Neglected Value Momentum investment strategy Europe

This Neglected, Value and Momentum (NVM) investment strategy is based on a very simple basic idea:

- First find companies with good share price momentum- increasing stock price

- Then look for neglected companies with low traded volume compared to profits - companies ignored by most fund managers and brokers

- Then remove low quality companies with low profit margins

- Choose the 20 most undervalued companies in terms of operating profits to enterprise value

How are the companies selected?

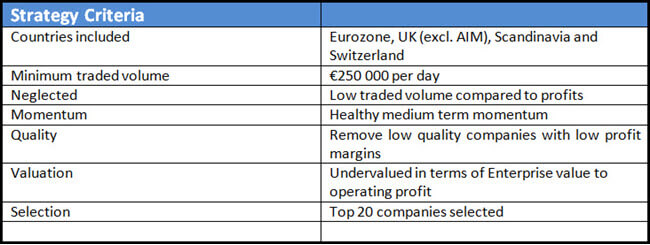

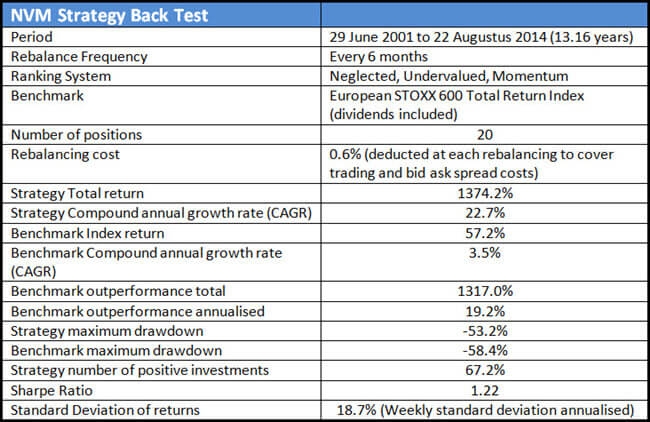

The following table gives you a summary of how this investment strategy selects investment ideas and how we back tested the strategy:

Click image to enlarge

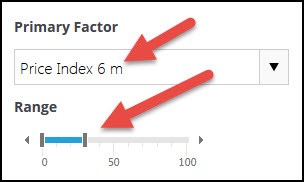

Momentum

If there's one fact that came out of our research study it is that if you want high returns you must include stock price momentum.

To select investment ideas for the NVM Strategy we use six month share price momentum so that only companies with an upward moving share price are selected.

This also helps you avoid value trap companies as they mostly have falling share prices.

To find these companies in the stock screener as a Primary Factor choose Price Index 6m from the drop down list under the heading Momentum and then with the slider select the top 30% of companies with the best Price index 6m as shown below.

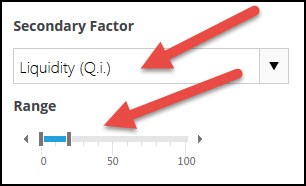

Neglected Companies

Next you want to select companies that are neglected by the market and thus are more likely to be undervalued.

You do this by only selecting companies where the yearly traded volume is low compared to profitability.

Because these companies have low traded volume they are not on the radar screen of fund managers with large amounts of money to invest as they can’t buy enough of the company to have any impact on the fund’s performance.

Also brokers (and their analysts) are not interested in these companies as they cannot make enough money trading the company’s shares to make it profitable for them to research the company.

To find these companies in the screener as a Secondary Factor choose Liquidity (Q.i.) from the drop down list under the Valuation heading. Select the most illiquid 20% of companies with the slider as you can see below.

Quality

The next step is to remove all the low quality companies. You do this by removing or screening out companies with low profit margins compared to assets.

Even though this ratio may seem odd at first studies have found that it is one of the best ways to identify quality companies.

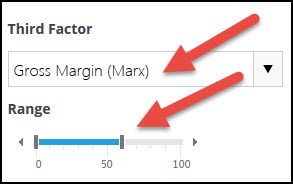

In the screener as a Third Factor choose Gross Margin (Marx) from the drop down list under the Quality heading. Use the slider to select the top 60% of companies with the highest Gross Margin (Marx) values.

Valuation

After doing all the above you then sort the companies that pass all the above criteria by Earnings Yield (earnings before interest and taxes (EBIT) to Enterprise value) which research studies have shown in the best valuation ratio you can use to identify undervalued companies as it also takes the capital structure (debt, equity and cash) of the company into consideration.

In the screener go to the column Earnings Yield and click on the column heading to sort the column from high to low.

To sort from high to low you must click the column heading twice because if the first time you do the column will be sorted from low to high which is not what you want (you want the small arrow to point down) as shown in the screenshot below.

Buy the top 20 companies

Once you have completed all the above steps the strategy invested in the 20 companies with the highest earnings yield.

Click here to implement Neglected, Value and Momentum in your portfolio Now!

1374.2% over 13 years or 22.7% per year

This table summarises the returns the strategy generated over a period of just more than 13 years.

Click image to enlarge

13.2 times your initial investment

As you can see in just over 13 years the strategy returned nearly 1320% or 13.2 times your original investment, outperforming the market by nearly 20% per year.

Yearly performance

The following table shows the yearly performance of the strategy compared to the European STOXX 600 Total Return Index which includes dividends:

Click image to enlarge

(*) Inception date 29-06-2001

(**) End date 22-08-2014

Growth of your investment in the strategy

This chart shows the growth of investing €1 in the strategy compared to if you invested in the European STOXX 600 Total Return Index (dividends included).

Click image to enlarge

This chart also shows your return of investing €1 in the NUM Strategy and the index but it used a logarithmic scale to show that the index is even more volatile than the NVM Strategy.

Click image to enlarge

Summary and Conclusion

As you have seen the Neglected, Value and Momentum investment strategy would have given you outstanding returns if you used it over the past 13 years.

But, like any equity investment strategy it is not without risk as you can see with the 52.3% maximum fall in the value of the portfolio. Even though this fall took place during the 2008 - 2009 financial crisis keeping your faith in the strategy, or just remaining invested in the stock market, after such a large loss is very difficult.

But in the end, you can see that your ability to stick to the strategy would have been very worthwhile.

PS To start getting Neglected Value Momentum investment ideas for your portfolio right now sign up here.

PPS It is so easy to put things why don't you sign up now before it slips your mind?

Click here to implement Neglected, Value and Momentum in your portfolio Now!