O'Shaughnessy trending value investment strategy

The James O’Shaughnessy Trending Value investment strategy is based on two basic principles:

- Pick the most undervalued companies

- With the highest stock price increase over the past six months

To implement the strategy you simply:

- Select the 10% most undervalued stocks ranked by the Value Composite Two indicator (also developed by James O’Shaughnessy) and then

- Buy the top 25 or 50 stocks with biggest price increase over the past six month.

The strategy was developed and explained by James O’Shaughnessy in the fourth edition of his excellent book What Works on Wall Street: The Classic Guide to the Best-Performing Investment Strategies of All Time.

It REALLY works as it beat the market by 10% each year in the 45-year back test period between 1964 and 2009.

Trending Value background information

Before I show you exactly how to implement the trending value investment strategy first a bit of background information.

Part 1 - What is the Value Composite Two Indicator?

Value Composite Two is a valuation indicator that is calculated using the following six valuation ratios:

- Price to book value

- Price to sales

- Earnings before interest, taxes, depreciation and amortization to Enterprise value (EBITDA / EV)

- Price to cash flow

- Price to earnings

- Shareholder Yield (Dividend yield + Percentage of Shares Repurchased)

The reason it works so well is because Value Composite Two is a single indicator that lets you find undervalued companies based on different valuation metrics, for example cash flow, book value, sales, EBITDA and cash returned to shareholders.

To calculate it you simply rank each company against all other companies using on all of the valuation ratios. Once you have ranked all the companies you add up all the individual rankings into one combined ranking for each company and rank all the companies by this combined ranking and then group them in percentiles (from 1 to 100). 1 is the most undervalued companies and 100 the most expensive.

For example if a company has a price to sales ratio that is in the lowest one percent for all the companies in the database, it gets a price to sales rank of 1 (lower is more undervalued) and if a company has a PE ratio in the highest one percent (it is overvalued) of all the companies in the database it will get a PE rank of 100.

All calculations done for you

Don’t worry if this looks intimidating, in the Quant Investing stock screener we do all the calculations for you. This means you can find all the companies that fit this investment strategy with a few mouse clicks.

Click here to start using Trending Value in your portfolio NOW!

Part 2 - What is momentum?

The second part of the trending value strategy is to buy companies with the biggest six month stock price increase, this is also called momentum.

A momentum strategy simply means buying stocks with the highest past price increase over a certain time period.

Lots of independent researchers have found that stocks that have had high returns over the past three to twelve months continue to perform well. You can find out more about momentum and why it works so well in this article: 10 myths about momentum investing, squashed

The downside of the momentum strategy it can be very volatile.

For example, James found out that investing in 10 percent of the stocks with the highest 6-month price appreciation returned a maximum of 175.2 % in one year but it also had the highest drawdown of -62.4%.

Part 3 - Combining momentum and value

In his book, James O’Shaughnessy found that by combining momentum and value factors you can significantly increase your stock market returns. He named the combined momentum and value investment strategy the Trending Value portfolio.

This is how the Trending Value portfolio is implemented:

- Include only stocks with a market capitalization over $200 million

- Select the 10% most undervalued companies using the Value Composite Two indicator

- Select the 25 or 50 stocks with the best six-month price appreciation – Use Price Index 6m in the stock screener

Does the trending value strategy work?

Before implementing the strategy in your portfolio I am sure you want to know it works. James tested the strategy extensively and it worked very well. But before I show you the performance numbers first a bit of background information.

What data was used in the back test?

To test the strategy James used data from Standard & Poor’s Compustat Active and Research Database and the Center for Research in Security Price (CRSP) over the 45 year period from 1964 to 2009.

12 monthly portfolios re-balanced once a year

He formed a portfolios each month that were held for one year and then calculated the average returns of all 12 portfolios. This was done as having only one portfolio that was re-balanced once a year in the same month may over- or understate the performance of the strategy due to a very large profit or loss in a few companies or because of seasonal effects depending on what month the portfolio was formed.

What companies were included?

The investment universe included companies with a market capitalization of over $200 million (adjusted for inflation). All stocks were equally-weighted and included U.S. companies and foreign stocks in the form of American Depository Receipts.

This is how it performed

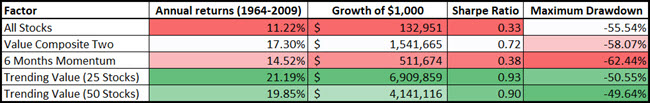

Click to enlarge

Source: James O’Shaughnessy: What Works on Wall Street: The Classic Guide to the Best-Performing Investment Strategies of All Time

Market performance

In the 45-year period between 1964 and 2009 the All Stocks universe earned an average annual compound return of 11.22% - the market index in other words.

