In our continuous efforts to help you increase your returns we added an Alert function to the screener.

For more information on exactly how to use the Alert function see this article: How to effectively use the screener’s company alert function

How to Use Trailing Stop (bottom)

In this glossary entry you can learn how to use the Price alert Trailing Stop (bottom).

(Also see Trailing Stop (top))

Alerts allow you to set Price limits and as soon as they are triggered, you'll receive an email notification.

How to Set Your Trailing Stop Loss Alert

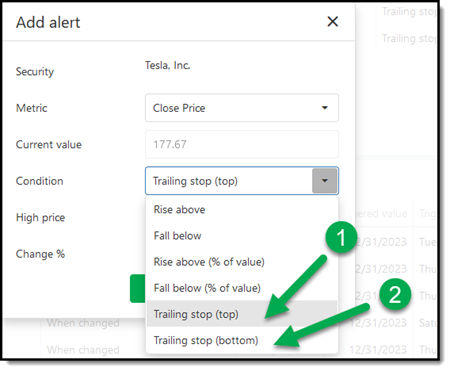

As you can see below there are two trailing stop losses you can use:

#2 Trailing stop (bottom)

How Trailing Stop (bottom) Works

Trailing stop (bottom) works like a trailing stop loss BUT INVERSE!

So, it’s the Alert you want to set if you want to be informed if a stock increases X% from the all-time low since you set it.

A Trailing stop (bottom) is triggered when the current price INCREASES more than the Change % from the Lowest price the stock reached after you set the Trailing stop. This means the Low price changes to the current Close Price if it’s lower than the previous Low price. So, it can only go down.

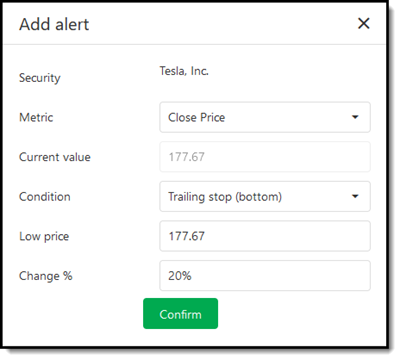

If you set a Trailing stop (bottom), you can either use the current stock price or enter your own value (perhaps the lowest price since you started following the stock).

Trailing Stop (bottom) Example

For example, if you enter a Low price of 20 and a Change % of 5% the alert will be triggered should the close price increase above 21 (20 + (20 x 5%)) = 21)

If the next day the Close Price falls to 18 then the alert trigger level becomes 18.9 (18 + (18 x 5%))

If the day after the Close price increases to 19 the alert is triggered, and you will get an email to let you know.

Low Price Automatically Adjusted

Thus, a Trailing stop (bottom) alert is designed to automatically adjust to the new Low price at each close date.

You don't have to manually adjust the "Low price". The system tracks the lowest price reached since you set the alert and automatically recalculates the trailing stop based on this new low.

Here is an example:

Tesla stock price rebound alert

If you have set an alert for Tesla with a 20% Trailing stop (bottom), the system will monitor the lowest price Tesla reaches after you've set the alert. And you will receive an email if the price increases 20% from the lowest price since you set the alert.

If Tesla's price at any close date sets a new low, the system automatically adjusts the "Low price" down, and the trailing stop loss is recalculated based on this new low.

Note that the “Low price” that is shown in the alert detail will not change. But behind the scenes the low price is tracked.

Click here to start automating Training Stop Losses in your portfolio NOW!