Shareholder Yield Letter

Track Record

Last updated: 31 December 2025

We sent out the first issue of the newsletter in May 2023, so it’s still new. As you know, good investment strategies prove their value over time. While it's early, we want to show you how all the recommendations have performed up until the end of June 2025.

The Shareholder Yield Letter's Performance

(Started in May 2023)

This is the performance of all the newsletter’s recommendations since the first company was added in May 2023.

How Returns Are Calculated:

- Total return = price change + dividends

- Measured in the currency of the company’s main listing

Returns are calculated as price change plus dividends in the currency of the company's main listing.

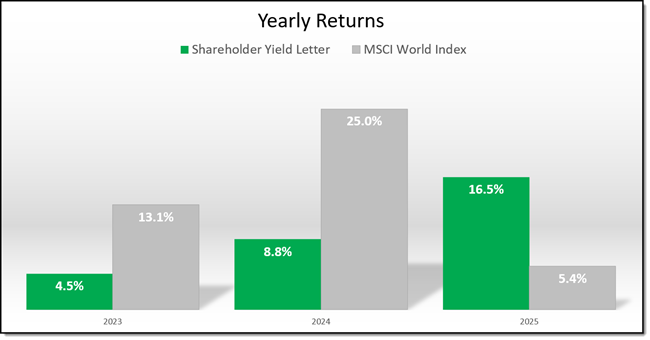

Yearly Returns

The following chart shows the average yearly returns (price gains + dividends) of all ideas in the portfolio.

In 2025 the newsletter’s performance caught up nicely with 2023 and 2004 when it the lagged the index because the strong performance of US technology companies and the strong US Dollar.

Both effects reversed in 2025. The S&P 500 returned a respectable +17.8% but the US Dollar declined 11.8% against the Euro which caused the low MSCI World return in Euro.

Click image to enlarge

A Strategy That Avoids Overvalued Stocks

The newsletter focuses on high Shareholder Yield companies—those that return cash to investors through dividends and buybacks. This means it deliberately avoided overvalued tech stocks and AI companies that require constant reinvestment.

Because the Magnificent 7 stocks drove much of the market’s gains in 2023 and 2024, the newsletter didn’t capture those returns.

In 2025 this trend reversed and the newsletter delivered strong returns.

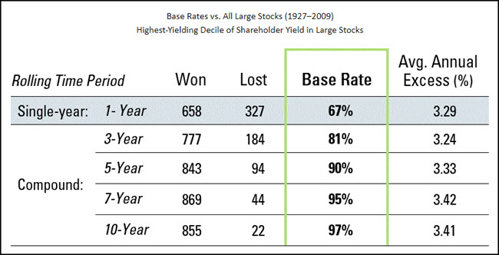

Why Patience Pays Off: The Base Rate

A conservative approach that returns cash to shareholders now may lag in certain years, but the story isn’t over. To understand how a strategy performs long-term, you must look at the base rate, the historical probability of success.

Jim O’Shaughnessy explains this well in his article 7 Traits for Investing Greatness, where he analysed 80 years of data (1927–2009) on Shareholder Yield stocks.

“In the stock market, I believe the surest way forward is to look at the long-term results for an investment strategy and how often - and by what magnitude - it beat its underlying benchmark.”

The following table shows you the results of simply buying the 10% of large stocks with the highest Shareholder Yield (dividend yield plus net stock buybacks) over an 80-year back test period:

Source: 7 Traits for Investing Greatness

Key Findings from 80 Years of Data:

- 3-Year Rolling Periods: The strategy outperformed the market 81% of the time by an average of 3.24% per year.

- 10-Year Rolling Periods: It outperformed the market 97% of the time by an average of 3.41% per year.

That’s an outstanding long-term edge.

While short-term performance can vary, history shows that patience with this strategy leads to strong results.

I'm interested, Click Here to sign up!

