Cash Return on Invested Capital (CROIC) is also known as Cash Return on Capital invested (CROCI) and is calculated as follows:

Cash Flow (FCF) / (Total Equity + Total Liabilities – Current Liabilities – Excess Cash)

Free cash flow is equal to the Cash generated by the operations of the company (cash flow statement) - Capital Expenditure (Capex).

Excess cash is the amount of cash in excess of what the company needs to run its business, in other words, cash that can be paid out to investors without harming the business.

How to use the ratio

You can use CROIC to search for undervalued stocks, BUT you can also, very effectively, use it to compare companies from different industries. This is because any business that generated more cash from its investments is more attractive than one that doesn’t.

Available as a screening ratio: Yes

Available as an output column ratio: Yes (Look for it under the Valuation heading)

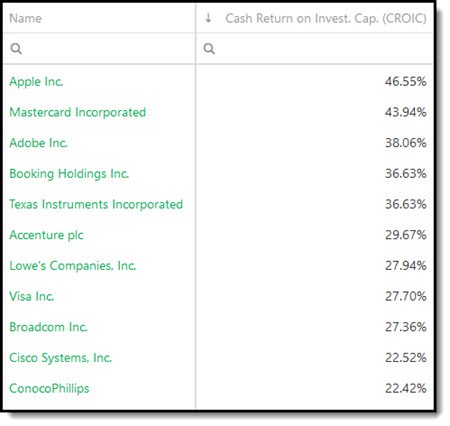

CROIC example from the screener

Here is an example from the screener:

As you can see it is very easy to compare companies from different industries.

Click here to start finding high CROIC investment ideas NOW!

What makes it different

What makes it different to other valuation ratios is that it gives you a cash-flow based return on the investments of a company. This is important as cash flow cannot be manipulated as easily as profits.

How to select the highest CROIC companies

To find companies with the highest CROIC set the slider from 0% to 10%.

What is a good CROIC?

As you can imagine the higher the CROIC, the better. For a great quality company, we prefer to see a CROIC value above 12%.

Remember

All ratios are calculated on a trailing 12 months (TTM) basis. This means the last twelve months (not the company’s financial year) is compared to the same period in the past.

We do this to make sure that the screener data includes the latest, most up to date, financial results of the company.

Click here to start finding high CROIC investment ideas NOW!