Quality Value Momentum investment strategy - North America

The investment strategy is a combination of quality, value and momentum, all the factors we have found that can give you the highest possible returns.

This is how companies are selected:

Click image to enlarge

How are the companies selected?

Quality

The first thing we do is remove all the low quality businesses from the list of possible investment ideas.

Firstly remove companies that generate a low level of free cash flow to total debt (a company must generate cash profits to repay its debt). Use the FCF to Debt ratio in one of the sliders in the screener and select 0% to 70%.

Secondly remove companies that have a low return on assets. Research has shown that companies with a low return on assets don't generate high investment returns. Use the ratio Gross Margin (Marx) and select 0% to 70% with the slider.

Thirdly remove companies where there's a big difference between the accounting profits and the cash flow the company generates. Again, because research has shown that companies with free cash flow nearly equal to profits (low level of accruals) give you much higher returns. Use the ratio Accrual Ratio CF and select 30% to 100% with the slider.

Valuation

After removing all the low quality companies we select the top 20% of companies with the highest Earnings Yield (EBIT to Enterprise value). Use the ratio Earnings Yield and select 0% to 20% with the slider.

Most of the time the simplest ideas lead to the best results, this is definitely true of this valuation ratio as numerous research studies have shown that this is the best valuation ratio you can use to find high return investments.

Momentum

If there's one fact that came out of the above-mentioned research study it is that if you want high returns you must use share price momentum.

To select investment ideas for the QVM strategy combine 3 month (Price Index 3m) and 6 months (Price Index 6m) share price momentum so that only companies with an upward moving share price are selected.

For both 3 and 6 month Price Index select the top 50% of companies with the top momentum.

To do this export the above results to Microsoft Excel.

Best 20 ideas

After you have applied the above-mentioned criteria, from the list of remaining companies, select the 20 most undervalued companies based on Value Composite One rank as defined by James O'Shaughnessy in the fourth edition of his excellent book What Works on Wall Street.

To do this simply sort the Value Composite One column in Excel.

In summary a simple idea

Even though this may seem really complicated the investment strategy boils down to the following simple principles:

- Remove bad quality companies

- Look for undervalued companies

- With good share price momentum

- Choose only the most undervalued companies

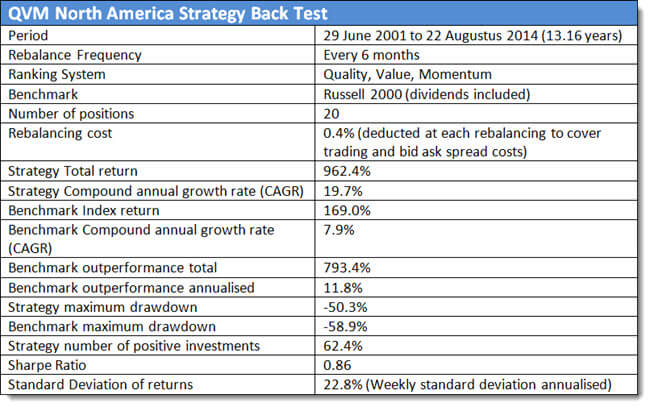

How did the strategy perform?

Click image to enlarge

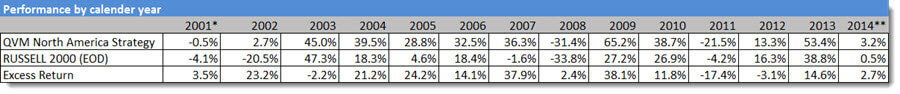

Yearly performance

The table below shows the yearly returns of the QVM North America strategy compared to the Russell 2000 (EOD) Total Return index (which includes dividends):

Click image to enlarge

(*) Inception date 29-06-2001

(**) End date 22-08-2014

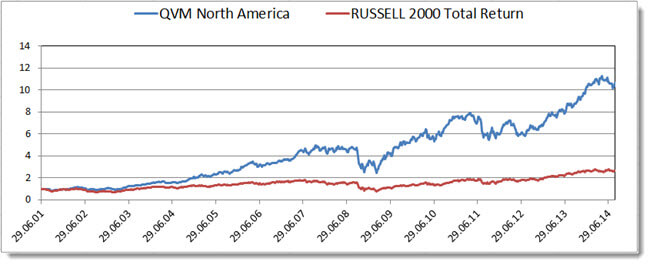

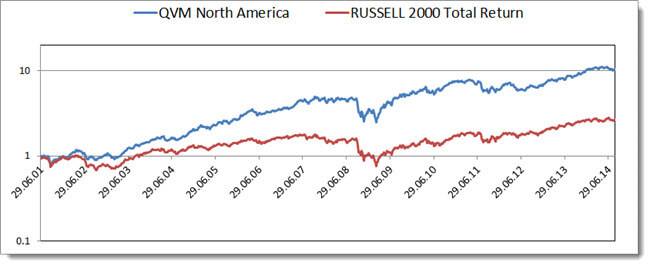

Growth of your investment in the strategy

This chart shows the growth of investing $1 in the QVM North America strategy compared to if you invested in the Russell 2000 (EOD) Total Return index (dividends included).

Click image to enlarge

$1 grown to $10.62 index only $2.69

As you have seen your $1 investment in the QVM North America Strategy would have grown to $10.62.

Compare this to if you invested $1 in the index you would have only had $2.69 after 13 years.

Your $10 000 grown to $106 238

This means if you invested $10 000 in this investment strategy after just more than 13 years you would have had $106 238 in your account.

If you invested the same $10 000 in the index you would have only had $26 899 after 13 years.

Returns logarithmic scale

This chart below also shows your return of investing €1 in the QVM Strategy and the index but it shows a logarithmic scale to show that the index was even more volatile than the QVM Strategy.

Click image to enlarge

Great returns easy to implement

As you have seen the strategy’s returns are great and you can be easily implement it using the screener.

To get these returns working in your portfolio (for less than an inexpensive lunch for two) sign up now by clicking on the following link: Quant Investing join today

PS It is so easy to put things off, why don't you sign up right now and start using this strategy in your portfolio?