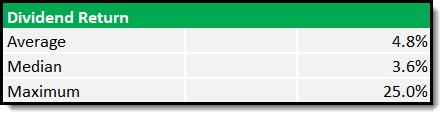

Dividend Income

As the main criteria of the newsletter is Shareholder Yield (Dividend Yield + Stock Buyback Yield) we do not specifically look for companies with a high dividend.

But as the back tests have shown these companies on average also pay attractive dividends.

This is the dividend return of the newsletter:

Average divided return of all ideas

How the Newsletter Manages Risk

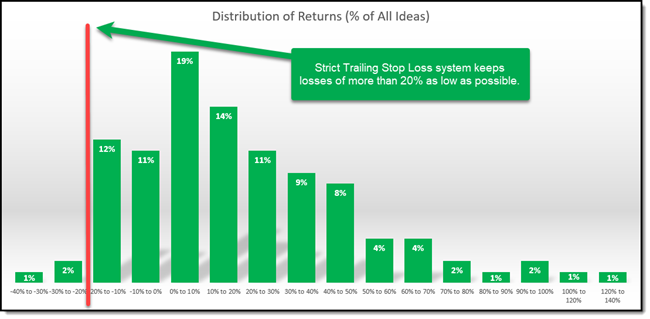

Successful investing is about cutting losses fast and letting winners run.

This is why the newsletter follows a strict 20% trailing stop-loss system.

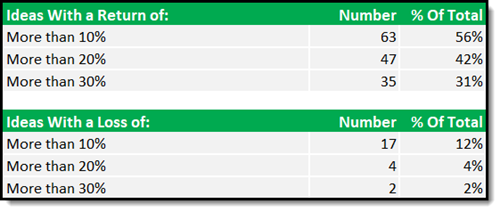

Chart Showing percent of all recommended companies:

Distribution of newsletter returns – Percent of all ideas

Click to enlarge

Over 3 to 1 More Winners Than Losers

3.1 times more winners over 10% than losers

As you can see the positive returns FAR outnumber negative returns.

For example, returns of more than 10% is 3.7 (63/17) times higher than losses of more than 10%.

This is because of three things:

• A proven time-tested investment strategy

• The strict stop loss system to limit downside

• Avoid new investments during market downturns

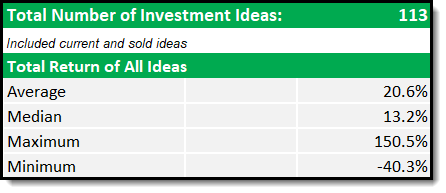

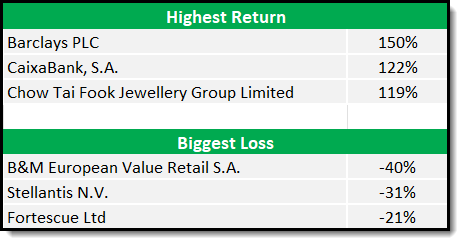

Results So Far

74% (nearly three-quarters) of all recommended stocks had positive returns.

Here is a table with the best ans worst performers to date:

Final Thoughts

It’s still early, but performance has been strong and is moving in the right direction, including a dividend yield of just under 5%!

Stay patient. Stick to the strategy. The best results come over time.

I'm interested, Click Here to sign up!

Join Our Community

When you join the Shareholder Yield Letter, you’re not just subscribing to a newsletter - you are becoming part of a community. A community of like-minded investors who share your goals and believe in smarter, more efficient ways to grow wealth.

Together, we’re taking control of our financial future.

Only Thing Left for You To Do

We have shown you why the Shareholder Yield Letter works and how it can make a difference in your portfolio. If you have not already it’s time to take the next step. Join us today and start investing with confidence and clarity.

It costs less than an inexpensive lunch for two and if you do not like it, you get your money back – no questions asked.

PS It is so easy to put things off and forget, so why not sign up right now while it is still fresh in your mind.