Performance of the single ratios

If you bought the most undervalued stocks using only the Value Composite Two indicator you would have earned 17.30% annually.

If you used a momentum strategy over the same period by only buying the stocks with the best six-month price appreciation you would earned an average of 14.52% per year.

As you can see both strategies outperformed the All stocks universe (market index). The maximum peak to trough decline of the market was 55.5%.

Performance of combining value and momentum

But if you combined the two factors into Trending Value portfolio strategy and bought the best ranked 25 stocks you would have achieved an average yearly return of 21.19% over 45 years. The maximum peak to trough decline was 50.6%.

As you can see the Trending Value portfolio significantly outperformed the other two single factor strategies and the All Stocks universe. The portfolio also experienced lower volatility (higher Sharpe ratio) and lower maximum declines.

Trending Value portfolio consisting of 50 stocks earned a yearly average return of 19.85% with a slightly lower maximum drawdown. The maximum peak to trough decline was 49.6%.

Click here to start using Trending Value in your portfolio NOW!

Another back test confirmed it’s a great strategy

We have not back tested the Trending Value investment strategy but a friend of ours did for his master’s degree thesis. I wrote an article about it here: The best investment strategy in Europe from 2000 to 2014 – data driven

The strategy was not exactly the same as trending value but it was close and he came to the same conclusion that combining value and momentum is a great idea.

How to implement the Trending Value strategy in your portfolio

Now for the step by step instructions on how you can implement this strategy in your portfolio with our stock screener.

It is very easy to do, here are the steps:

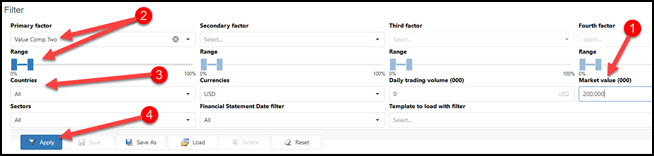

- Select the companies with market capitalization above $200 million by entering 200,000 in the box below Market value (000)

- As the Primary Factor choose Value Composite Two in the box below Primary Factor and use the sliders to select the 10% of the most undervalued companies – set the slider from 0% to 10%

- In the box below Countries select the countries where you would like to invest

- Click on the Apply button to run your screen

Click to enlarge

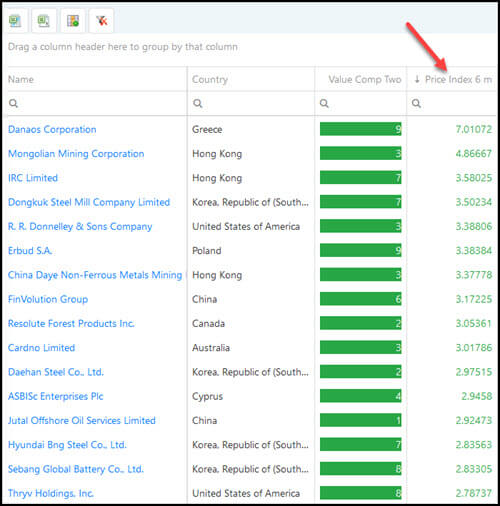

In the results table from the screener click on the Price Index 6m column heading twice to sort the companies by six months price momentum from high to low. High is good momentum and low is bad momentum.

Click to enlarge

Buy the best 25 or 50 ideas

After you have selected all the above-mentioned criteria, the top 25 or 50 companies fit the Trending Value portfolio.

As you saw in the above table if you include more than 25 companies in your portfolio it will reduce volatility and drawdowns, while making returns a bit lower.

Investing a total of $1,000 in the top 25 stocks of the Trending Value portfolio would net you $6.9 million after 45 years. During this period, you would experience a volatility of 17.44% and a maximum drop in the value of your portfolio of 50.55%.

If you bought 50 Trending Value stocks each year it would have lowered your volatility to 16.51% and given you a slightly lower maximum drop in value of 49.64%. On other hand, you would have given up a large portion of returns. After 45 years you would end up with $4.1 million dollars or 40% less than 25 stocks portfolio.

Summary and conclusion

As you have seen the Trending Value strategy is a simple strategy that looks for undervalued companies with an upward moving stock price. And it works VERY well as it returned an average of 21.2% per year over a period of 45 years.

Using strategies that have historically produced market besting results is the key to long-term investing success. And combining undervalued stocks with good share price momentum is a great way to get market beating returns.

But remember even this investment strategy, like all investment strategies is not without risk. The maximum fall of in the value of the portfolio was 50.5%. In the end you will only be rewarded with your ability to stick to the strategy in good and bad – this is the really hard part.

PS To get the Trending Value investment strategy working in your portfolio sign up here.

PPS It is so easy to put things off why not sign up now before you get distracted.

Click here to start using Trending Value in your portfolio NOW!