Price to Book and 12m Momentum Investment Strategy

The Price to Book ratio (Current share price / Book value per share) is another good valuation measure you can use to find undervalued investment ideas.

It has been tested in numerous research papers, over long periods of time, and is an investment strategy that outperforms the market.

It can be improved a LOT

But, as you have seen with other one ratio investment strategies, it can be substantially improved.

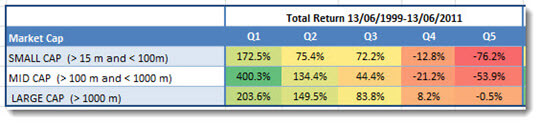

Before we get to that here are the back tested returns you could have earned if you used a low PB strategy to invest in Europe over the 12 year period 13 June 1999 to 13 June 2011.

Click image to enlarge

Source: Quantitative Value Investing in Europe: What works for achieving alpha

Q1 (Quintile 1) represents the cheapest 20% of companies in terms of PB and Q5 (quintile 5) the most expensive.

The lowest PB companies (Q1) substantially outperformed the market, which over the same 12 year period returned 30.54%.

As you can see the strategy worked best for medium sized companies.

You can do even better

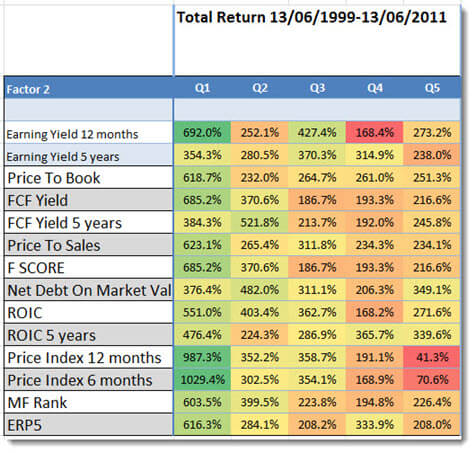

As mentioned you can improve your returns substantially if you combine PB with another ratio or indicator as the table below clearly shows:

Click image to enlarge

Source: Quantitative Value Investing in Europe: What works for achieving alpha

Best combination – Momentum

The best way to increase your returns was to combine PB with Price Index 6 months (6 months momentum) or Price Index 12 months (12 months momentum).

Momentum beats the Piotroski F-Score

As you can see the combination of price to book with momentum did even better compared to using the Piotroski F-Score investment strategy (+685.2%).

Exact definition – in glossary

You can see the exact definition of all the ratios and indicators in the Glossary.

Be careful! – Long periods of under-performance

Although the Price to Book ratio is a good valuation ratio it also has long periods of under-performance, please refer to the following article: Be careful of this time tested value ratio

Use Book to Market not Price to Book

When searching for low Price to Book companies it is better if you use the Book to Market ratio (the inverse of Price to Book) to see why read the following article: Why use book to market and not price to book?

Backtest Updated 2015 to 2022

We updated the backtest combining six months momentum (Price Index 6 months) with low price to book stocks here:

Momentum Meets Value: Europe's Stunning +1157.5% Strategy Updated!

PS To start getting Price to Book and Momentum investment ideas for your portfolio right now sign up here.

PPS It is so easy to put things why don't you sign up now before it slips your mind?