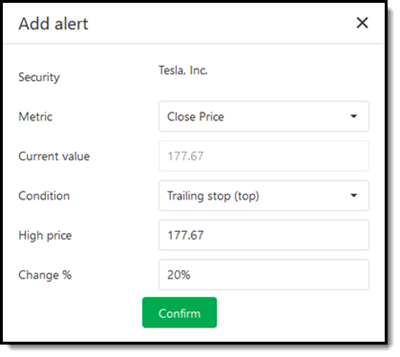

Tesla trailing stop loss alert

If you have set an alert for Tesla with a 20% trailing stop, the system will monitor the highest price Tesla reaches after you've set the alert.

If Tesla's price at any close date sets a new high, the system automatically adjusts the "High price" upward, and the trailing stop loss is recalculated based on this new high.

Note that the “High price” that is shown in the alert detail will not change. But behind the scenes the high price is tracked.

Click here to start automating Training Stop Losses in your portfolio NOW!